Venture Capital Meets the Reality of Public Markets

A growing number of newly launched crypto projects are exposing a serious disconnect between private venture capital valuations and public market pricing. According to recent market data, several high-profile VC-backed tokens are trading at fully diluted valuations that are only a fraction of what investors originally paid in funding rounds.

This trend is raising questions about the sustainability of the current crypto funding model and whether private valuations have become completely detached from market reality.

The Gap Between VC Valuations and FDVs

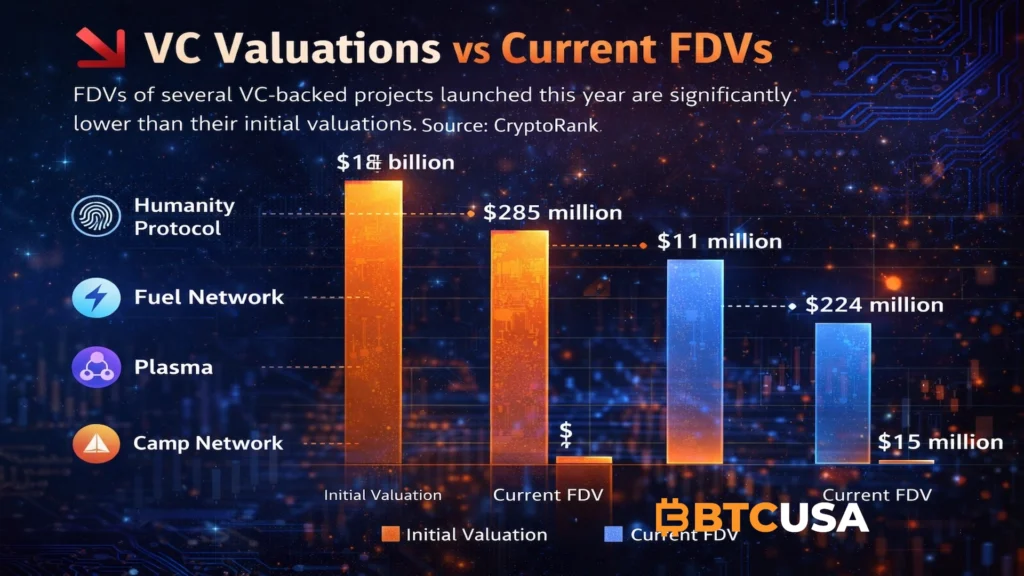

The scale of the divergence is difficult to ignore. Some of the most discussed examples this year include:

Humanity Protocol launched with an initial valuation of $1 billion, yet its current FDV is roughly $285 million.

Fuel Network was also valued at $1 billion privately but is now trading at a FDV close to $11 million.

Plasma entered the market after a $500 million valuation, only to settle near $224 million in FDV.

Camp Network was valued at $400 million but currently sits around $15 million.

In each case, more than half of the project’s perceived value evaporated almost immediately after public trading began.

Why Are FDVs Collapsing After Launch?

The core issue is that VC rounds are priced in an environment with limited liquidity, restricted access, and aggressive narrative building. These private markets are driven by future promises rather than present demand.

Once tokens hit public exchanges, those expectations collide with real trading conditions where price discovery happens instantly and brutally.

Retail investors are no longer willing to pay premium prices for unproven protocols, especially in a market that has already endured multiple boom-and-bust cycles.

Token Unlocks Add Downward Pressure

Another major factor is the aggressive token unlock schedules built into most of these projects. Early investors and insiders often receive their tokens at extremely low effective prices, then begin unlocking shortly after launch.

This creates relentless sell pressure precisely when liquidity is weakest, crushing price momentum before any organic demand can develop.

Even strong technology narratives struggle to survive when the circulating supply is expanding faster than user adoption.

The Liquidity Illusion in Private Markets

Private crypto funding has become a closed loop where valuations are marked up based on the next funding round rather than real usage.

Funds mark positions to model prices that assume perfect liquidity, yet when those same tokens reach open markets, there is rarely enough capital to absorb the supply at those levels.

This illusion of liquidity makes portfolios look strong on paper while hiding massive fragility underneath.

What This Means for Retail Investors

Retail participants are effectively inheriting the risk that private investors are shedding.

Instead of discovering promising projects at early stages, public traders are now being offered fully priced assets with heavy unlock schedules and little fundamental demand.

This inversion of the traditional venture cycle has left many retail investors holding tokens that were already overvalued before the first trade was executed.

Is the VC Model Breaking?

The evidence increasingly suggests that the traditional crypto VC playbook is no longer functioning.

High seed valuations, minimal product validation, and large token allocations to insiders create a structural mismatch between incentives and market sustainability.

Projects no longer grow into their valuations — they launch into immediate repricing.

A Structural Reset for the Crypto Funding Cycle

This collapse in FDVs may represent a long-overdue reset.

Markets are demanding real traction, real users, and real revenue rather than abstract roadmaps and aggressive marketing. Protocols that cannot demonstrate product-market fit quickly are being repriced to near-zero regardless of their previous funding success.

What Comes Next?

Expect funding rounds to become smaller, token unlock schedules to be extended, and retail demand to focus only on projects with proven traction.

The era of billion-dollar valuations before product delivery is coming to an end.

BTCUSA Insight

The crypto market is no longer rewarding narratives — it is pricing survival. In 2025, liquidity belongs to Bitcoin and Ethereum, while experimental VC tokens must now earn every dollar of valuation in open markets.