[ad_1]

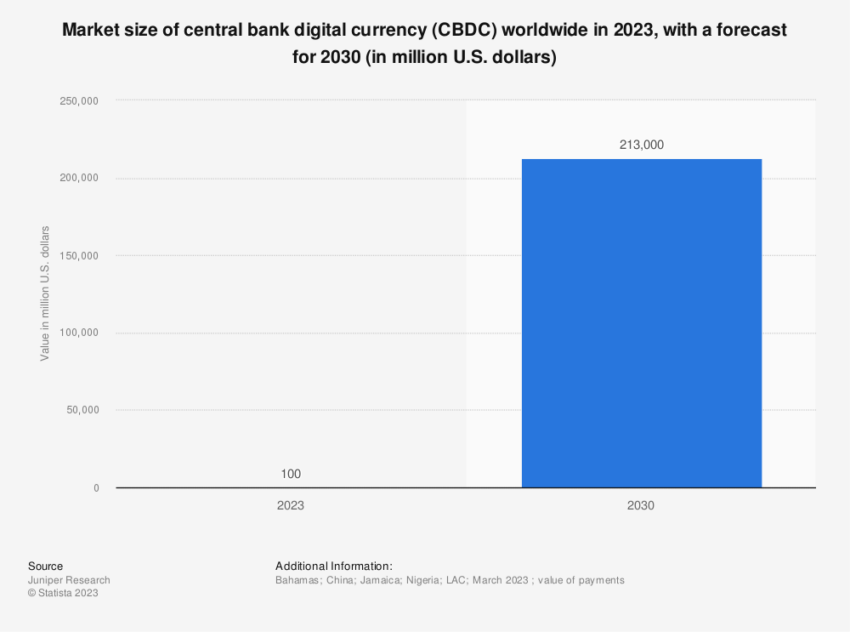

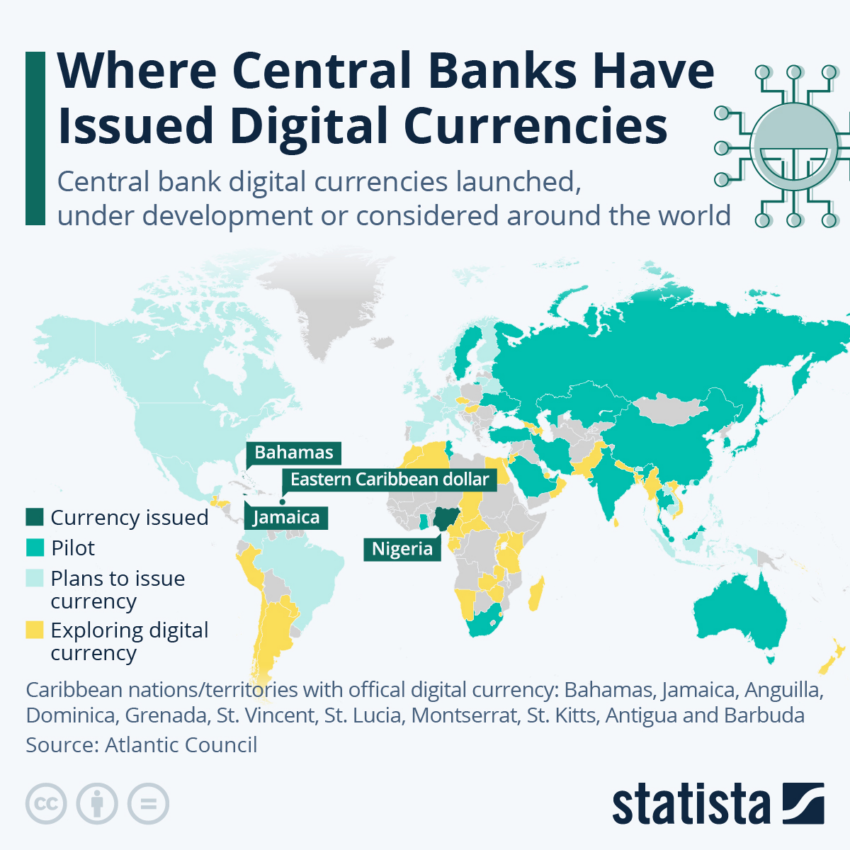

The digital revolution has taken a giant stride, with cryptocurrencies reaching mainstream adoption. As an indicator of this change, a study shows that 130 countries, representing 98% of the global economy, are now actively exploring digital versions of their currencies, often called Central Bank Digital Currencies (CBDCs).

With the global financial system showing an ever-increasing shift towards CBDCs, a fascinating panorama of nations experimenting with digital money is unfolding.

The Global Financial System Turns Digital

Major economies such as the G20 nations, barring Argentina, have entered the advanced phases of CBDC development. The vanguard comprises eleven countries, including Caribbean nations and Nigeria, which have already launched their digital currencies.

The sheer scale of this endeavor is visible in China. Pilot testing of their CBDC covers 260 million people across 200 diverse scenarios ranging from e-commerce to government stimulus payments.

Two other prominent emerging economies, India and Brazil, also plan to launch their digital currencies next year. The European Central Bank has been equally proactive, setting the groundwork for its digital euro-pilot with a possible launch in 2028.

In 2023 alone, over 20 countries will make substantial strides toward their CBDC pilots.

While the United States is progressing on a wholesale bank-to-bank digital dollar, the retail version for the broader population has hit a roadblock. Despite this, the potential global consequences of any US move towards CBDCs are enormous, given the dollar’s heavyweight status in the global financial system.

