[ad_1]

The technology sector is undergoing a seismic shift, with artificial intelligence (AI) emerging as a major player. The transformational potential of AI has not gone unnoticed, particularly by the world’s most astute investors.

Among them, billionaire magnates Stanley Druckenmiller, Dawn Fitzpatrick, and Ray Dalio have expressed their bullish outlook on AI’s future. In contrast, these investors remain considerably bearish on cryptocurrencies. The reasoning behind their polarized perspectives illuminates intriguing trends in the financial markets.

AI Is Bigger Than the Internet Revolution

Stanley Druckenmiller, CEO of the Duquesne Family Office, leads the charge in the AI-optimistic narrative. He presented a compelling case for AI’s transformative power, equating its potential impact to the internet revolution.

Nvidia, a frontrunner in the AI sector, has been a significant recipient of Druckenmiller’s endorsement. Often called the “picks and shovels leader in the AI gold rush,” Nvidia has seen its valuation soar, almost reaching the trillion-dollar market cap threshold.

Druckenmiller remains unwavering despite some industry voices, such as ARK Invest CEO Cathie Wood and finance professor Asmath Damodaran, raising concerns about overvaluation.

“In our view, for every dollar of hardware that Nvidia sells, software providers, SaaS [software as a service] providers will generate $8 in revenue. So we are looking to the software providers who are actually right now where Nvidia was when we first bought it,” said Wood.

Still, Druckenmiller plans to retain his Nvidia stock for at least two or three years, underscoring his long-term confidence in AI. He firmly believes that AI-related firms with robust, sustainable earnings, like Nvidia, can weather such downturns despite anticipating an impending recession.

Druckenmiller’s faith in the resilience of these AI powerhouses reinforces his bullish stance on the AI sector.

“Don’t get emotional, don’t get crazy… If this is a secular move, if this thing is real, you just don’t have 10-month moves. That’s not how it works,” said Druckenmiller.

At the Beginning of the AI “Megacycle”

This bullish AI sentiment echoes other billionaire investors’ views. Dawn Fitzpatrick, Chief Investment Officer of Soros Fund Management, also acknowledges the game-changing capabilities of AI.

She believes that application-oriented cloud companies and high-performance chipmakers stand to benefit immensely from the AI boom. At the same time, Fitzpatrick warns against chasing every AI prospect, indicating a prudent approach towards overhyped segments.

“The real beneficiaries are the applications… Your cloud and and your high-performing chip companies. Those stocks right now are extrapolating pretty enormous compounding growth — we wouldn’t necessarily chase that. Yet, the capabilities are just going to be exponential,” said Fitzpatrick.

Ray Dalio, the founder of Bridgewater Associates, bridges these perspectives. He recognizes that discerning the eventual winners in the fiercely competitive AI landscape remains challenging.

Yet, Dalio’s overall outlook on the sector is unequivocally positive despite the risk of human extinction from AI voiced by the the Center for AI Safety.

“AI is an unbelievable technology that will create enormous powers. We’re on this environment where it can either produce a tremendous amount of productivity and raise our living standards and really make things a whole lot better. Or it could be used…in various ways to hurt each other,” said Dalio.

Cryptocurrencies Have No Inherit Value

Regarding cryptocurrencies, Dalio, like his fellow billionaires, exhibits substantial skepticism. This caution primarily stems from perceived financial instability, particularly among smaller lenders and regional banks, due to aggressive monetary tightening by the Federal Reserve.

As depositors increasingly seek refuge in larger, “too big to fail” institutions, Dalio cautions about the heightened risks in the crypto space. Additionally, billionaire investors like Druckenmiller have criticized the inherent value proposition of cryptocurrencies.

Druckenmiller notably mentioned that he did not see the inherent value in cryptos, especially compared to something tangible like AI technology, which has clear applications and can drive efficiency and profitability in numerous sectors.

“They haven’t separated the wheat from the chaff yet, but I do believe, unlike crypto, that AI is real and it could be as transformative as the internet.”

