[ad_1]

Coinbase (COIN) reached the highest weekly close since April 2022 last week. The close was also made above the $100 horizontal resistance area.

ARK Invest reduced its position in Coinbase shares by $26.23 million. This was the third sale in the last seven days.

The flagship ETF fund “ARK Innovation” sold 127,266 shares, “ARK Next Generation” sold 44,784 shares, and “ARK Fintech” sold 76,788 shares.

Nevertheless, technical analysis paints a bullish outlook. The COIN price shows bullish signs in the weekly and daily time frames, which could lead to a continuing increase.

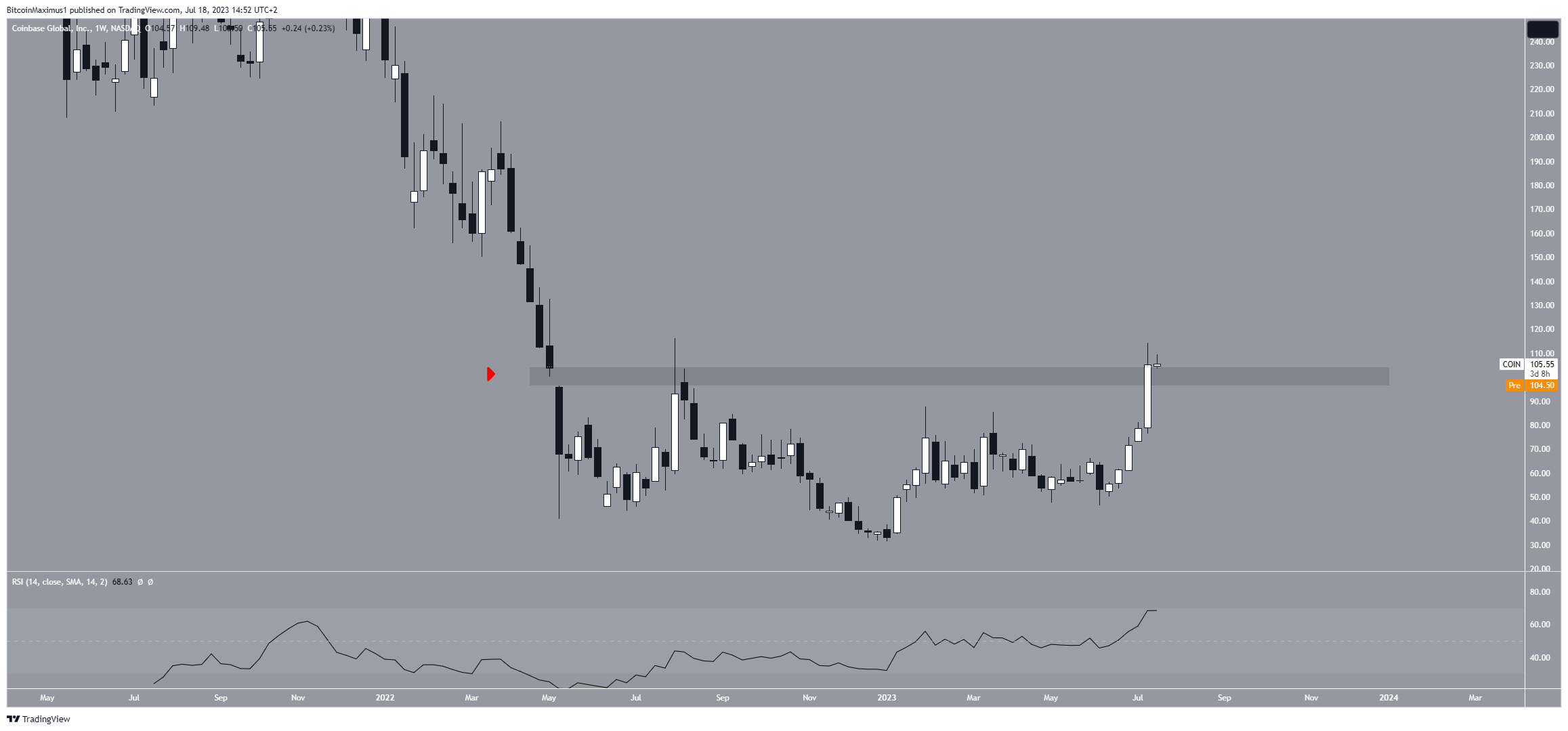

COIN Weekly Close Validates Breakout

The COIN price has increased since the beginning of the year. It created a higher low in June and accelerated its rate of increase afterward. Last week, the price reached a close of $105.

This was the highest close since April 2022 and also caused a breakout above the $100 horizontal resistance area. Therefore, it is a significant bullish sign that could mean the upward movement is just beginning.

