Bitcoin Price Prediction as U.S. 10-Year Yields Drop Below 4%

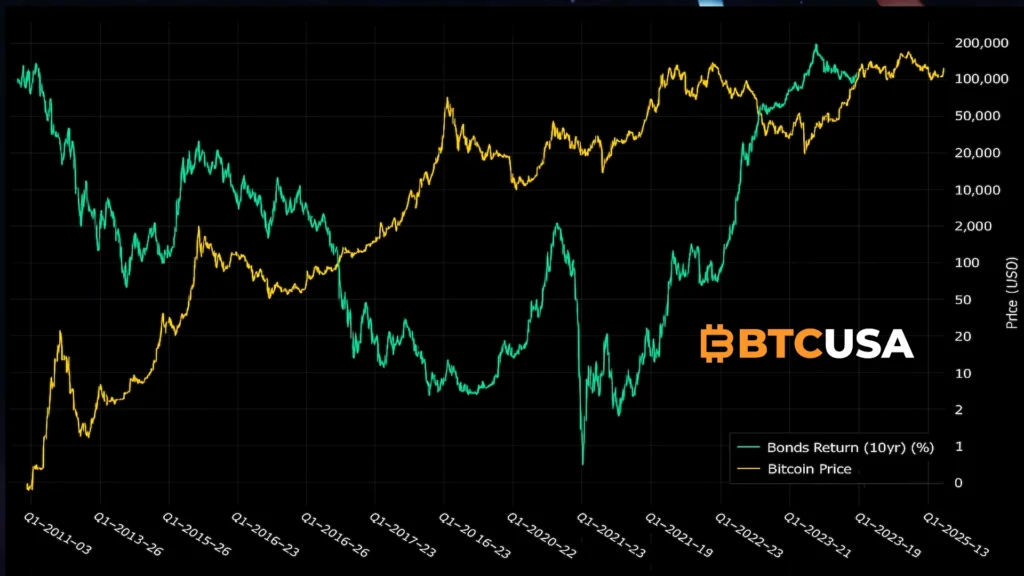

The recent move of U.S. 10-year Treasury yields below the critical 4% level has shifted the entire macro environment and significantly influenced current Bitcoin price prediction models. This is not a minor fluctuation in the bond market. It is a structural signal that affects liquidity, investor behavior, capital allocation, and long-term pricing assumptions for all major risk assets — especially Bitcoin.

When long-term yields fall, the opportunity cost of holding non-yielding assets decreases. This is one of the most important factors in any Bitcoin price prediction framework. As bonds become less attractive from a yield perspective, capital is forced to search for alternative stores of value and asymmetric return opportunities. Historically, Bitcoin has been one of the primary beneficiaries of this transition.

The drop below 4% is more than a technical milestone. It is a psychological turning point that reinforces a new phase in monetary expectations. It signals that markets are beginning to price in easier financial conditions. That expectation alone is enough to support a strong Bitcoin price prediction narrative in both the near and long term.

The Historical Relationship Between Falling Yields and Bitcoin Price Prediction

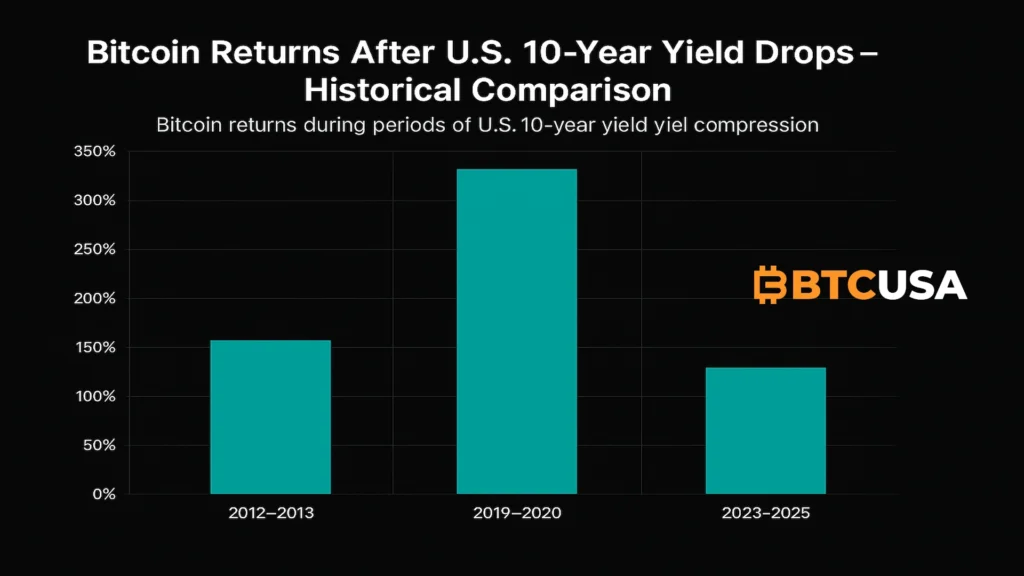

Periods of declining U.S. Treasury yields have consistently preceded major shifts in Bitcoin price prediction. In previous market cycles, every significant downturn in long-term yields created a favorable environment for Bitcoin appreciation.

