[ad_1]

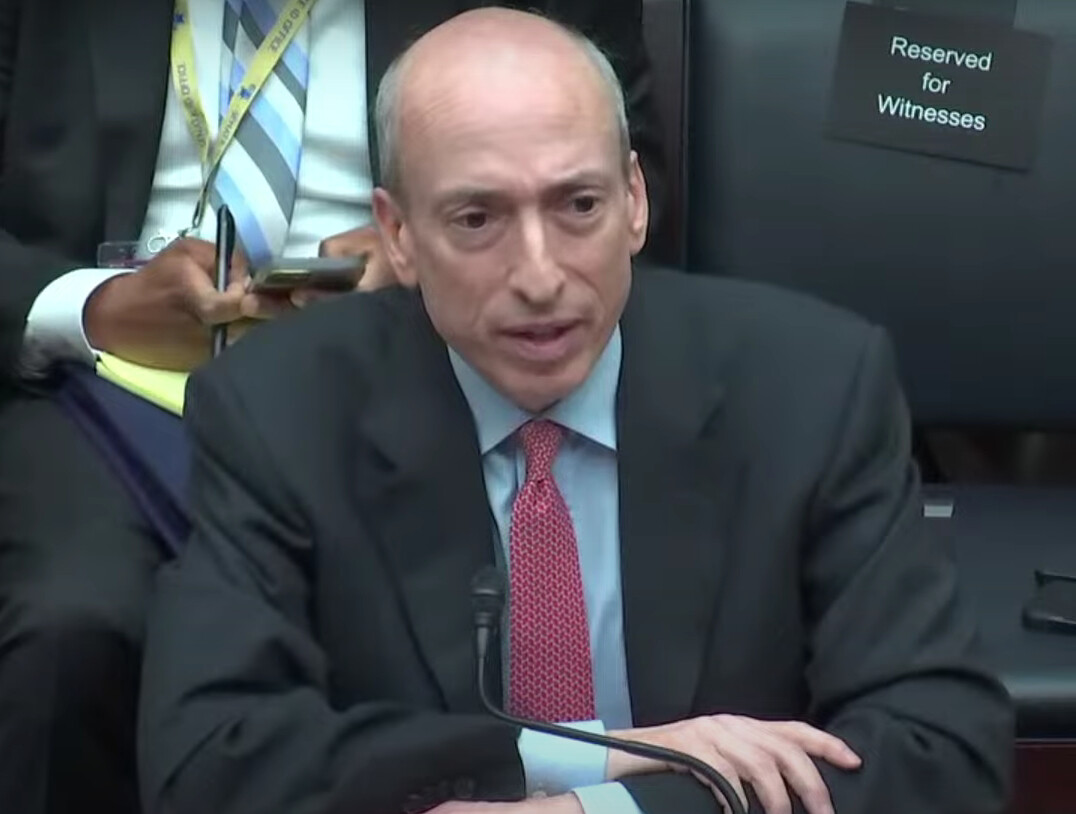

Since assuming the position of Chair at the Securities and Exchange Commission (SEC), Gary Gensler’s stance on cryptocurrencies has undergone a notable shift.

During the pre-Covid boom of the cryptocurrency market, Gensler expressed optimism about blockchain and its potential to drive change.

In a December 2019 op-ed for CoinDesk, he wrote about being intrigued by the innovation’s capacity to lower verification and networking costs, reduce economic rents and data privacy costs, and promote economic inclusion.

“The potential to lower verification and networking costs is worth pursuing, particularly to lower economic rents and data privacy costs, and promote economic inclusion,” he wrote at the time.

However, upon assuming the role of SEC Chair, Gensler adopted a more skeptical approach, using a “poker chips” analogy to describe cryptocurrencies.

He warned Congress in October 2021 about the growing stablecoin market, emphasizing the systemic risks associated with it.

“I do think that if this continues to grow – and it’s grown about tenfold in the last year – it can present those systemic wide risks,” Gensler said.

Gensler Increase Crypto Crackdown Follosing FTX Collapse

Gensler increased his crypto crackdown after the collapse of cryptocurrency exchange FTX, which brought allegations of negligence towards the SEC and Gensler himself.

The collapse of FTX led also to criticisms from lawmakers, with US Representative Ritchie Torres holding Gensler solely responsible for the catastrophe.

This seemingly marked a turning point for Gensler, as he became more hardline on crypto.

In addition to pursuing legal action against FTX, Gensler initiated lawsuits against prominent players in the industry.

Back in June, the SEC sued both Binance, the world’s largest cryptocurrency exchange, and Coinbase, the largest US-based cryptocurrency.

The commission filed 13 charges against Binance and its US affiliates, ranging from allegedly operating as an unregistered exchange to offering unregistered securities.

The regulator also levied similar charges against Coinbase, claiming that it operated as an exchange, broker, or clearing agency without the required registrations.

Despite Gensler’s initial success in his regulatory efforts, the SEC boss has faced a number of legal setbacks as of late.

Just last week, the US Court of Appeals for the District of Columbia Circuit ruled in favor of Grayscale, ordering the SEC to set aside its earlier rejection of Grayscale’s application to turn its GBTC fund into a spot Bitcoin exchange-traded fund (ETF) and reopen the review process.

JPMorgan analysts have claimed that the ruling will force the SEC to “approve the spot bitcoin ETF applications that are still pending from several asset managers, including that from Grayscale.”

It is worth noting that while Gensler’s approach to crypto regulation has received significant attention, he has also been active in bringing new rules to the traditional finance sector.

According to the Committee on Capital Markets Regulation, Gensler has introduced more new rules and regulatory proposals to the financial sector than any of his predecessors since the aftermath of the 2008 financial crisis.

[ad_2]

Source link