[ad_1]

At the start of 2021, NFTs were a niche technology most often discussed online among in-the-know tech nerds. By early spring, they were everywhere: plastered on the front pages of mainstream news sites, discussed feverishly in workplaces, invoked at kitchen tables across the world, and mocked and ogled on late-night television.

One particular event from that timeframe looms large: On March 11, digital artist Mike “Beeple” Winkelmann sold an Ethereum NFT work, “Everydays: The First 5000 Days,” for a record-shattering $69.3 million at a Christie’s auction. Within minutes, news publications and social media accounts began breathlessly attempting to dissect the sale, and the curious new technology at its center.

The Beeple sale not only helped remake public understanding of NFTs; it also permanently altered the auction house behind it. In the aftermath of the auction, Christie’s—a 257-year-old institution until then best known for handling masterwork paintings, fine jewelry, and historical artifacts—suddenly found itself with first-mover advantage at the crest of a new technological frontier.

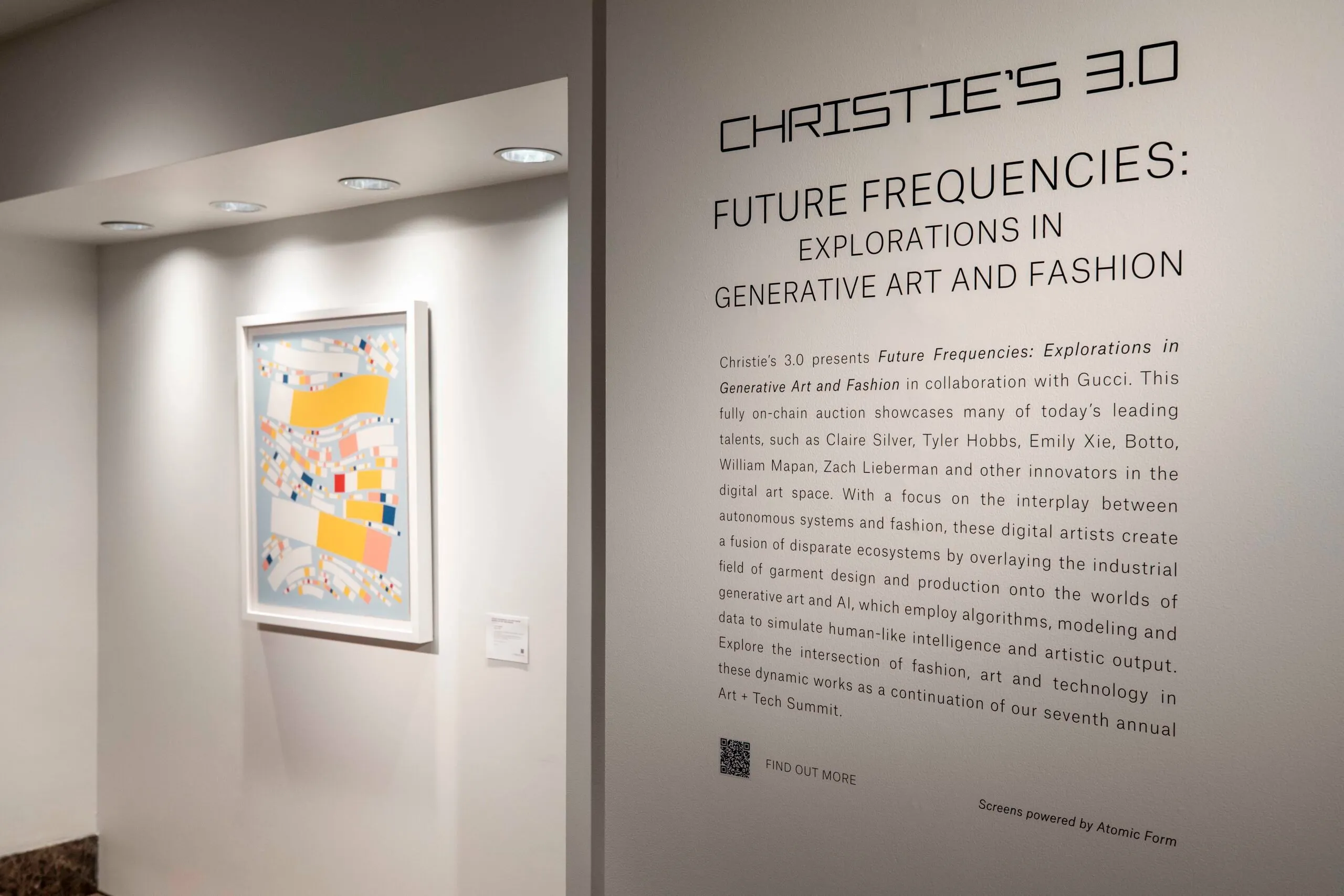

In the months following March 2021, the auction house seized on that head start by establishing multiple new wings of the company, including Christie’s Ventures, a tech-focused venture capital arm, and Christie’s 3.0—a first-of-its-kind, fully on-chain Ethereum NFT art marketplace built by a traditional art world titan.