In 2019, yields began to fall sharply as recession fears emerged. Shortly afterward, Bitcoin price prediction models shifted upward as capital moved away from traditional safe-haven instruments and into alternative assets. In 2020, yields collapsed even further as central banks accelerated monetary expansion. That period triggered one of the most dramatic moves in Bitcoin history, validating the strongest bullish Bitcoin price prediction scenarios of the time.

By contrast, rising yields in 2022 and 2023 suppressed liquidity and created headwinds for Bitcoin price prediction. Now, with the trend reversing again, the macro logic that supports higher Bitcoin valuations is back in play.

This relationship is not theoretical. It has repeated itself through multiple economic regimes. When yields decline, Bitcoin price prediction improves.

Liquidity Expansion and Overall Bitcoin Price Prediction

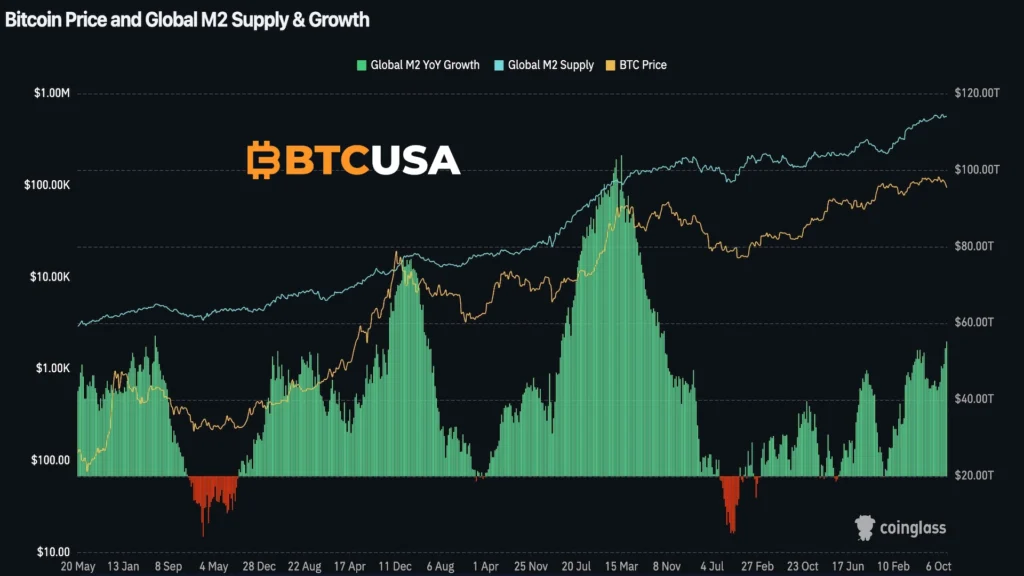

Bitcoin price prediction is inextricably linked to global liquidity conditions. Expansion of the money supply and easing financial conditions increase the amount of capital available for speculative and long-term investments. As yields fall, borrowing becomes cheaper, leverage increases, and government debt becomes easier to sustain. This combination often results in the expansion of the monetary base over time.

At the same time, Bitcoin supply remains fixed and predictable. This imbalance between an expanding currency base and a fixed digital asset supply is one of the strongest structural arguments behind a bullish long-term Bitcoin price prediction.

When liquidity increases, Bitcoin historically absorbs a portion of that expansion. It functions as a financial sponge, drawing in excess monetary supply that seeks protection from inflation, debasement, and systemic risk.

This is why liquidity trends must always be included in any serious Bitcoin price prediction.

Macro analysts increasingly track indicators such as the Global M2 money supply, central bank balance sheets, real interest rates, and risk-on / risk-off sentiment when building a Bitcoin price prediction framework. These metrics provide deeper insight into how excess liquidity flows through the global financial system and eventually finds its way into scarce assets like Bitcoin.

Additional signals supporting the current Bitcoin price prediction include the weakening long-term purchasing power of fiat currencies, rising sovereign debt levels, and the growing role of Bitcoin as a geopolitical hedge. As more institutional and sovereign players begin to view Bitcoin as a strategic asset rather than a speculative instrument, its role in long-term Bitcoin price prediction becomes even more structurally significant.

