[ad_1]

The Polygon (MATIC) price broke down from a long-term pattern at the beginning of April and accelerated its rate of decrease last week.

The wave count supports the continuation of the upward movement. While it is possible that the price will initiate a relief rally, the downward movement is likely not done yet.

Polygon Price Breaks Down From Long-Term Structure

The weekly time frame technical analysis for MATIC provides a decisively bearish outlook. There are several reasons for this.

Firstly, the price broke down from a long-term ascending parallel channel in April 2023. This indicated that the previous upward movement had come to an end. Moreover, since such channels usually contain corrective patterns, the breakdown indicated that the increase was corrective. Thus, the dominant trend is likely to be bullish.

The MATIC price now trades slightly above the $0.53 horizontal support area.

The weekly Relative Strength Index (RSI) also provides a bearish reading. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

The indicator is below 50 (red icon) and falling, indicating a bearish trend.

MATIC Price Prediction: Will Price Manage to Recover?

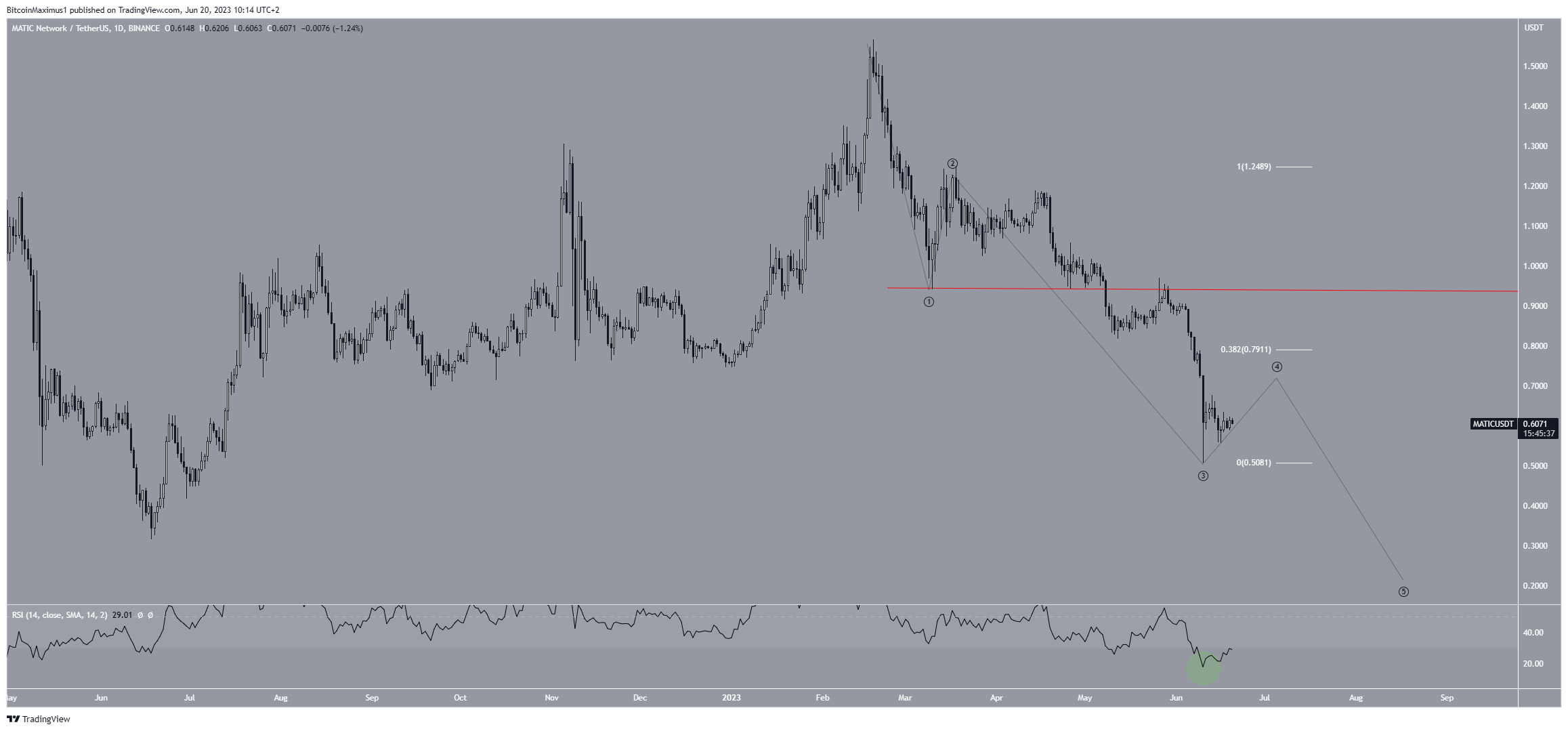

The technical analysis from the short-term daily time frame gives conflicting readings due to the bullish implications of the RSI and bearish ones from the wave count.

Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The most likely count suggests that the MATIC price is currently in wave four of a five-wave decrease (black). If the count is correct, the MATIC price will reach a top near the $0.79 Fib resistance (white) before falling again.

However, the daily RSI fell to an extremely oversold reading of 18 at the beginning of June (green circle). This was an all-time low value. The indicator has increased since and nearly moved outside its oversold territory. If this occurs, it will be considered a bullish sign.

Thus, the most likely future price outlook is an increase to the $0.79 resistance area followed by a drop towards $0.30 and a new yearly low.

Despite the bearish MATIC price prediction, an increase above the bottom of wave one (red line) at $0.94 will mean that the trend is bullish instead. In that case, an increase to $1.30 will be likely.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link