[ad_1]

The Curve DAO Token (CRV) price saved a breakdown from a long-term support level with a strong bounce at on August 1.

The support line has been in place for 252 days. Therefore, whether it breaks down or stays in place could determine the future trend’s direction.

Curve DAO Trades at Key Level After Bounce

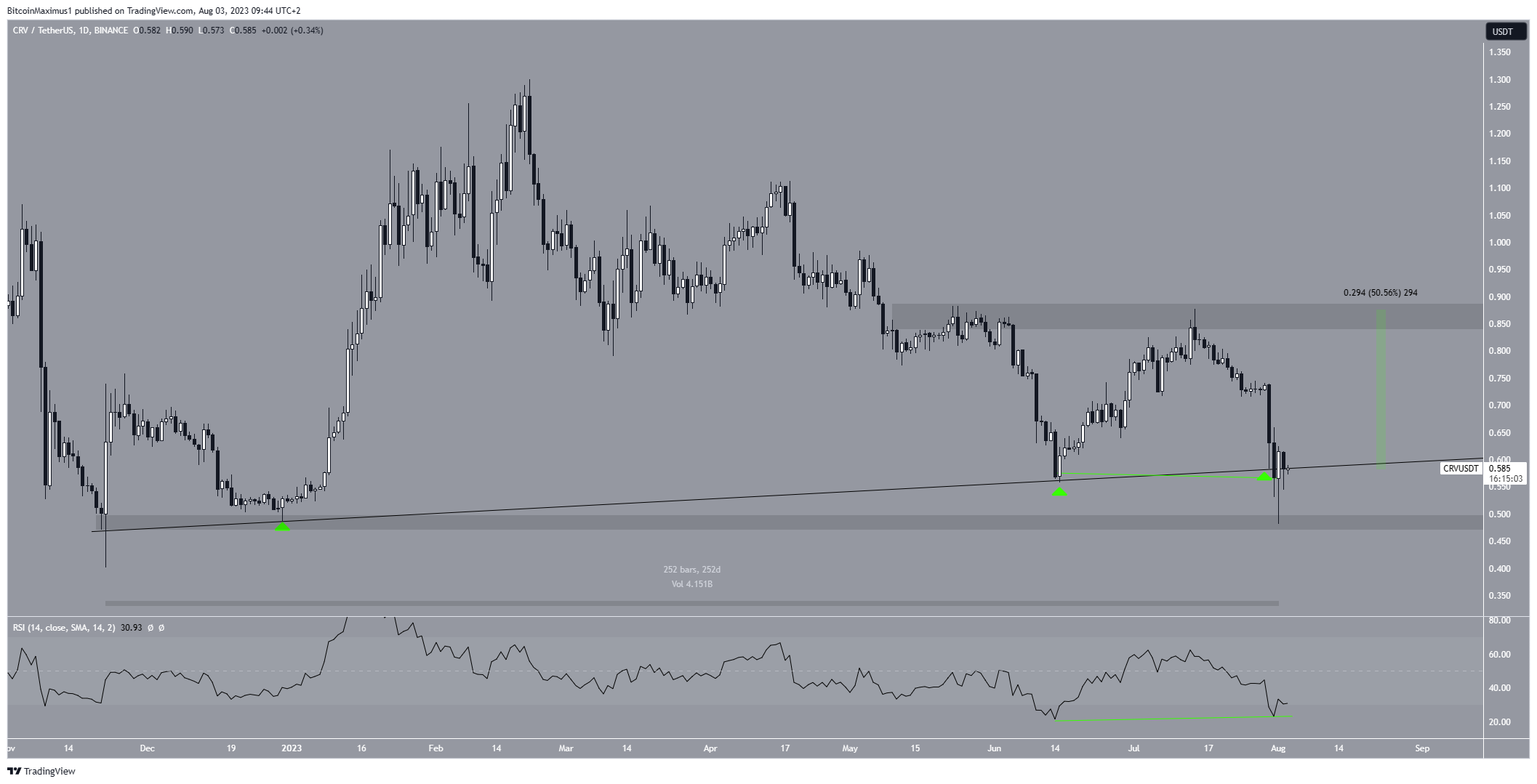

The CRV price has increased alongside an ascending support line since November 2022. So far, the line caused three bounces (green icons). However, after the third bounce on July 30, the price seemingly broke down from the line the next day, falling to a low of $0.48.

But, a bounce ensued, and the price created a long lower wick, validating the $0.48 horizontal area as support. The bounce salvaged the price falling to a new yearly low. Rather, CRV is now attempting to reclaim the ascending support line, which has been in place for 252 days if the alleged breakdown is discounted.

It is possible that the downward movement was caused by a potential liquidation faced by CRV’s founder Michael Egorov.

Reclaiming the line could lead to a 50% increase to the next resistance at $0.88, while a rejection from it will likely cause a drop to the $0.48 support area.