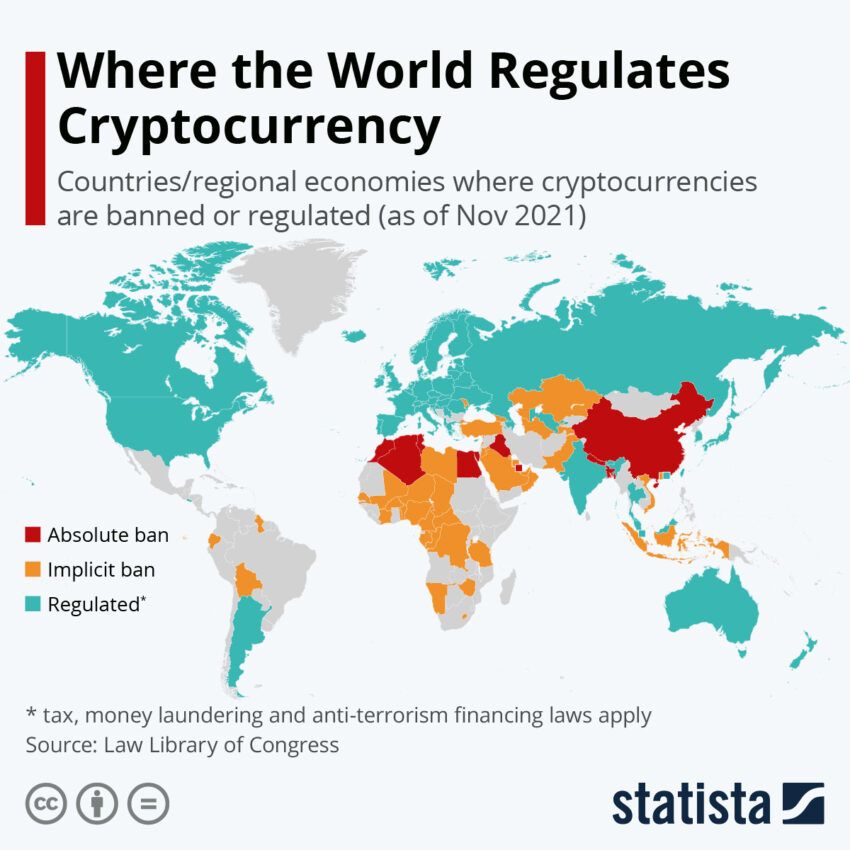

One of the most prominent reasons is the issue of regulatory uncertainty. In several countries, the regulatory environment surrounding cryptocurrencies remains undefined or is rapidly evolving. This legal ambiguity creates substantial investment risk.

Governments can ban or limit cryptocurrencies, as seen in China’s crackdown on Bitcoin mining and India’s proposed regulations on crypto. Such measures can lead to dramatic price fluctuations and potential losses for investors.

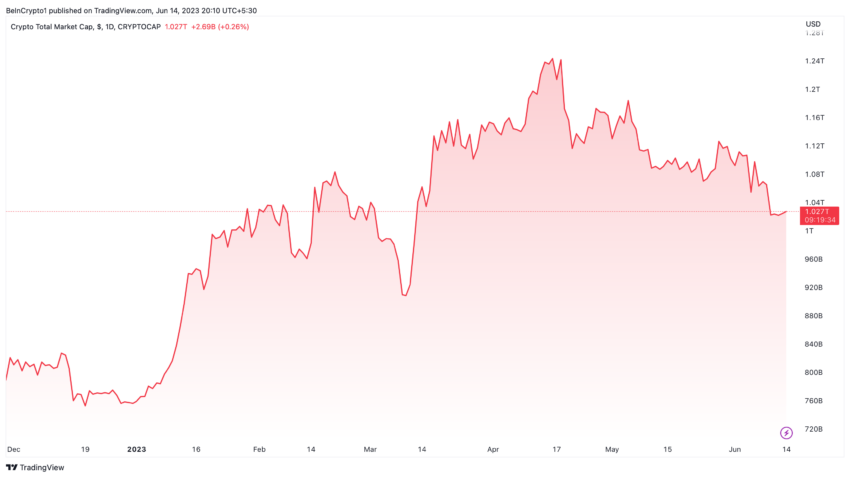

Secondly, cryptocurrencies’ extreme volatility is a concern. The value of cryptocurrencies can swing wildly in short periods, a level of volatility rarely seen in other asset classes. While this can potentially lead to high returns, it poses significant risks.

High volatility combined with a lack of liquidity in certain situations can be a challenging environment, even for seasoned investors.

Lastly, there is an issue of maturity and acceptance. While cryptocurrencies have gained substantial public attention, they are not widely accepted as a medium of exchange.

Only a small fraction of businesses accept cryptos, and their use in everyday transactions is limited. This factor can affect the long-term viability and growth potential of cryptocurrencies.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link