[ad_1]

Crypto miner Riot Platforms has recorded a weekly gain of almost 50%. The surge in RIOT share prices comes after Vanguard Group, one of the world’s largest asset managers, disclosed it acquired a 10.2% stake in the company.

At press time, the trading price of RIOT remains close to $17.80, an annual high for the company. The recent gains have pushed its market capitalization to over $3 billion. Meanwhile, Vanguard Group has significantly increased its exposure to Bitcoin mining companies, including Riot competitor Marathon.

Vanguard Navigates Investments in Bitcoin Mining

Vanguard’s filings with the US Securities and Exchange Commission revealed that it had expanded its investment in Riot Blockchain to 17.932 million shares. The stake is valued at over $300 million based on Riot’s current share price.

Additionally, Vanguard disclosed another filing indicating ownership of 17.5 million shares in Marathon Digital, a competitor to Riot. It has added another $300 million to Vanguard’s stake.

Previously, the asset manager held 10.968 million shares in Marathon Digital, while its investment in Riot included 15.2 million shares.

Through these investments, Vanguard now holds 10.24% of Riot and 10.31% of Marathon, based on figures by Fintel. These figures reflect a substantial increase from their previous holdings earlier this year, with Vanguard’s investment in Marathon rising by nearly 60% and its investment in Riot increasing by 18%.

The decision to increase investments in Bitcoin mining companies showcases Vanguard’s confidence in the potential of these industry leaders, particularly in anticipation of the Bitcoin halving scheduled for April 2024.

However, it is worth noting that Vanguard has exercised caution in the overall crypto market in the past.

In a statement released in May 2022, the company emphasized its commitment to traditional investment principles while acknowledging the merits of supporting cryptocurrency technology. It had said that Vanguard’s approach aims to protect clients’ assets while ensuring a reliable investment experience.

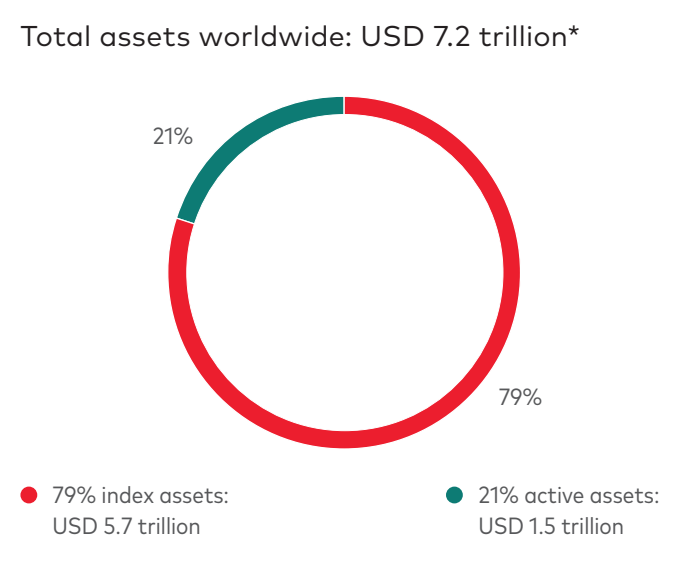

Meanwhile, Vanguard’s total assets under management (AUM) have experienced significant growth. It surpassed $7.2 trillion in 2022, an eightfold increase since 2005.

Performance of Riot Bitcoin Mining Peers

Riot’s mining peers, including Marathon Digital, HUT8, Hive, and Canaan, have faced challenges in recent times. Marathon Digital reported a 21% decline in Bitcoin mined in June compared to May.

HUT8 Mining Corp. disclosed that it generated 120 Bitcoin in June, resulting in an average production rate of approximately 4 Bitcoins daily. Meanwhile, HIVE Blockchain Technologies announced that it produced 259 Bitcoins in June, averaging 8.6 BTC daily.

Cipher, another mining giant, produced around 360 BTC in June, representing a 27% decrease compared to the previous month. Additionally, Canaan reported a 5% decline in revenue for the first quarter of 2023 compared to the last quarter, as per its Q1 2023 report.

All this comes in addition to a drop in revenue. Glassnode data indicate a significant reduction in miner revenue derived from transaction fees. It reportedly reached a four-month low as of July 9, implying a decrease in earnings.

Impact of SEC Actions

The recent actions taken by the U.S. Securities and Exchange Commission (SEC) against major crypto players like Binance and Coinbase have adversely impacted crypto stocks.

This regulatory scrutiny has now extended to the secondary market and miners. Bloomberg reported in May that Marathon Digital Holdings received another subpoena from the agency related to a potential violation of securities laws.

However, despite these challenges, Vanguard’s increased stake in miners indicates a positive outlook.

These major fund managers do not seem overly concerned about potential SEC actions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link