Drivers Behind the Digitalization of Money

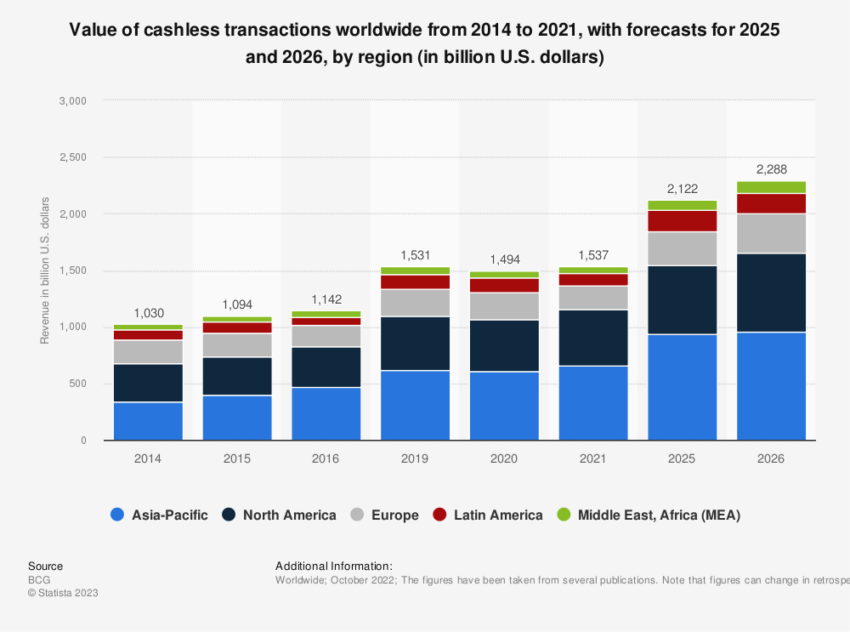

Several factors drive the global push for CBDCs. These include the declining use of physical cash and authorities’ desire to protect their money-printing powers against Bitcoin and “Big Tech” firms.

Even political events like sanctions on countries such as Russia and Venezuela propel the trend. Therefore, prompting even long-time US allies to seek alternatives to existing payment networks.

Sweden, a European pioneer in CBDCs, continues its progress. Meanwhile, the Bank of England is working on a potential digital pound. Down under, Australia, Thailand, South Korea, and Russia persist with pilot testing.

However, the journey is not without its bumps. Some countries like Nigeria have witnessed disappointing take-up rates post-launch, while others like Senegal and Ecuador have shelved their development work.

Currently, 64 countries are in an advanced exploration phase, while eleven have fully launched a digital currency.

CBDCs, the digital form of a country’s fiat currency, aim to promote financial inclusion, introduce competition in the domestic payments market, increase payment efficiency, and provide seamless execution of monetary and fiscal policies.

Full List of Countries Exploring CBDCs

The exploration of CBDCs is not just a technological evolution but also holds substantial economic and geopolitical implications. Here is the full list of countries exploring CBDCs:

Canada

United States

Mexico

Bermuda

The Bahamas

Belize

Guatemala

Honduras

Costa Rica

Jamaica

Haiti

Anguilla

Sint Maarten

Antigua and Barbuda

Saint Kitts and Nevis

Montserrat

Dominica

Saint Lucia

Saint Vincent and the Grenadines

Grenada

Curaçao

Venezuela

Trinidad and Tobago

Brazil

Colombia

Ecuador

Peru

Paraguay

Uruguay

Argentina

Chile

Iceland

Ireland

United Kingdom

Spain

France

Switzerland

Italy

Germany

Netherlands

Austria

Czech Republic

Hungary

Montenegro

Denmark

Norway

Sweden

Finland

Estonia

Lithuania

Belarus

Ukraine

Tunisia

Algeria

Morocco

Senegal

Egypt

Eritrea

Chad

Nigeria

Benin

Ghana

Central African Republic

Cameroon

Equatorial Guinea

Gabon

Uganda

Rwanda

Kenya

Tanzania

Madagascar

Zambia

Zimbabwe

Botswana

Namibia

South Africa

Eswatini

Madagascar

Mauritius

Oman

Saudi Arabia

United Arab Emirates

Qatar

Bahrain

Kuwait

Jordan

Palestine

Israel

Lebanon

Russia

Kazakhstan

Georgia

Azerbaijan

Iran

Pakistan

India

Sri Lanka

Nepal

Bangladesh

Bhutan

Myanmar

Laos

Thailand

Vietnam

Cambodia

Hong Kong

China

Malaysia

Singapore

Macau

Taiwan

South Korea

North Korea

Japan

Australia

New Zeland

Vanutau

Fiji

Solomon Island

Indonesia

Palau

Philippines

Tonga

The New Era: Central Bank Digital Currencies

The introduction of CBDCs does come with its challenges. These range from potential bank runs and operational risks such as cyber-attacks to the necessity for complex regulatory frameworks that uphold privacy, consumer protection, and anti-money laundering standards.

National security implications must also be considered, as new payment systems could impact a nation’s ability to track cross-border flows and enforce sanctions.

Despite these challenges, 2023 is a landmark year in CBDC exploration. With an expanding list of countries exploring CBDCs like Australia, Brazil, Japan, and Russia making significant progress, the future of digital currencies appears promising.

It seems certain that the digitalization of money is here to stay, signaling a paradigm shift in the world’s monetary system.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link