Table of Contents

A Debate Bigger Than Ethereum and Solana

Most crypto arguments revolve around price, speed, or market share. This one is different.

Vitalik Buterin and Anatoly Yakovenko just laid out two radically opposing visions of how a blockchain should evolve. Their disagreement is not technical. It is philosophical.

Should a blockchain aim to become so stable that it can survive without further updates?

Or must it constantly iterate to remain useful?

This is not just Ethereum versus Solana.

It is two fundamentally different models of what a blockchain is supposed to be.

Vitalik’s Vision: Ethereum Must Pass the Walkaway Test

Vitalik Buterin argues that Ethereum should be able to function even if all core developers disappeared tomorrow.

He calls this the walkaway test.

In his view, Ethereum should behave like a tool rather than a service. Once built, it should not require ongoing maintenance to remain useful.

To achieve that, Vitalik outlines several long-term goals:

• full quantum resistance

• scalability through ZK-EVM and data sampling

• a state architecture capable of lasting decades

• complete account abstraction

• a robust gas model resistant to attacks

• a stable Proof-of-Stake economic design

• a block building model resistant to censorship

The ultimate objective is clear: Ethereum must reach a point where it could ossify — become largely unchanging — and still deliver its core value.

Innovation would continue, but mostly through applications and parameter tweaks, not radical protocol redesigns.

This is the blockchain as digital constitution model.

Toly’s Counterpoint: Solana Must Never Stop Iterating

Anatoly Yakovenko, co-founder of Solana, takes the opposite stance.

In his view, a blockchain that stops evolving is a blockchain that dies.

Toly argues that:

• protocols must continuously adapt to user needs

• usefulness matters more than philosophical purity

• iteration is essential for survival

• real-world problems should drive development

• improvements should be constant and practical

He does not reject decentralization or resilience. But he rejects the idea that long-term stability should come at the cost of progress.

For Solana, change is not a risk.

Change is the strategy.

This is the blockchain as evolving product model.

Two Different Definitions of Success

The disagreement reveals two incompatible ideas of what a blockchain should optimize for.

Ethereum focuses on:

• maximum long-term security

• independence from specific developers

• minimal reliance on future upgrades

• predictability and permanence

Solana focuses on:

• immediate utility

• developer experience

• performance improvements

• rapid adaptation to market needs

One model prioritizes robustness.

The other prioritizes relevance.

What This Means for Users and Investors

For users, the distinction matters.

Ethereum’s approach favors:

• conservative financial applications

• high-value settlement layers

• systems where stability matters more than speed

Solana’s approach favors:

• consumer applications

• high-performance use cases

• fast-moving DeFi and payments ecosystems

Neither model is objectively right or wrong. They simply optimize for different futures.

The Risk of Ossification

Vitalik’s vision comes with a potential downside.

A protocol that becomes too rigid may struggle to adapt to new technologies, user behaviors, or unforeseen challenges.

If innovation slows too much, applications may migrate elsewhere.

Stability can turn into stagnation.

The Risk of Endless Iteration

Toly’s vision has its own dangers.

Constant upgrades can introduce:

• technical complexity

• coordination challenges

• centralization pressure

• unpredictable changes

A system that never stops changing may struggle to become a truly neutral foundation.

Flexibility can turn into fragility.

Two Blockchains, Two Roles

The likely outcome is not that one philosophy defeats the other.

Instead, the industry may need both.

Ethereum could become the global settlement and trust layer — slow, stable, and nearly unbreakable.

Solana could become the high-speed application layer — fast, adaptive, and relentlessly optimized.

Different tools for different purposes.

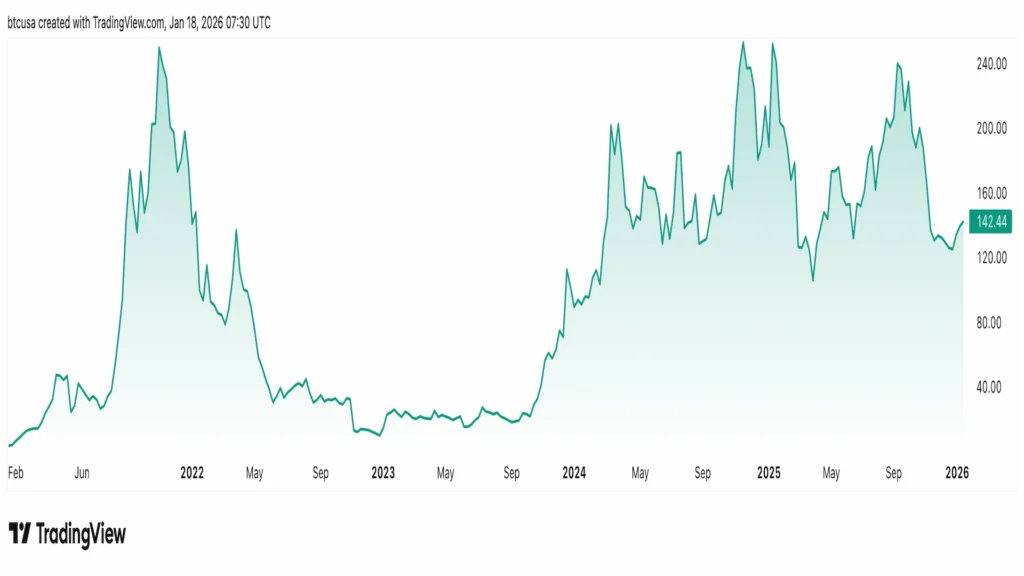

Market Context: How ETH and SOL Have Performed

While this debate is primarily philosophical, market behavior provides useful context for both visions.

Over the last several years, Ethereum and Solana have followed very different performance trajectories. Ethereum has gradually positioned itself as a more conservative, institutional-grade network, while Solana has behaved like a fast-growing, high-beta technology platform.

Here is how the two assets compare from a pure market perspective.

Ethereum price chart reflects a more mature asset profile:

• slower but steadier growth cycles

• deeper liquidity

• lower volatility compared to newer chains

• stronger correlation with institutional flows

This aligns with Ethereum’s philosophy of stability and long-term reliability.

Solana’s price dynamics, on the other hand, illustrate:

• faster and more aggressive market cycles

• sharper drawdowns and rebounds

• higher sensitivity to ecosystem news

• stronger retail-driven momentum

These patterns mirror Solana’s iterate-first development model and focus on rapid evolution.

Price charts alone do not determine which philosophy is superior. But they show how the market currently perceives the two approaches: Ethereum as digital infrastructure, Solana as a high-growth technology platform.

What BTCUSA Will Watch

This philosophical split will shape crypto for years.

BTCUSA will monitor:

• how Ethereum progresses toward quantum resistance and long-term architecture

• how Solana manages decentralization while iterating

• developer migration trends between ecosystems

• user adoption patterns across both chains

• real-world performance under market stress

The debate is not academic. It will influence capital flows, application design, and the structure of the next crypto cycle.

A Healthy Tension

In the end, this disagreement is a positive sign.

It shows that blockchain is mature enough to ask deep questions about its future.

Ethereum says: build it once, build it right.

Solana says: keep building, forever.

Between those two ideas lies the future of decentralized technology.

And the market will ultimately decide which vision proves more resilient.