[ad_1]

The Ethereum (ETH) price has moved past $2,000 amid the largest altcoin rally so far this year. The second largest crypto by market capitalization is currently trading at $2,006 after a 7.15% move up in the past 24 hours.

Apart from a brief April 2023 spike above $2,100, this is the first time that ETH has traded above $2,000 since falling below it in May 2022.

The increase has been swift and could be a sign of things to come, as ETH moves to a new yearly high and beyond.

How Long Will the Ethereum (ETH) Price Increase Continue?

The ETH price created a bullish engulfing candlestick yesterday. This is a type of bullish candlestick in which the entire previous period’s decrease is negated with a large candlestick in the other direction.

The movement caused the price to reclaim the $1,950 horizontal area, which is likely to act as support again. This is also a bullish sign that supports the continuing of the increase.

Moreover, the daily RSI is also bullish. When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold, and to decide whether to accumulate or sell an asset. The indicator bounced at the 50 line (green icon) and is now increasing. Both are signs of a bullish trend.

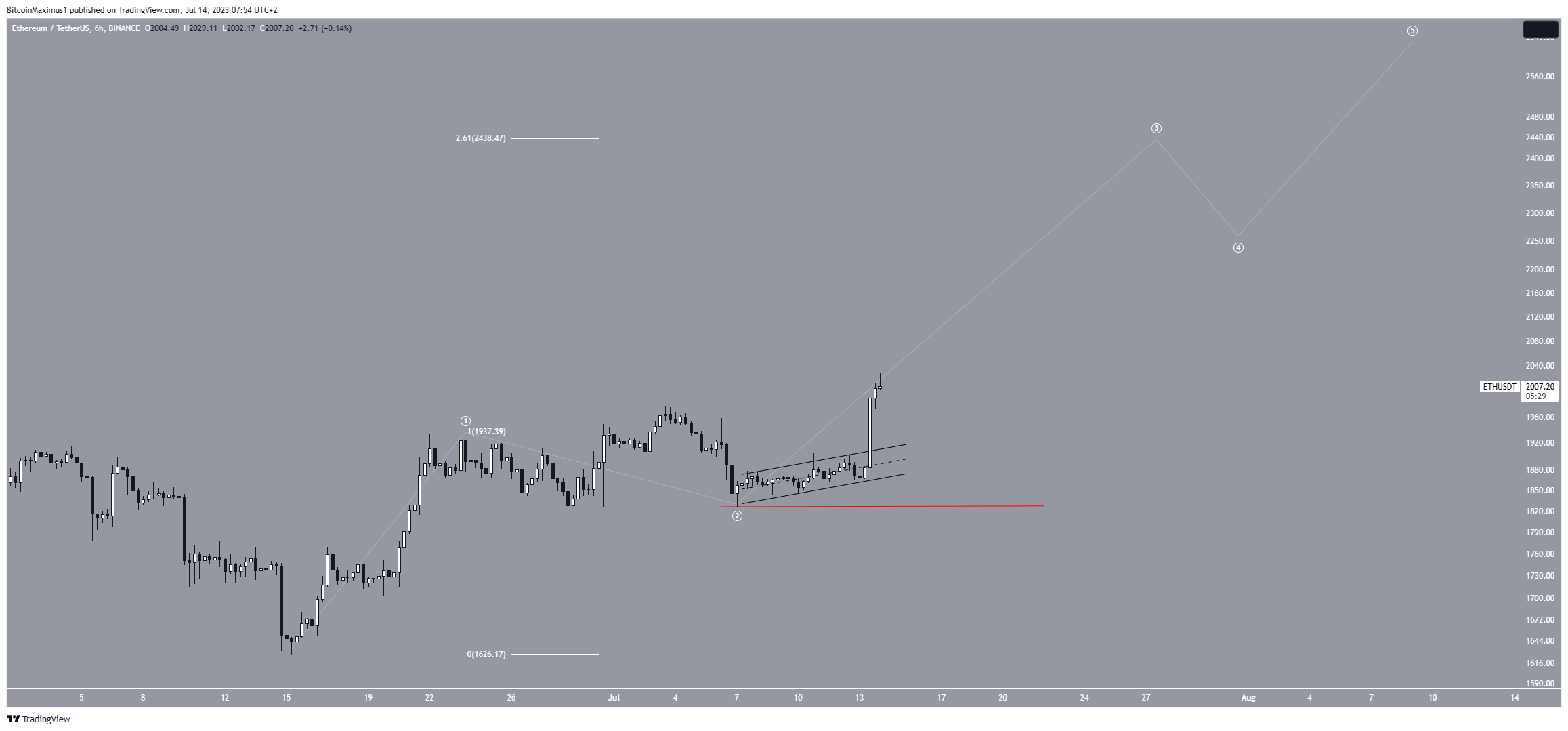

The short-term chart also supports the continuing of the increase, both because of the wave count and the price action. The wave count shows that ETH is likely in wave three of a five-wave increase that began on June 15. Wave three is often the sharpest of the bullish waves. If it reaches the 2.61 extension of wave one, ETH will reach a high of $2,440.