These macro variables remain aligned in favor of higher Bitcoin price prediction scenarios over extended time horizons.

Investor Psychology and Its Impact on Bitcoin Price Prediction

Another powerful element of Bitcoin price prediction is investor behavior. When bonds offer attractive yields, investors tend to favor safer, income-generating assets. When those yields fall, psychology shifts. Risk appetite increases. The attractiveness of growth and scarce assets rises.

With yields now below 4%, traditional fixed-income products lose relative appeal. This shift begins to favor assets with asymmetric upside potential. Bitcoin, due to its scarcity, portability, and growing institutional acceptance, is one of the primary destinations for this redirected capital flow.

This reopening of risk appetite is an essential driver in current Bitcoin price prediction thinking. It supports both short-term momentum and long-term valuation expansion.

Technical Structure Supporting Bitcoin Price Prediction

Beyond macro conditions, Bitcoin’s technical and on-chain structure also supports a strong Bitcoin price prediction outlook.

Key factors include:

– Long-term holders continuing to accumulate

– Exchange reserves trending lower

– Increasing institutional exposure through ETFs and funds

– Reduced miner selling pressure following the halving cycle

These structural conditions reduce available supply while demand remains consistent or increases. When combined with the macro shift driven by collapsing yields, the path of least resistance for Bitcoin price prediction moves higher.

Short-Term Bitcoin Price Prediction (3–6 months)

This short-term Bitcoin price prediction is based on the immediate reaction of the market to yield compression and improving liquidity conditions.

As U.S. 10-year yields dropped below the key 4% level, short-term risk appetite strengthened. Historically, this has provided near-term momentum for Bitcoin.

Current Bitcoin price prediction ranges:

Base scenario:

$72,000 – $95,000

Bullish scenario:

$95,000 – $115,000

Pullbacks or consolidations should be seen as temporary pauses, not as a change in the broader directional bias. The macro backdrop continues to support a constructive Bitcoin price prediction outlook.

This short-term Bitcoin price prediction reflects a market that is responding to improving liquidity and shifting expectations around future monetary policy. As long as yields remain suppressed and capital continues rotating into risk assets, this Bitcoin price prediction scenario remains active.

Mid-Term Bitcoin Price Prediction (6–18 months)

The mid-term Bitcoin price prediction is anchored in sustained yield compression, improved liquidity conditions, and ongoing institutional demand.

As bond yields remain suppressed, more capital becomes available for allocation toward Bitcoin and other growth assets. The compounding effect of ETF inflows, decreasing exchange balances, and increased long-term holding behavior adds strong structural support to the mid-term Bitcoin price prediction.

Mid-term Bitcoin price prediction ranges:

Base scenario:

$110,000 – $160,000

Bullish scenario:

$160,000 – $220,000

This chart highlights a structural continuation of the current trend. It reflects a transition from recovery to expansion, where confidence in Bitcoin’s role as an alternative monetary system strengthens the overall Bitcoin price prediction outlook.

Long-Term Bitcoin Price Prediction (2026–2027)

The long-term Bitcoin price prediction is driven by structural fiat devaluation, sovereign debt stress, demographic shifts in capital allocation, and Bitcoin’s fixed supply curve.

Historically, the periods following major yield compression have coincided with exponential increases in Bitcoin’s valuation. If long-term yields remain suppressed or continue to decline, and if global liquidity expands further, Bitcoin price prediction models begin to shift into an entirely new valuation regime.

Long-term Bitcoin price prediction ranges:

Base scenario:

$250,000 – $350,000

Bullish scenario:

$350,000 – $500,000+

Aggressive liquidity expansion scenario:

$500,000 – $750,000+

This long-term Bitcoin price prediction is grounded in macroeconomic trends rather than short-term speculation. It reflects Bitcoin’s transition from a speculative asset into a global store-of-value alternative.

Bitcoin Price Prediction – Common Questions (People Also Ask)

Is Bitcoin price prediction reliable long term?

Bitcoin price prediction over long time horizons is based on macroeconomic trends, network fundamentals, and historical adoption curves rather than short-term market noise. While exact timing is unpredictable, long-term models for Bitcoin price prediction have remained structurally strong during periods of expanding liquidity and declining real yields.

What factors influence Bitcoin price prediction the most?

The most important drivers of Bitcoin price prediction include global liquidity conditions, interest rates, monetary policy, institutional adoption, supply dynamics, and macroeconomic instability. Among these, liquidity and interest rates are currently the most influential in shaping Bitcoin price prediction.

