[ad_1]

Arbitrum (ARB) price has rebounded 13% from the $1.10 support level to reach $1.24 on Tuesday morning. After playing catch-up in the first half of May, bullish Arbitrum whales now appear to have seized control of the market. How long with the ARB price rally last?

This week, Arbitrum (ARB) bulls overturned the negative market sentiment to clear the $1.20 resistance. On-chain data reveals that Arbitrum whales have split into two camps, making opposing bets.

Will the recent spike in Arbitrum network activity convince the bulls to consolidate their long positions and stay in the driving seat?

Bullish Arbitrum Whales Have Taken the Lead

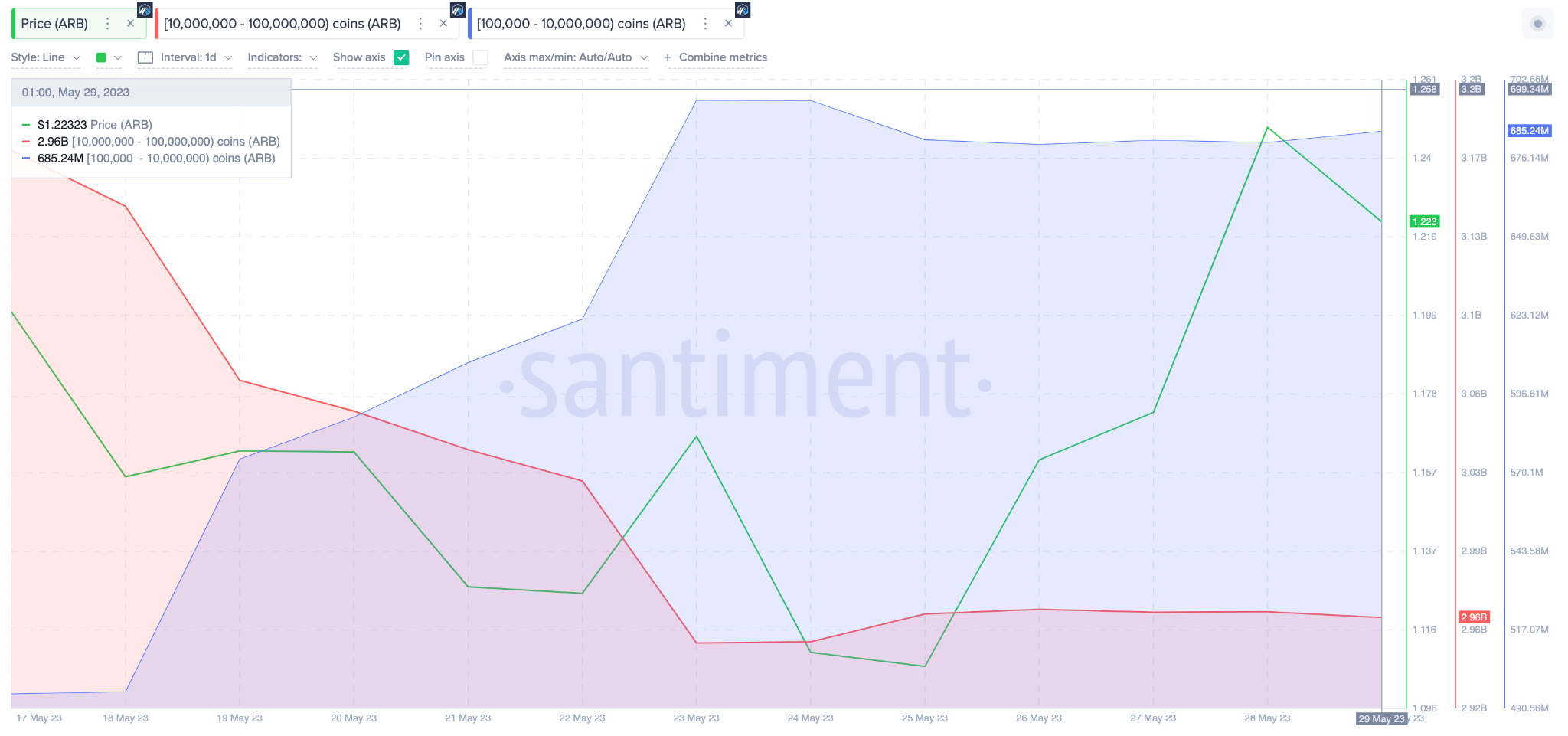

On-chain data shows that Arbitrum whales have split into two camps since mid-May. The largest cohort, holding 10 million to 100 million ARB balances, has taken a largely bearish position. In contrast, those holding 100,000 to 10 million tokens have taken a positive stance.

The chart below shows that the bearish whales (red) sold off 190 million tokens between May 18 and May 30. Meanwhile, the bullish whales (blue) bought 191.2 million ARB tokens during the same period.

