[ad_1]

Binance’s Market Share Shift Amid Regulatory Challenges

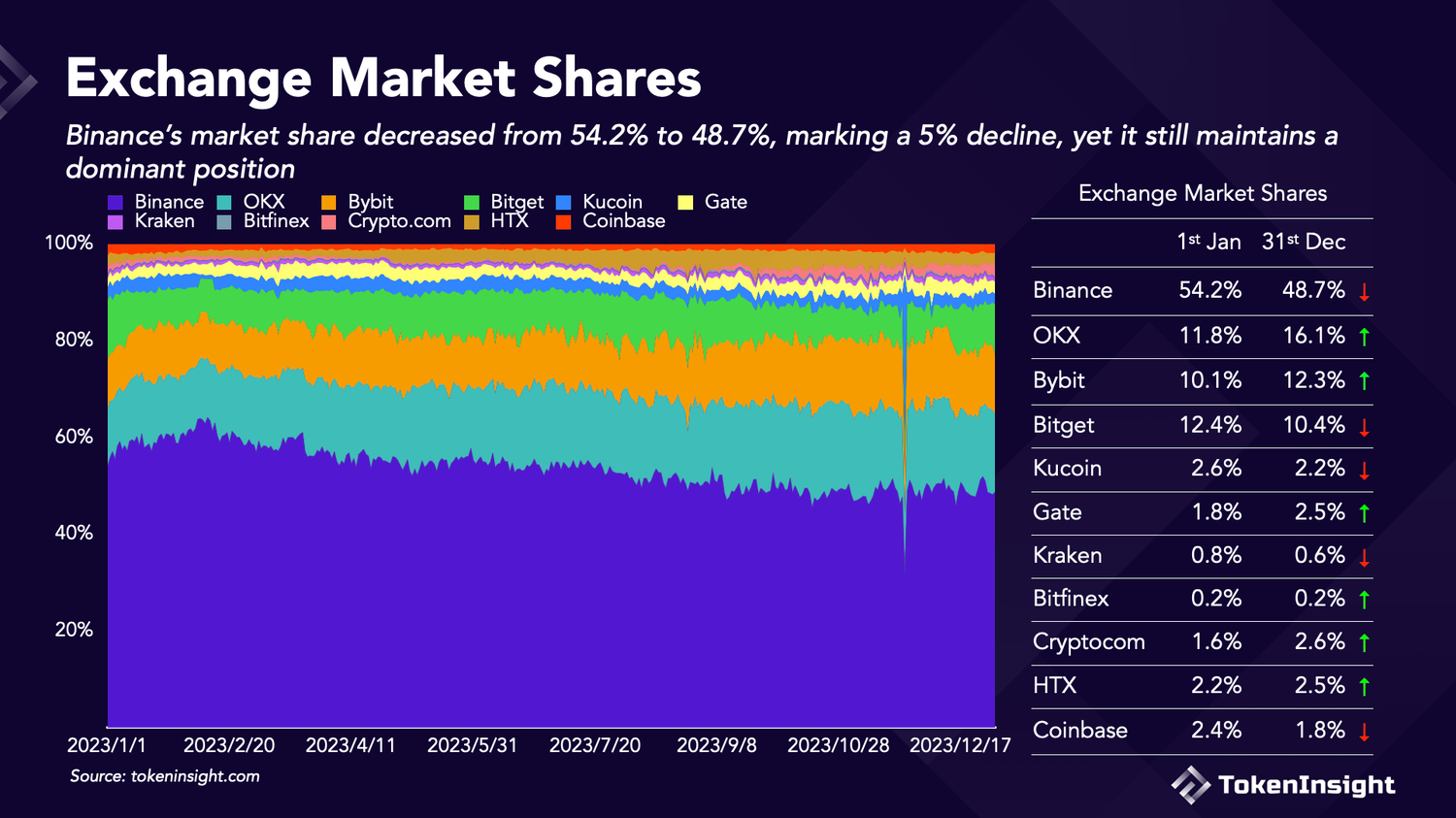

Binance, a prominent player in the cryptocurrency exchange landscape, is navigating regulatory challenges that have led to a 5% decrease in its market share, dropping from 54.2% to 48.7%. The notable shift in market dynamics comes on the heels of the departure of Binance’s founder, Changpeng Zhao, as part of a $4.3 billion settlement with the U.S. Department of Justice, as revealed by recent research from TokenInsight.

Changpeng Zhao’s Exit and Regulatory Impact

Binance experienced a 5% decline in market share, dropping from 54.2% to 48.7%. This shift followed the decision of Binance’s founder, Changpeng Zhao, to step down as CEO as part of a $4.3 billion settlement with the U.S. Department of Justice, according to recent research from TokenInsight.

Rise of OKX and Bybit in the Market

As per data, other cryptocurrency exchanges such as OKX and Bybit appeared to be significant gainers in the market, with OKX increasing by 4.3% in market share to 15.7%, while Bybit saw a rise of 2.2% up to 11.6%.

Trader Confidence in Centralized Exchanges Despite Regulatory Troubles

Analysts added that despite Binance facing troubles with U.S. regulators last year, traders “do not seem to have lost confidence in centralized exchanges.”

Decentralized Exchanges’ Q1 2023 Peak and Subsequent Contraction

In Q1 2023, decentralized exchanges — including Uniswap, PancakeSwap, Orca, and others — reached their peak market share at 2.98%. Meanwhile, Q1 was also the quarter with the largest transaction volume, analysts added. However, in the subsequent two quarters, both trading volume and market share gradually contracted. While there was a slight increase in both metrics in Q4, the overall proportion did not undergo significant changes, as per TokenInsight’s data.

An Evolving Crypto Ecosystem

The crypto ecosystem, marked by regulatory fluctuations and market responses, remains a dynamic space. Binance’s experience reflects the resilience and adaptability inherent in the industry. As the regulatory landscape continues to evolve, the crypto community witnesses the rise of new contenders and the shifting fortunes of established players, paving the way for an exciting future in the ever-evolving world of digital assets.

[ad_2]

Source link