[ad_1]

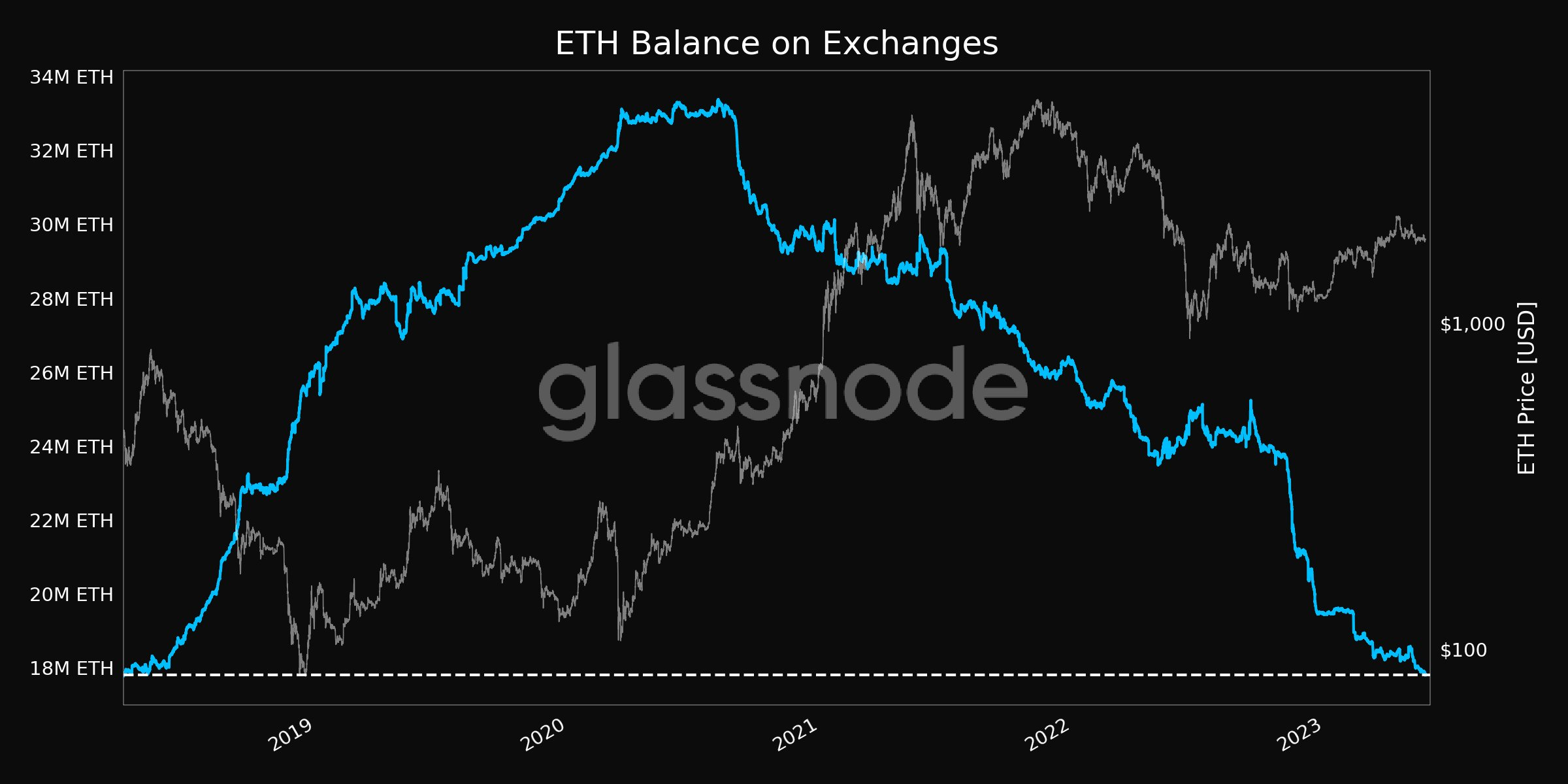

Ethereum’s volume on centralized exchanges has dropped to its lowest level in five years, according to Glassnode data.

According to the data, there are only 17.882 million ETH on centralized exchanges, around 14% of the network’s total supply. DeFi Protocol Velvet Capital noted that this low was last seen during the early days of the blockchain in 2016.

Declining Exchange Balance Indicates Bullish Sentiments

Since the ETH exchange balance peaked at over 30 million in 2020, the numbers have gradually declined following the increased focus on self-custody due to FTX’s collapse.

However, recent events suggest that the balance on exchanges should be growing. For context, the Shanghai upgrade recently enabled the withdrawal of staked ETH, while the liquid staking protocol Lido also allowed its users to redeem their stETH for ETH.

But all these factors did not increase ETH flow to exchanges nor trigger a sell-off — indicating the bullish sentiment surrounding the digital asset.