At the current ARB market price of $1.22, the Arbitrum bulls have invested $233.2 million to overrule the $231.8 million sell-pressure from the bearish whales.

While the bulls only lead by a small margin, it could be enough to sway the opinion of other retail investors and neutral institutional holders.

If that happens, the Arbitrum price rally could gain momentum in the coming days.

Network Activity Has Spiked 350%

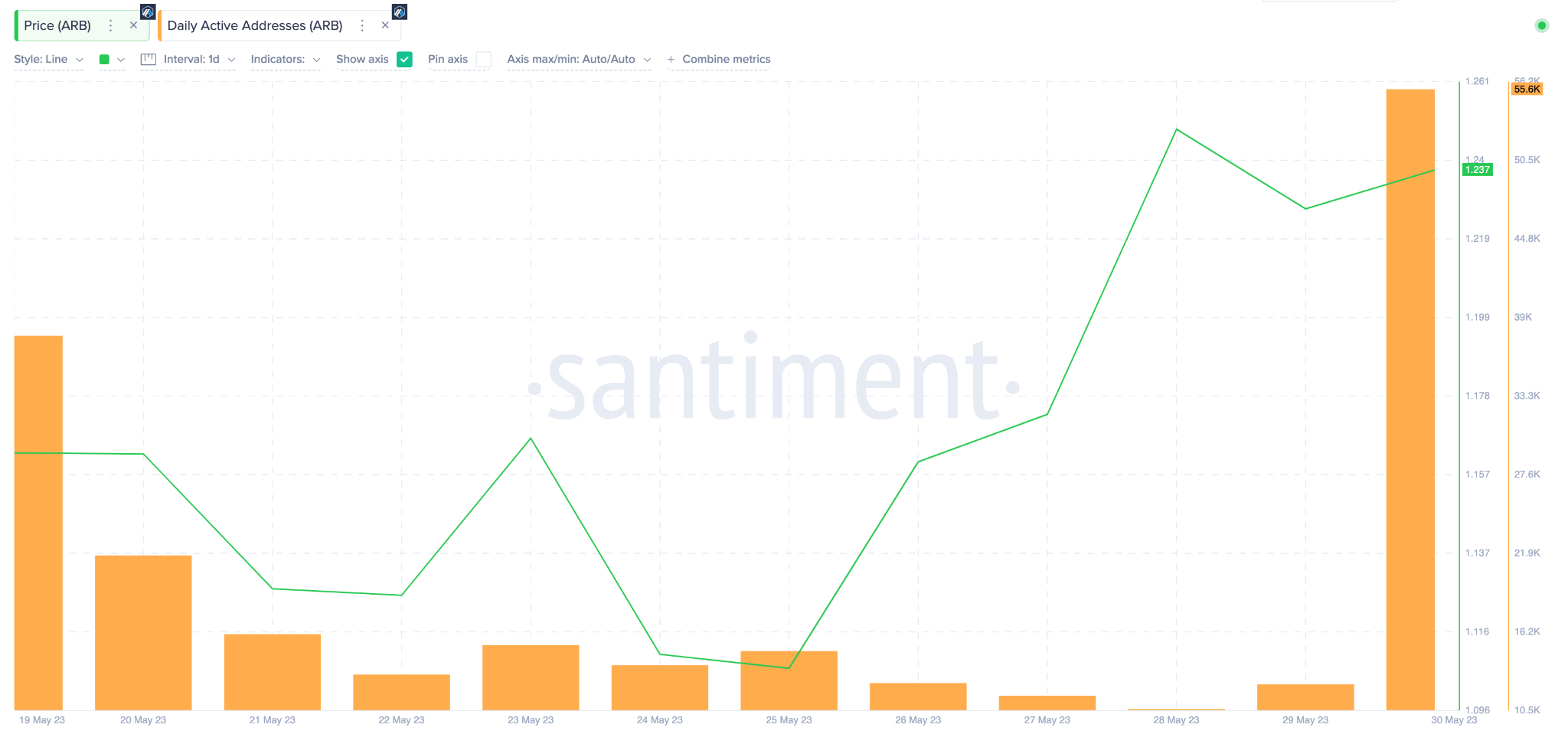

Moreso, the Arbitrum network witnessed a 350% spike in user activity on May 30. This adds credence to the bullish Arbitrum price prediction.

On May 30, Arbitrum recorded 55,700 Daily Active Addresses, a 350% increase from 12,400 recorded the previous day. Quite remarkably, it was even more than what was recorded in the previous four days combined.

The Daily Active Addresses metric sums up the number of unique wallet addresses that carry out on-chain transactions on a given day. Typically, it is positively correlated to price since it indicates increased demand for the network’s underlying services.

