[ad_1]

Recent data suggests that staking Ethereum might be more prudent than using the same number of ETH to acquire non-fungible tokens (NFTs).

This assumption emerges in light of the significant decline in NFT floor prices. But is it true?

Ethereum Staking Post-Shapella

Post the Shapella upgrade, Ethereum has witnessed a soaring demand for staking. A key driver for this trend appears to be ETH whales, who, rather than liquidating their holdings, are exploring avenues to generate passive income.

Despite waiting times stretching to 33 days and 8 hours, nearly 700,000 validators have joined the network, and over 80,000 validators are eagerly lined up. This represents a testament to the immense trust and optimism in Ethereum’s future.

There are a few factors that set Ethereum staking apart. For one, the Shapella upgrade introduced new staking withdrawal features. This significant move caught the attention of investors, directing them toward long-term benefits.

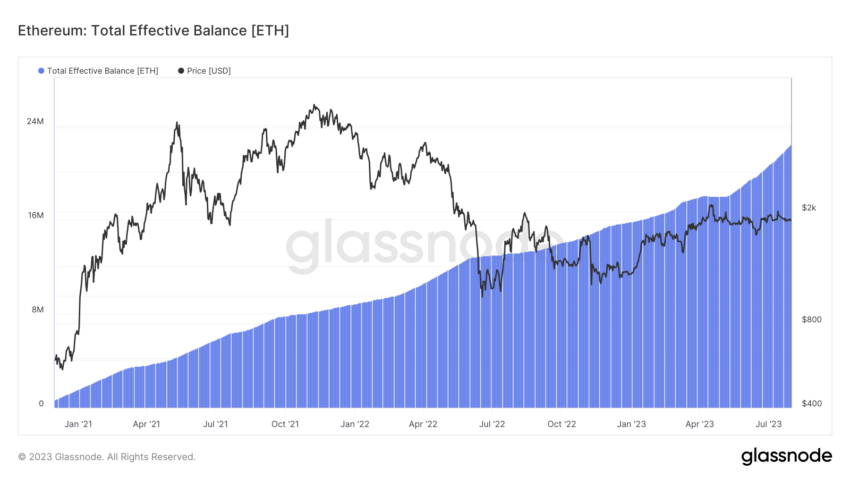

Indeed, data from Glassnode shows that more than 22 million ETH are staked, and nearly 4 million ETH in staking rewards have been distributed, worth $44 billion and $8 billion, respectively.

Read more: How To Stake Ethereum (ETH)

On the other hand, only 12 million ETH have been withdrawn from staking pools since the Shapella update.

Another important factor to consider is Ethereum’s deflationary nature, which magnifies scarcity. A diminished circulating supply can potentially spike Ether’s value, an attractive proposition for any investor. More than 3.5 million ETH have been burned since the Merge.

