[ad_1]

It has been almost two years since Bitcoin (BTC) reached its current all-time high. Experts point to four factors suggesting a new Bitcoin bull market has started. Let’s look at them in a little more detail.

The period of bearish trend and market stagnation are ending. But what are the factors that suggest a Bitcoin bull market is approaching?

Situation on Bitcoin Chart

Bitcoin price moves in cycles. The digital asset industry as a whole has a strong opinion on this topic, as cryptocurrency trades in cycles lasting about four years. This means that during each cycle, the digital asset industry goes through a bull market phase and then collapses.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The halving occurs every 210,000 blocks and reduces the issuance rate of new BTCs by half. Consequently, with stable demand in such a situation, the asset’s price should increase. And it is indeed growing – at least this pattern has never been broken after the three previous halvings.

The next halving will take place in spring 2024. The exact day of this event cannot be determined at this time, as the procedure is based on the number of blocks mined.

Under ideal conditions, each block takes 10 minutes to mine. However, in reality, blocks are mined faster and slower. The less time left before the halving, the more accurate the forecasts will be.

Nonetheless, according to NiceHash, approximately 157 days are left before the next Bitcoin halving.

Recently, however, there has been a growing consensus that global geopolitical tensions will play a much larger role in the halving. This leads to a decline in people’s trust in the traditional economy and forces them to look for alternative tools to store value.

Who is Accumulating Bitcoins

Whales are large investors with over a thousand BTC in their wallets. This means we are talking about experienced market players with large capital who can influence trends.

Data from a new study by Glassnode analysts shows that whales are still actively accumulating cryptocurrencies. They are not selling coins now, which positively affects the situation in the digital asset market.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market.

Investors with smaller amounts of funds in their accounts do the same. For example, the wallets of “crabs” holding less than 10 BTC have accumulated 191,600 BTC in the last thirty days with a total value of over USD 3.1 billion.

This is a record number of coins at the disposal of this category of investors. This means that owners of various capitals are interested in the digital asset.

Spot ETF Approval on Horizon?

Major financial firms have been fighting for the right to launch their own Bitcoin spot exchange-traded fund for years. However, it was only in the summer of 2023 that the debate took a serious turn, thanks to the world’s largest investment firm, BlackRock, which also joined the race and submitted an application.

Previously, the US Securities and Exchange Commission (SEC) refused to approve ETFs. However, over the past four months, the SEC has lost two major lawsuits against cryptocurrency companies and has also come under significant pressure from the US Congress. With this in mind, the regulator is still expected to approve the launch of Bitcoin spot ETFs, which would be a serious source of capital for the entire crypto industry.

The scale of the possible impact of the Bitcoin-ETF approval in the US was previously revealed by an unpleasant situation. In October, Cointelegraph mistakenly published news of an ETF approval from BlackRock. Although it turned out to be fake news, Bitcoin’s price rose from $28,000 to $30,000 in a matter of minutes. With the real adoption of ETFs, the growth of the cryptocurrency market will become even more dynamic.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Cryptocurrency Investors Are Preparing for Bull Market

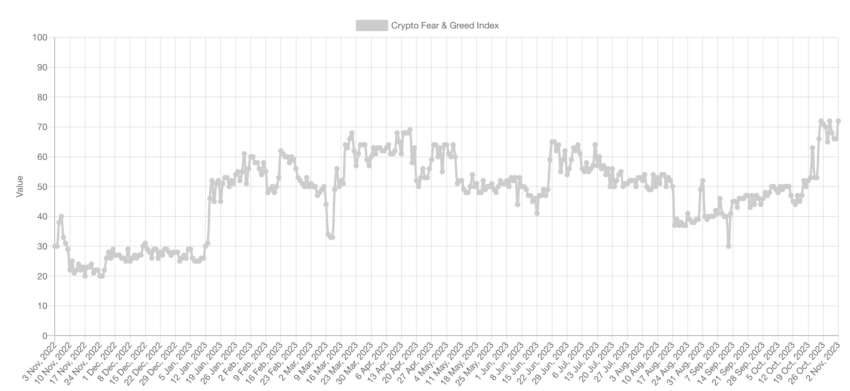

According to Alternative, on Nov. 6, the so-called Bitcoin Fear and Greed Index rose to 74 points out of 100. This is its record value for over a year, which is a clear sign of optimism among investors and traders.

Read more: What Is the Crypto Fear and Greed Index?

Many investors believe that assets should be sold when the market is euphoric. However, in this case, the market is still far from this state, and the indicators are simply optimistic about the possible end of the downward trend.

It seems that the prospects of a new bull market in the digital asset market no longer seem so distant. Digital assets now seem much more attractive to capital holders. Cryptocurrency enthusiasts should, therefore, probably prepare for an influx of money into the market.

Also, it is worth mentioning that the crypto market is subject to extreme volatility. Hence, the readers must do their own research before making any investing decisions.

Do you have anything to say about the Bitcoin bull market or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link