Moreover, the weekly RSI supports the ongoing increase. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The indicator is above 50 and increasing, both signs of a bullish trend.

How Long Will Coinbase Share Price Increase Continue?

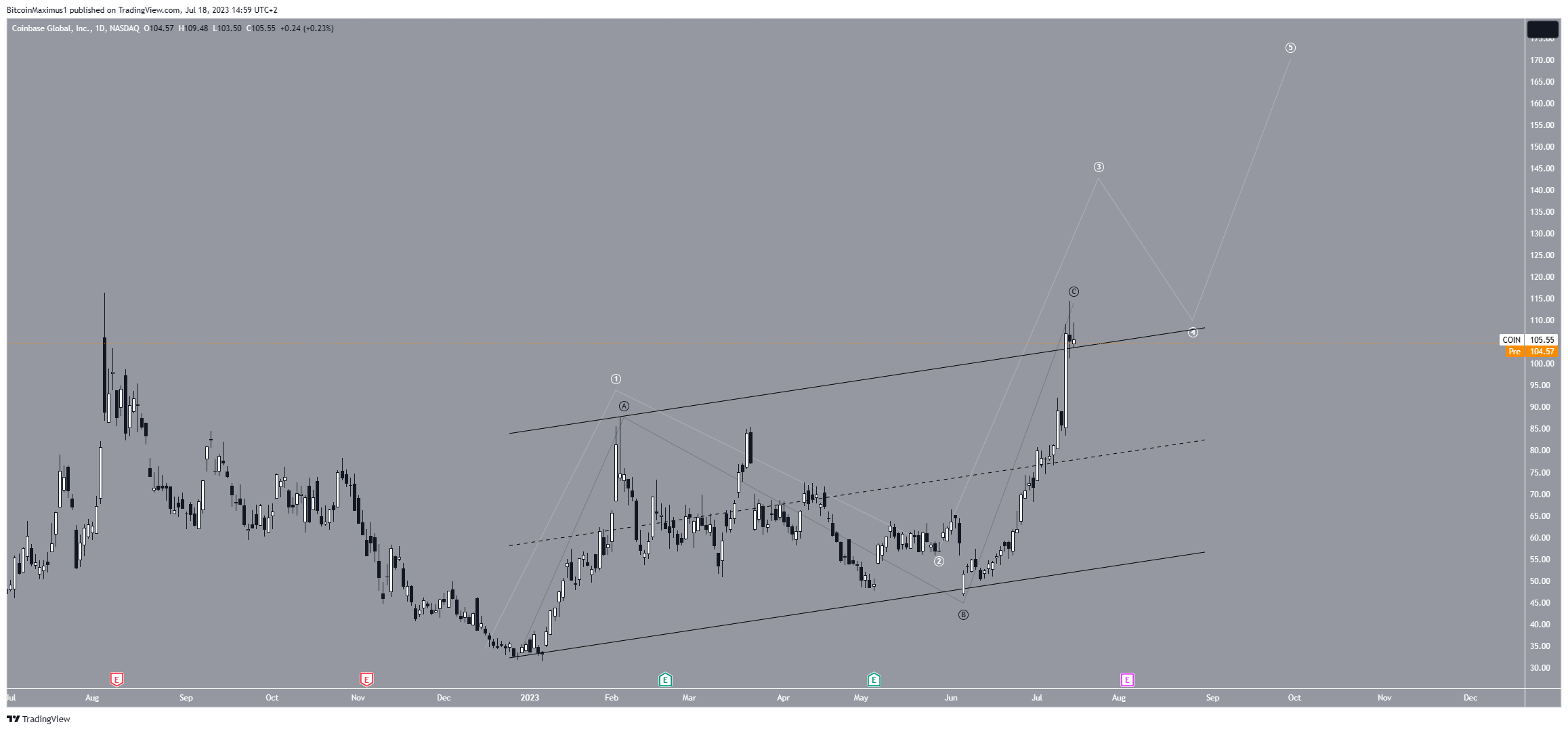

The daily time frame offers two possibilities for future movement.

The most likely one is bullish, given both the price action and the wave count. Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend. The most likely count suggests that the COIN price just began wave three of a five-wave increase (white).

This is also supported by the fact that the price just broke out from an ascending parallel channel.

If the count is correct, the price will complete wave three near $150 before returning to validate the channel’s resistance line as support. Then, another increase to $170 will be likely.

Despite this bullish COIN price prediction, falling below the channel’s resistance line will mean that the trend is still bearish.

In that case, the COIN price will have likely completed an A-B-C correction (black) and could fall to the channel’s support line at $65.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link