How does Risk-On / Risk-Off sentiment influence Bitcoin’s price?

Bitcoin acts primarily as a Risk-On asset. In a Risk-On environment (driven by falling interest rates, economic optimism, and abundant liquidity), investors seek higher returns and pile into assets like tech stocks and Bitcoin. Conversely, in a Risk-Off environment (driven by rising yields, uncertainty, or economic fear), investors retreat to traditional safe havens like US Treasury bonds, the US Dollar, and sometimes gold, causing a sell-off in Bitcoin. The current macro shift is strongly supporting a Risk-On environment.

Can Bitcoin really reach $250,000 or higher?

Historical post-yield-compression cycles support the possibility of $250,000+ levels in long-term Bitcoin price prediction scenarios. Such outcomes depend on sustained adoption, continued supply scarcity, and further weakening confidence in traditional monetary systems.

Is now a good time to consider Bitcoin based on this price prediction?

Every investment decision depends on individual risk tolerance. However, from a macro perspective, current conditions align with historically favorable environments for Bitcoin price prediction when compared to previous cycles of declining yields and rising liquidity.

A Brief Note on Altcoins and Traditional Markets

While this analysis is focused on Bitcoin price prediction, falling yields often benefit broader markets as well.

Technology stocks, selected altcoins, and emerging market assets tend to perform better in low-yield environments. However, Bitcoin remains the primary beneficiary due to its scarcity, macro positioning, and status as digital gold.

Any broader market recovery triggered by declining yields almost always begins with Bitcoin and is reflected most clearly in Bitcoin price prediction models.

Final Thoughts on Current Bitcoin Price Prediction

The current macro environment presents one of the clearest alignments for a bullish Bitcoin price prediction seen in recent years. With U.S. 10-year Treasury yields now below 4%, the opportunity cost of holding scarce, non-yielding assets is decreasing. At the same time, liquidity conditions are improving, and structural demand for Bitcoin continues to grow.

Volatility will always remain a feature of Bitcoin markets. However, when viewed through the lens of history, liquidity, supply dynamics, and macro regime shifts, the directional bias of Bitcoin price prediction remains decisively upward.

If present trends persist, the coming years may redefine not just Bitcoin’s price, but its global monetary role.

Investment Disclaimer

This Bitcoin price prediction analysis is provided for informational and educational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile and speculative. All investments carry risk, including the possible loss of principal.

Readers should conduct their own research and consult with a qualified financial professional before making any investment decisions based on this Bitcoin price prediction or any content published on BTCUSA.

Frequently Asked Questions

What is “global liquidity” and how is it linked to the Bitcoin price prediction?

Global liquidity is the total amount of money available in the global financial system (often measured by indicators like the Global M2 money supply). Falling bond yields signal an easing of financial conditions, which leads to the expansion of the money supply. Since Bitcoin’s supply is fixed while the monetary base expands, Bitcoin functions as a “financial sponge,” absorbing excess liquidity and, consequently, increasing in price.

How does the drop in US 10-Year Treasury Yields affect the Bitcoin price prediction?

The drop in US 10-Year Treasury Yields below a key level (e.g., 4%) is a bullish macroeconomic signal for Bitcoin. When bonds yield less, the opportunity cost of holding non-yielding assets (like Bitcoin) decreases. Capital is forced to rotate out of “safe,” low-yield bonds into assets offering asymmetric return potential, and Bitcoin has historically been a primary beneficiary of this transition.

What other factors, besides bond yields, support the bullish prediction?

In addition to macroeconomic factors, the prediction is supported by strong technical and on-chain fundamentals:

Supply Scarcity: Decreasing Bitcoin reserves on exchanges and continued accumulation by Long-Term Holders.

Institutional Demand: The growing influence of Exchange-Traded Funds (ETFs) and the increasing recognition of Bitcoin as a strategic asset.

Monetary Trends: The weakening purchasing power of fiat currencies and rising sovereign debt levels.

Why does falling bond yield change investor psychology?

When high-yield bonds become less attractive (yields fall), investors are psychologically less inclined toward safe, fixed-income assets. A shift in risk appetite occurs, which directs capital towards assets with high growth potential (asymmetric upside). Bitcoin, due to its scarcity and growing acceptance, is one of the primary destinations for this redirected capital flow.

Is now a good time to consider investing in Bitcoin, based on this price prediction?

From a macroeconomic perspective, current conditions (declining yields and improving liquidity) align with historically favorable environments for Bitcoin price appreciation, comparable to previous major growth cycles. However, any investment decision should always consider individual risk tolerance and financial goals.