When there is a sudden spike in transactional activity, as seen above, it often spurs market participants to take bullish positions. Evidently, it has already put some upward pressure on Arbitrum’s price in the last few days.

ARB Price Prediction: $1.50 Could be the Next Target

If the bullish Abritrum whales continue to double down on their long positions, ARB price could leap closer to $1.50 before retracting.

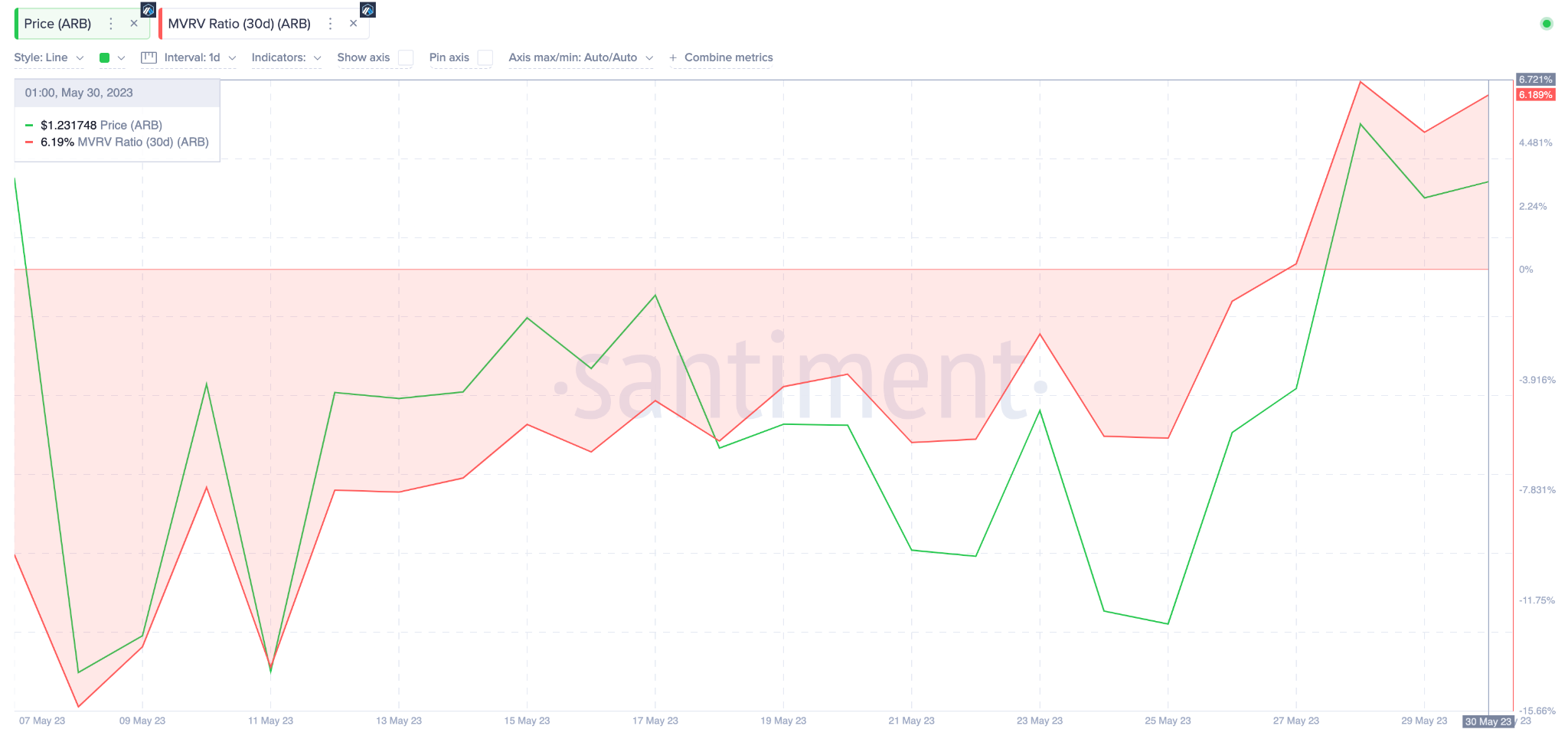

With prices currently sitting at $1.22, the Market-Value to Realized-Value (MVRV) data shows that crypto investors who bought ARB within the last 30 days are holding unrealized profits of 6%.

Considering the bullish momentum, most ARB investors are likely to hold out for 4% gains before booking some profits around $1.27.

But if it can push past that resistance, Arbitrum price could edge close to achieving the $1.5 price target.

Conversely, the bears could overturn the bullish narrative if the ARB price unexpectedly drops below $1.15. Nevertheless, many Arbitrum investors will offer bullish support at that zone to avoid slipping into a net-loss position.

Otherwise, ARB could slip further toward the next significant support level at $1.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link