[ad_1]

The Financial Toll of Crypto Hacks

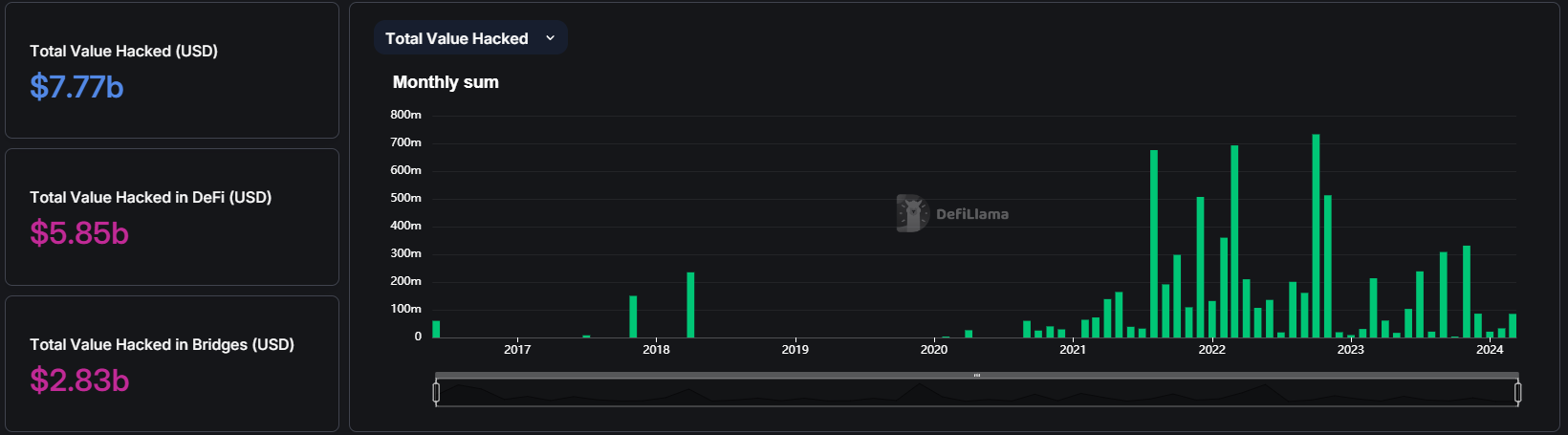

The digital asset industry has been besieged by financial predators, with crypto hacks siphoning off billions of dollars. A recent analysis by DefiLlama shines a light on the severity of the situation, revealing that the all-time losses from such security breaches have exceeded $7.7 billion as of April 1. This alarming figure comes despite a 23% reduction in incidents during the first quarter of 2024 compared to the previous year.

Decentralized finance (DeFi) protocols have borne the brunt of these attacks. Since 2016, hackers have extracted a colossal $5.8 billion from DeFi platforms, demonstrating the high stakes involved in securing these digital landscapes.

Bridges: A Hacker’s Goldmine

A significant vulnerability within the DeFi sector lies in the bridges that facilitate asset transfers between blockchains. These platforms have been particularly susceptible, with over half of DeFi hacks targeting them. Attackers have successfully exploited smart contract flaws to misappropriate $2.8 billion, highlighting critical security lapses in bridge designs.

DefiLlama’s report categorizes the most prevalent hacking methods, which include private key compromises, access control exploits, and flash loan price oracle attacks. Yet, a puzzling 42% of incidents remain unclassified, leaving experts guessing at the methodologies employed in nearly half of all hacks.

Historic Hacks: From The DAO to Ronin

The crypto community still recalls the shockwaves sent by the first major hack against “The DAO” in 2016, which resulted in a $60 million loss. This incident underscored the dangers of reentrancy bugs and set a precedent for the vulnerabilities inherent in smart contracts.

The record-breaking heist of over $600 million from Axie Infinity’s Ronin bridge in 2021, attributed to North Korea’s Lazarus group, marked a grim milestone in crypto theft. Despite such setbacks, platforms like Ronin have managed to recover, supported by major exchanges and enhanced security measures.

The Path to Robust Security

While the threat of hacks looms large, there is a silver lining. Industry leaders and experts are optimistic about the future of blockchain security. Slava Demchuk, co-founder and CEO of AMLBot, believes that through sustained growth and collaboration among stakeholders, the cryptocurrency industry can achieve comprehensive security defenses against malicious actors.

As the digital asset space evolves, the collective efforts of governments, law enforcement, and the crypto community will be crucial in fortifying the ecosystem against future threats.

[ad_2]

Source link