Since its launch about a year ago, Christie’s 3.0 has auctioned on-chain works both from digital-native artists like Claire Silver, William Mapan, Jack Butcher, but also on-chain versions of works from more traditional artists including Keith Haring. In the process, it has imbued the emerging on-chain fine art market with the legitimacy of one of the most esteemed art brands in the world.

But the path that brought Christie’s to the dominant position it currently enjoys at the intersection of art and technology was never guaranteed—and never even expected. By all accounts, the historic sale that kicked it all off was something of a fluke.

“We had zero expectations when we put it up for sale—the first bid was $100 and we had no reserve,” Christie’s Digital Art Director Nicole Sales Giles, who helped spearhead the Beeple “First 5000 Days” auction, told Decrypt’s SCENE of that first auction. “And then we’re just sitting there watching the computer, and we were like, ‘What the fuck?’ It just kept going up.”

Shortly after the piece seized global headlines for its record-shattering sale price, Sales Giles and her colleagues realized they had likely tapped into something bigger than a single eye-grabbing auction.

“Beeple was the first one that I really took attention to,” Jon Ross Le Haye, Christie’s Head of Digital Design, recalled of his first exposure to NFT art. “That was the big one that Nicole brought into Christie’s. I think that was the one where I—and I think the whole art market—just did a double take at that kind of value. That was the moment where I really saw the potential.”

Reinforcing confidence in that potential was the fact that, in the immediate aftermath of the Beeple sale, Christie’s high-powered clientele were soon peppering the auction house’s employees on a daily basis with questions about how to best take advantage of NFTs as a new asset class.

“We’ve always said: We go where our collectors want us to,” Le Haye said. “There’s a market there, if lots of collectors are asking. That really empowered us—and we knew that we needed a platform to be able to be that authority.”

So Le Haye, Sales Giles, and a handful of other eager Christie’s employees soon abandoned their day jobs to embark on the ragtag project of creating a fully blockchain-native digital auction platform worthy of the Christie’s brand.

“For me, it was terrifying—absolutely terrifying, blockchain,” Le Haye said. “On the developers’ side, they knew nothing about art. We just trusted each other. And it just worked. I don’t know how.”

One of the chief obstacles facing the project was the Christie’s team’s adamancy that the platform’s auction mechanism exist fully on-chain, as a gesture of Christie’s 3.0’s genuine and long-term commitment to the mission of blockchain-backed art.

“It would have been so much easier to build the entire thing on a 2.0 web-based system, and do what everyone else was doing: collective bidding in a format that looks like it’s bidding, but it’s not,” said Daniel Hart, a Christie’s product designer. “Where, you know, once the auction closes, then you do an on-chain transaction—we could have very easily just come to that.”

But the team pushed ahead with its vision for a fully on-chain digital art platform. And after nearly half a year of building and testing, by the fall of 2022, it was ready.

Christie’s 3.0 launched in October 2022. In the year and change since that debut, the platform has experimented with a wide variety of featured artists, artistic mediums, and auction structures—serving as an informal incubator for Christie’s as a whole.

One such experiment, in May, saw the Christie’s 3.0 team list a very small collection of Twitter-inspired NFT pieces by digital artist Jack Butcher without adding estimates on the works. It was a seemingly minor omission, but one that made waves at such a traditional and regimented auction house as Christie’s. The pieces were instead listed at an uncommonly low opening bid of $8—a nod to the controversial Twitter verification subscription at the center of Butcher’s project.

“I remember our site kind of blew up. We had over 500 new registrants for the auction. Everybody was trying to get a bid in, and we couldn’t believe what we were seeing,” Lydia Chen, a senior member of the Digital Art Sales team for Christie’s 3.0, recalled of the Butcher auction. “We’ve never seen such a rush to participate in an auction before.”

NFTs have not only increased Christie’s appetite for risk in the art world. They have also expanded the conservative auction house’s willingness to take on new sectors entirely.

In the months following the March 2021 Beeple sale—before Christie’s 3.0 was even off the ground—Christie’s tapped Microsoft veteran Devang Thakkar to see if he could help sift through the incredible amount of tech-related information that was suddenly flowing into the storied company.

The day after [the Beeple sale], they just started getting information and deal flow comparable to a very successful venture capitalist firm,” Thakkar said. “Anyone in the sphere of digital art and Web3 suddenly wanted to ask us either, ‘What the hell were you guys thinking doing this Beeple sale?’ or, ‘I have a company, would you be interested in collaborating since you’re so forward-thinking?’”

So Thakkar helped turn that deal flow worthy of a venture capital firm into a venture capital firm itself. In July 2022, Christie’s Ventures opened its doors as a tech-minded VC offering a unique entry point into one of the world’s most dominant art institutions. Since then, the firm has invested in seven projects, running the gamut from blockchain technology and AI to FinTech, SaaS, and hardware.

“Christie’s was formed maybe 100 years before the first light bulb. When we were formed, there was no technology,” Thakkar said. “I bet my two Bitcoin, or whatever I have left these days, that every new tech that came after our birth, one of our clients was the first one to adopt it.”

“Our clients are highly affluent,” Thakkar continued. “They want the best things in life, including art, and they’re buying newer technologies and experimenting with them. I think we will stay relevant by learning about these technologies as our clients use them, and integrating them again, thoughtfully, into the art market.”

Edited by Andrew Hayward

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link