[ad_1]

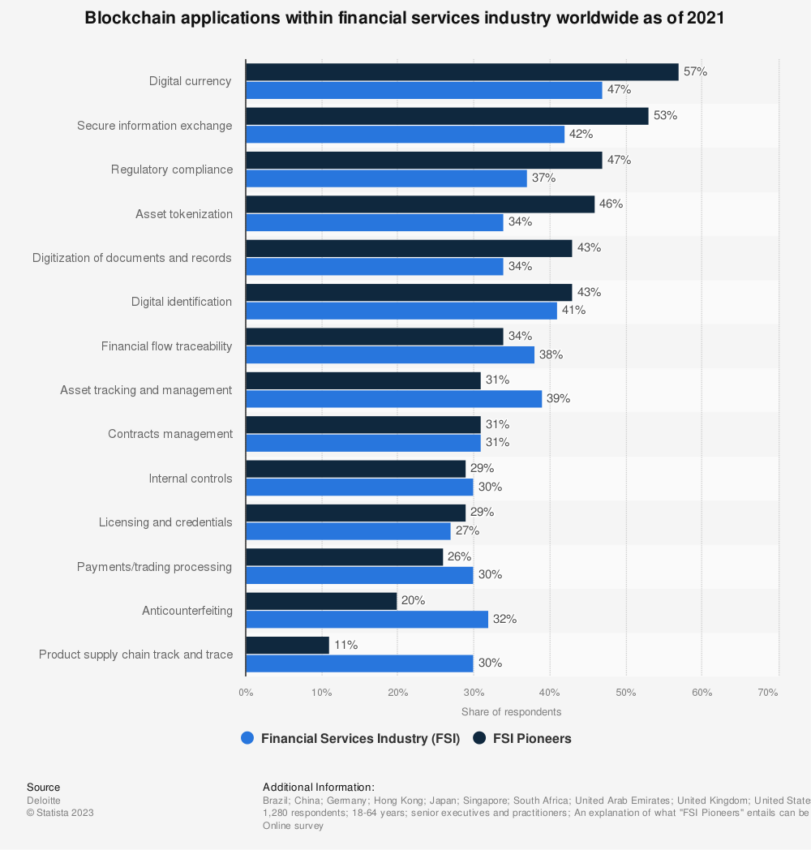

Tokenization has the potential to revolutionize asset management, with several leading firms investigating blockchain’s ability to digitize diverse asset classes.

However, as digital asset management seems poised for mainstream adoption, the momentum in blockchain development investment appears to be waning.

Franklin Templeton’s Bold Foray into Digital Funds

Tokenization involves issuing digital tokens to represent varied assets. Using blockchain technology, assets like securities, real estate, and art can be digitized, offering a more fluid and transparent trading environment.

Franklin Templeton has been a pioneer in this space. After successfully launching the Franklin OnChain US Government Money Fund (FOBXX) on the Stellar blockchain, they extended their operations to the Polygon Network.

Presently, the cumulative value of tokenized US money market funds is an impressive $660 million, with FOBXX boasting the lion’s share at a $294 million market cap. However, competition is heating up.

WisdomTree: A New Contender on the Horizon

Aiming to carve a niche in asset tokenization, WisdomTree unveiled several digital funds through its WisdomTree Prime platform this year.

By leveraging Stellar and Ethereum blockchains, WisdomTree offered alternatives to Franklin Templeton’s offerings and introduced index funds tracking top United States corporations.

During an earnings call, Jonathan Steinberg, WisdomTree’s CEO, recently highlighted the firm’s tokenization endeavors, emphasizing WisdomTree’s advantage as an early bird in this domain.

BlackRock’s Imminent Entry into Digital Asset Management

BlackRock, the global asset management behemoth, might soon dip its toes in the tokenization waters.

Larry Fink, BlackRock’s CEO, has consistently highlighted blockchain’s transformative potential. He has underscored its promise to enhance market efficiencies and cost-effectiveness for investors.

BlackRock has not formally declared any tokenization strategies. However, the firm partnered with Jio Financial Services to design a “digital-first” asset management platform for India.

It also applied for a Bitcoin ETF with the United States Securities and Exchange Commission, hinting at a forthcoming digital transition.

A Paradox: Reduced Venture Capital in Blockchain

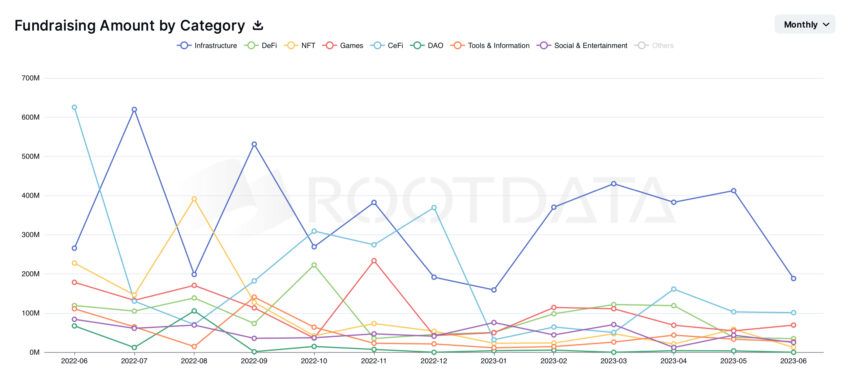

Surprisingly, venture capital (VC) funding in the crypto sector seems cooling down even as asset management warms up to blockchain.

Sequoia Capital recently trimmed its crypto venture fund from $585 million to a mere $200 million and concurrently halved its crypto ecosystem fund.

Data from RootData reveals a marked dip in VC funding for crypto startups over the past year. From a high of $12.6 billion in Q1 2022, VC investments dropped to just $2.14 billion by Q2 2023.

The significant decline spans all blockchain-centric enterprises, from DeFi and GameFi to NFTs and infrastructure.

The Ripple Effect: Crypto Exchanges Bear the Brunt

The funding freeze has notably affected crypto exchanges. For instance, Bitkub’s valuation in Thailand nosedived from a peak of nearly $1 billion to $184 million.

Many analysts link Sequoia’s retrenchment with its stakes in the now-defunct crypto exchange FTX. The repercussions of FTX’s downfall continue to deter investors, casting a shadow over the industry’s future.

While tokenization presents a promising future for asset management, the broader blockchain and crypto sectors face challenges, especially concerning investments and valuations.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link