The daily RSI is bullish, supporting the continuing of the bounce. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold, and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

Even though the RSI is below 50, it has generated a significant amount of bullish divergence (green line). This is an occurrence when a momentum increase accompanies a price decrease, reducing the validity of the drop. Such a divergence often precedes strong upward movements.

CRV Price Prediction: Wave Count Suggests Decrease Is Corrective

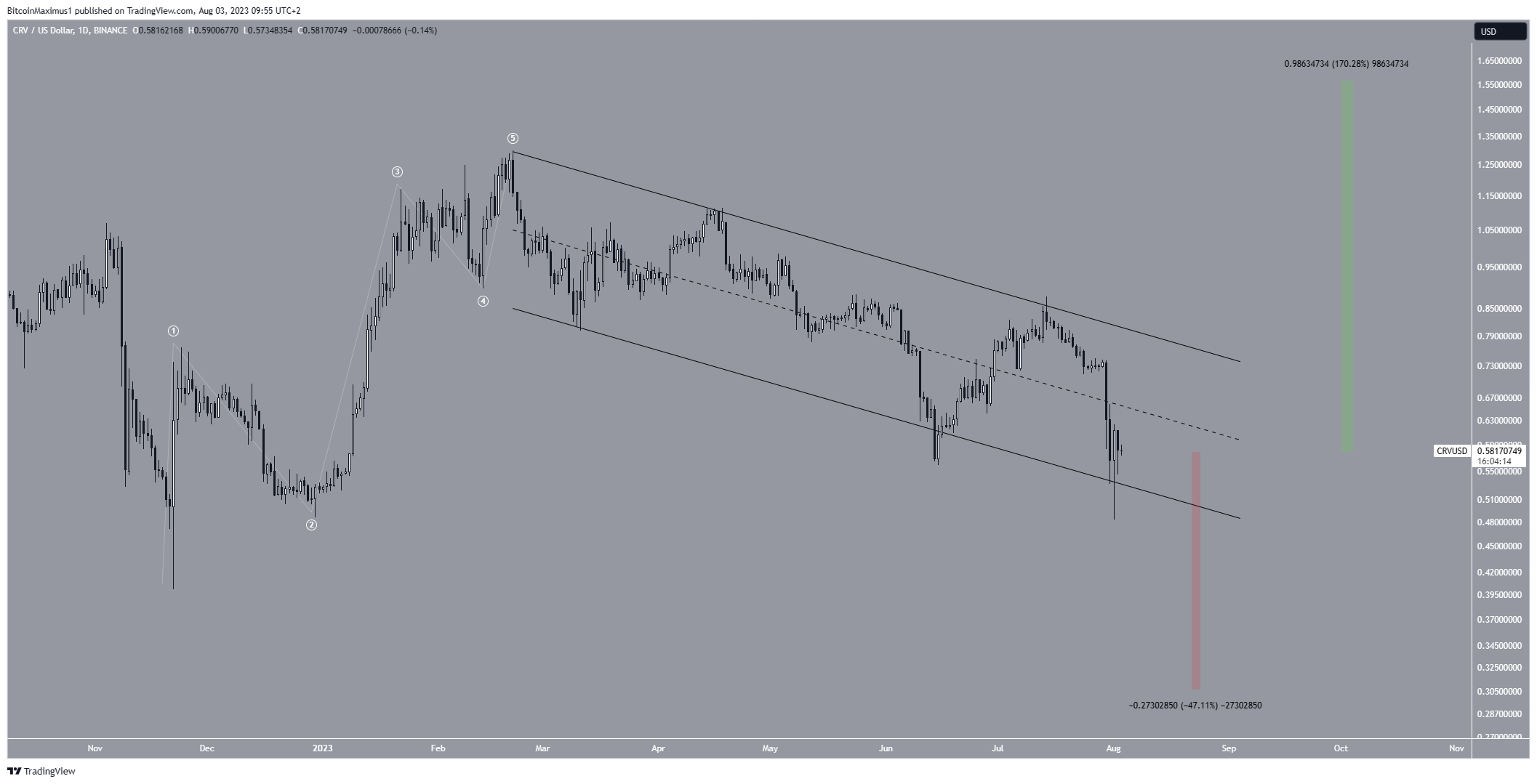

A closer look at the technical analysis from the daily time frame suggests that the increase that began in November 2022 is a five-wave upward movement (white).

If the count is correct, the ensuing decrease is a correction. The fact that it has been contained inside a descending parallel channel aligns with this possibility.

However, the price still trades in the lower portion of the channel. It has top break out from it in order to confirm that the trend is still bullish.

If it does, the price could increase by 170% and reach the next resistance at $1.55.

Despite this bullish CRV price prediction, closing below the channel’s support line will mean that the trend is still bearish. In that case, the November 2022 low will not hold and the CRV price can fall by another 47% to $0.30.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link