Furthermore, the price action shows that the ETH price broke out from an ascending parallel channel, meaning that the increase is not corrective.

Despite this bullish ETH price prediction, a drop below the wave two low (red line) will mean that the trend is still bearish. In that case, a decrease to $1,600 will be expected.

Is Altseason Back in Play?

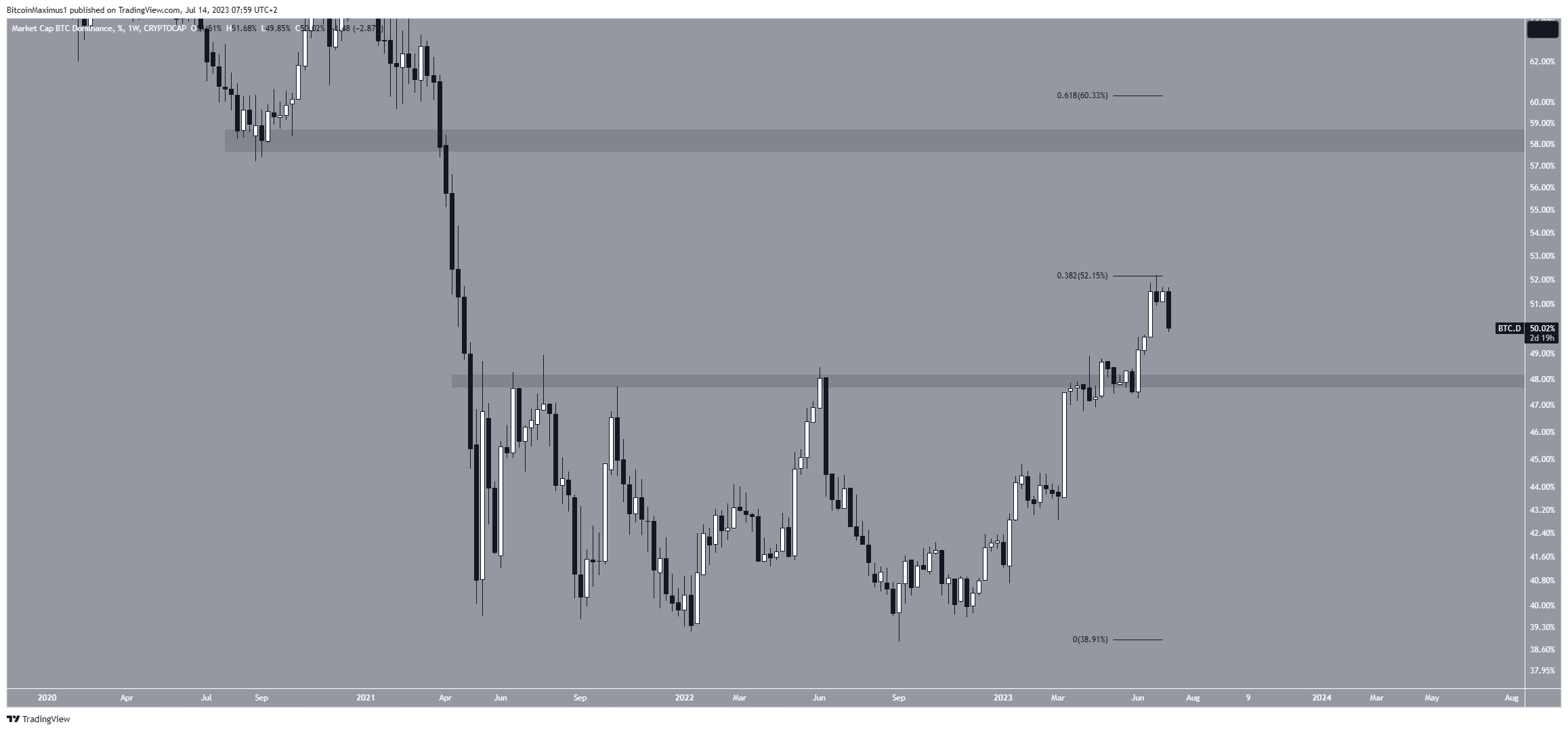

The Bitcoin Dominance Rate (BTCD) reached a new yearly high of 52.15% two weeks ago. The high occurred after BTCD broke out from the 48% horizontal resistance area.

However, BTCD was rejected by the 0.382 Fib retracement level and fell sharply this week. It seems that a local top is in place and BTCD will now fall to the 48% area, validating it as support. The reaction once it gets there can determine the future trend’s direction.

If BTCD bounces, it can resume its upward trend to 58%. However, if it breaks down, it will mean that the previous breakout was a deviation and new lows will follow.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link