[ad_1]

The Bitcoin (BTC) price action has been bearish over the past few weeks. The price now also risks a breakdown from a short-term bearish pattern.

A breakdown from this pattern could be what causes a sharp descent, taking the BTC price to levels not reached since the beginning of March.

BTC Price Solidifies Resistance

The BTC price action since the beginning of April has been bearish. This was accentuated by the bearish engulfing candlestick pattern on April 17 and 24, and the two ensuing rejections (red icons) in the following weeks.

The movement decisively validated the $29,800 area as resistance. The resistance area is present in the weekly time frame. So, it makes it possible that a local top has been reached.

Despite the bearish price action, the weekly Relative Strength Index (RSI) remains positive. The indicator is currently above 50 and is increasing.

Traders use the RSI as a tool to determine whether a market is overbought or oversold and decide whether to buy or sell an asset. If the RSI is above 50 and trending upward, it indicates that the bulls are in control.

Conversely, if the RSI falls below 50, it suggests that the bears are in control. So, the current RSI reading suggests that the long-term trend is still bullish.

Bitcoin Price Prediction: Does a Correction Await?

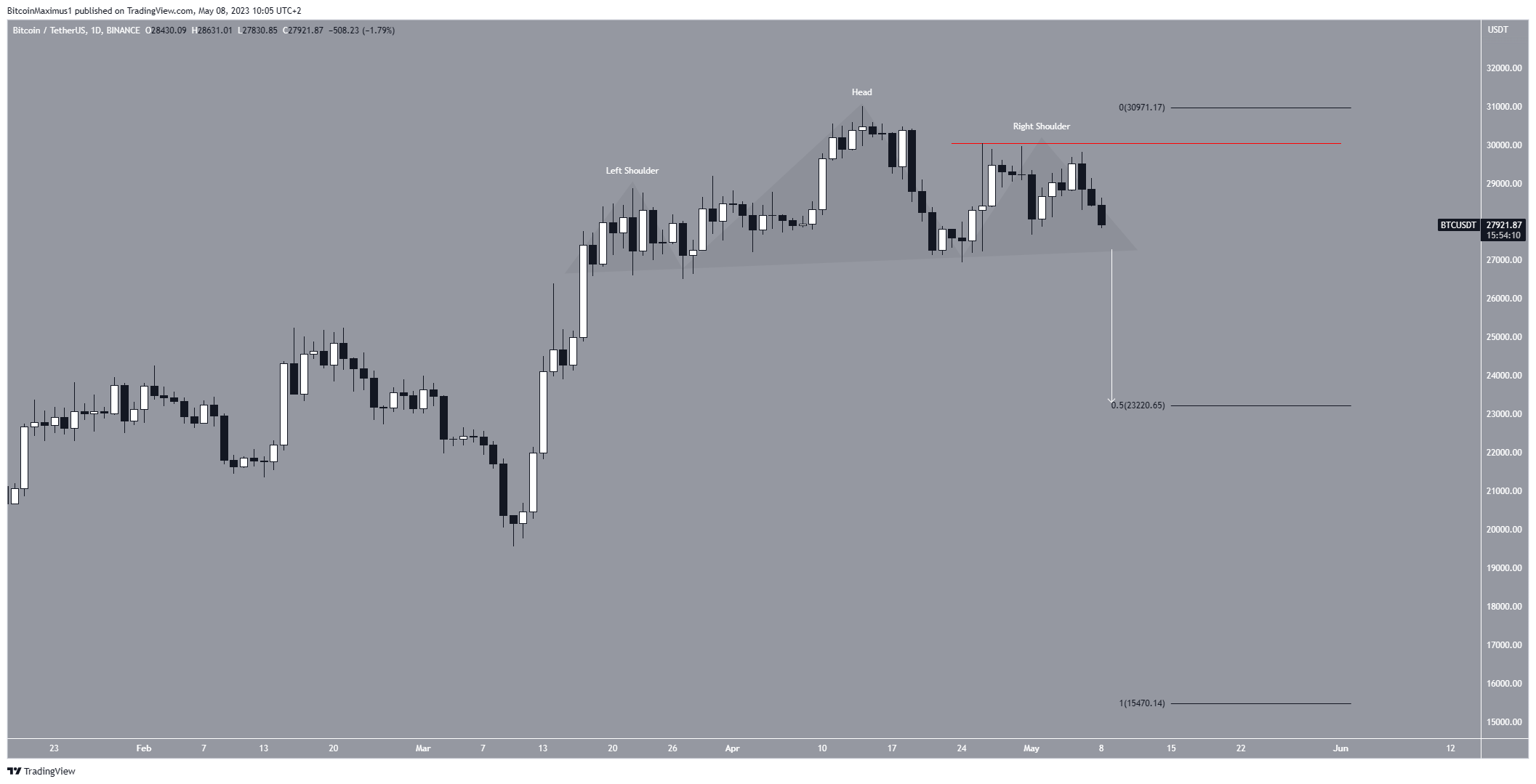

The current technical analysis on the daily time frame indicates a bearish Bitcoin price prediction. This is due to the creation of a head and shoulders pattern, typically viewed as a bearish pattern.

This pattern consists of an initial high, then a peak that is higher than the preceding one, followed by a second peak similar in length to the first one. Afterward, a drop breaks the neckline and catalyzes a sharp fall.

If the potential breakdown in price follows the entire height of the pattern (white), it could cause the digital asset to fall to a minimum price of $23,400. This aligns with the 0.5 Fib retracement support level (black).

According to the Fibonacci retracement principle, after a significant price change in one direction, the price often partially retraces or returns to a prior price level before continuing in its original direction.

Despite this bearish prediction, if the price were to move above the right shoulder (red line) at $30,000, it would indicate that the trend is not bearish.

Instead, it could lead to an increase toward the next long-term resistance at $36,500.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link