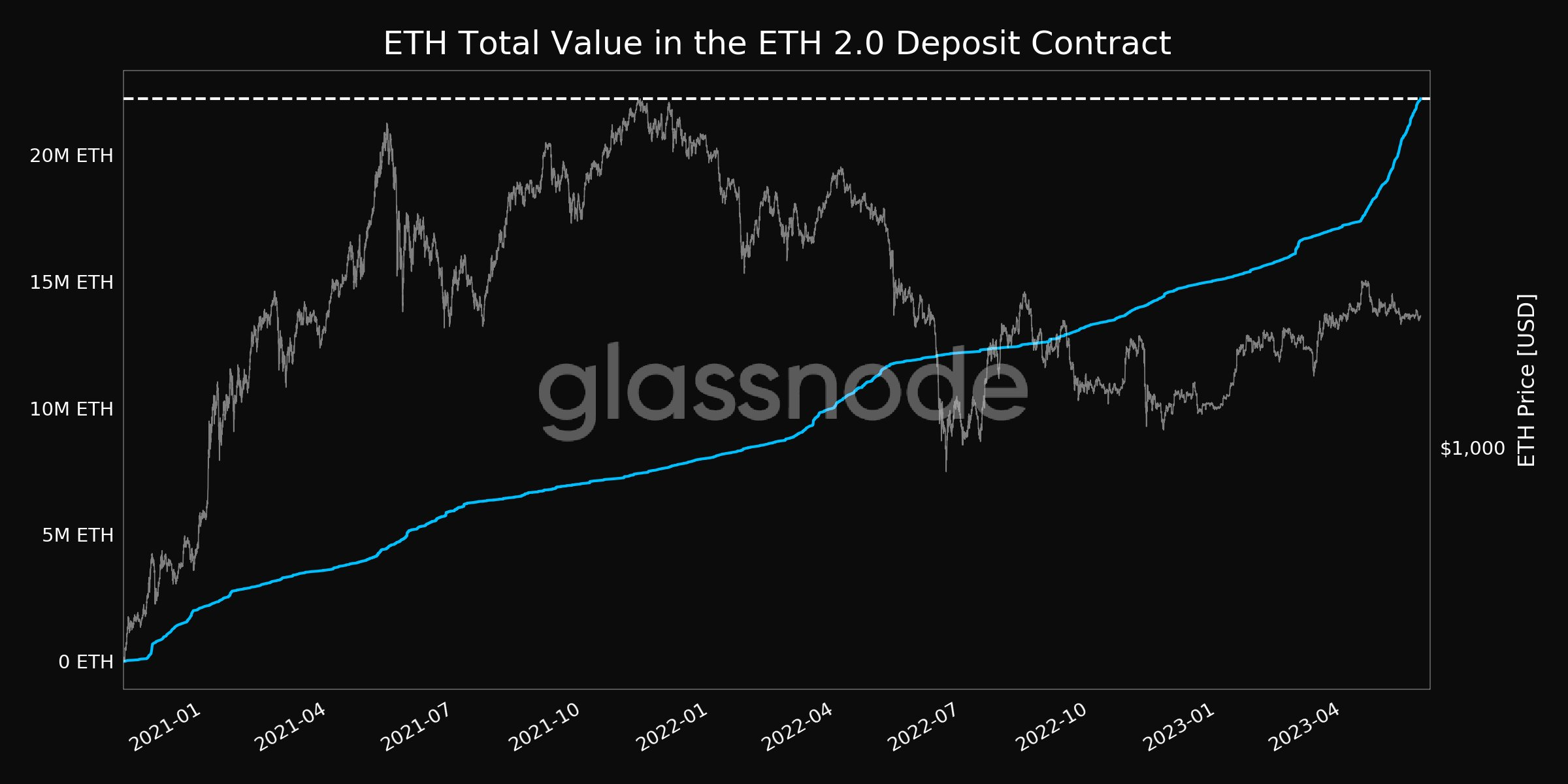

Ethereum Staking Deposits Reach ATH

Staked Ethereum deposits have grown to a new all-time high of 22.2 million, according to Glassnode data. This means there are currently more ETH locked on the beacon chain than those held on centralized exchanges.

On May 22, blockchain analytical firm Arkham Intelligence reported that there had been significantly more deposits than withdrawals since the Shanghai upgrade was enabled on April 12 — around $7.7 billion in inflows.

While daily deposits have varied, it is clear that there has been a surge in Ethereum staking deposits since the Shappella upgrade. Velvet Capital corroborated this, saying the increased numbers were caused by investors opting for passive income.

The initial spate of withdrawals by centralized platforms like Celsius and others caused a decline in the amount of staked ETH. However, that soon changed as deposits began to outpace withdrawals. BeInCrypto reported that liquid staking protocols like Lido saw the total value of assets locked on them soar.

ETH Trades Flat

According to BeInCrypto data, ETH is up 0.83% to $1,829 in the last 24 hours.

Since withdrawals were enabled, ETH peaked at over $2,000 in Early May before dropping to its current levels. Since then, the asset has mostly traded above $1,800.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link