The Great NFT Depression

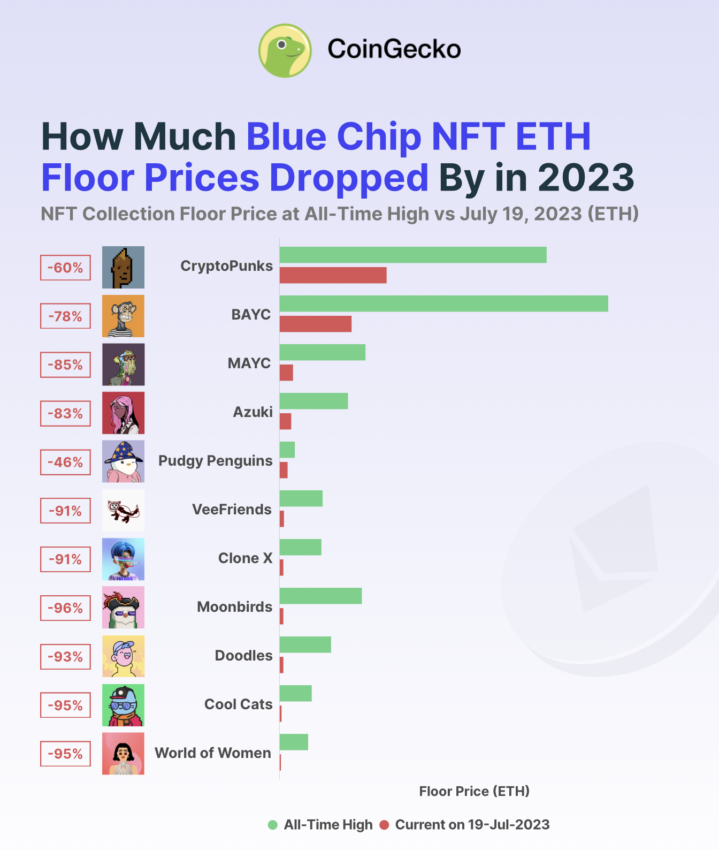

While Ethereum staking is booming, NFT floor prices witnessed a dramatic crash from their all-time highs. Most NFT collections have plummeted by an average of 82.80%, or 34.60 ETH.

The undeniable correlation between NFT value and Ethereum underscores the volatile nature of the NFT market.

Amidst the vast sea of NFTs, some experienced more profound losses than others. Moonbirds, for instance, suffered the sharpest decline, with floor prices crashing by 95.70% in ETH. Meanwhile, the floor prices of Bored Ape Yacht Club (BAYC) and CryptoPunks, declined by 60.00% and 78.00%, respectively.

Read more: Top 9 OpenSea Alternatives in 2023

In contrast, Pudgy Penguins, which largely steered clear of the NFT frenzy, exhibited remarkable resilience, seeing a more modest drop of 45.90% in its floor price.

The downturn is symptomatic of the broader “NFT winter,” which saw a mirrored decline in metaverse land prices. Somnium Space experienced the steepest decline, plummeting 93.90% from its peak, closely trailed by Voxels at 93.80%.

Other popular collections like The Sandbox dropped by 89.80%, Decentraland by 87.80%, and Otherdeeds registered an 85.5% decrease.

Furthermore, a 35.00% reduction in NFT trading volume in Q2 2023 suggests a rapid recovery for NFTs, and metaverse land costs might be wishful thinking.

The present situation offers a nuanced perspective. NFT collections have never been more affordable. This could represent an unprecedented opportunity for discerning investors to participate in NFT collections with sound fundamentals.

Read more: How To Start NFT Trading: A Step-by-Step Guide

However, the downturn in the NFT market also leaves many wondering whether they would have been better off staking their ETH instead.

Staking ETH vs. Buying NFTs

The decision largely depends on an individual’s risk tolerance. Staking Ethereum provides a more predictable return while diving into NFTs like CryptoPunks or Pudgy Penguins involves a speculative play where prices are notably volatile.

Given that staking Ethereum necessitates a minimum of 32 ETH, let’s hypothetically consider the same amount invested in popular NFTs.

In August 2021, CryptoPunks held an average floor price of 32 ETH. During the same period, BAYC stood at 10 ETH, and by September 2021, Pudgy Penguins were priced at around 2 ETH. Fast forward to the present, CryptoPunks, BAYC, and Pudgy Penguins are now trading at 47 ETH, 29.30 ETH, and 4.35 ETH, respectively.

Breaking it down, CryptoPunks offered a return of 17 ETH, BAYC 19.30 ETH, and Pudgy Penguins a modest 2.35 ETH.

To put this into perspective, a 32 ETH investment back then could have acquired a single CryptoPunks NFT, three BAYC tokens, or 16 of the Pudgy Penguins. The respective returns from these choices would have been 17 ETH, a staggering 57.90 ETH, and 37.60 ETH.

In comparison, staking the same 32 ETH in August 2021, at a projected linear reward rate of 5.50%, would have garnered roughly 5.62 ETH.

Read more: Ethereum (ETH) Price Prediction

Prominent figures like Raoul Pal, formerly of Goldman Sachs, have championed Ethereum’s potential, forecasting its value could surge by 300-400% in the foreseeable future, a sentiment also shared by Bloomberg’s Mike McGlone, who sees ETH values potentially reaching $6,000 by 2025.

However, in hindsight, NFT investments in CryptoPunks, BAYC, and Pudgy Penguins would have been more lucrative for those with a risk appetite.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link