[ad_1]

Bybit will cease operations in Canada after the Canadian Securities Administrators recently mandated increased due diligence.

The company will no longer onboard new Canadian residents or nationals starting Wednesday, while traders must close margin positions by September 30 to avoid automatic liquidation.

New Canadian Laws Eject Bybit and Binance

Bybit will also halt fiat deposits and withdrawals by July 31.

Its shutdown follows new regulations from the Canada Securities Administrators (CSA) that impose significant compliance requirements on exchanges.

Among other things, the new regulations don’t allow crypto exchanges to list stablecoins, assets the regulator deems securities. Stablecoin trading pairs provide customers with a vital on-ramp.

Exchanges that could not comply within 30 days were advised to offload Canadian clients.

Binance recently cited the strict stablecoin regulations for its Canadian exit.

The exchange recently announced zero-fee-trading for its Bitcoin/TrueUSD pair, causing TrueUSD stablecoin volumes to rise to $34 billion in April.

TrueUSD recently surpassed USDC as the third-largest stablecoin on exchanges. USDT stablecoin trades. Bitcoin’s (BTC) trading volume with USDT stablecoin totaled $117 billion in the same period.

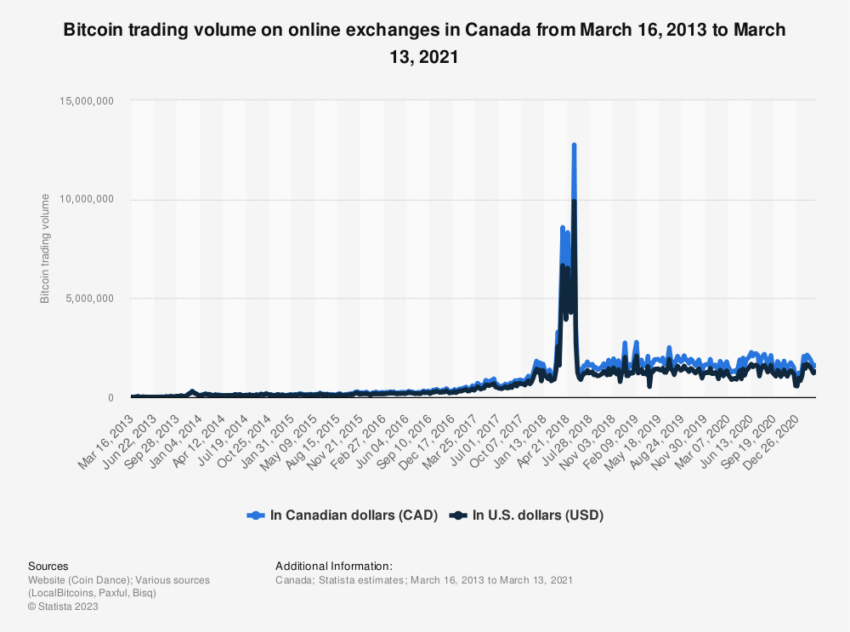

Data published by Statista last week suggests that Canada’s BTC trading volumes were among the top 10 globally in 2020.

Despite the Binance exit, rivals Kraken, Gemini, and Coinbase hold active license applications with Canadian regulators.

Coinbase has embraced the new Canadian regulations even as it battles the US Securities and Exchange Commission’s (SEC) reluctance to create crypto rules.

Learn more about crypto regulations around the world.

The SEC recently refused to commit to new crypto regulations without proof that existing laws were insufficient.

Venture Capitalist Suggests US Ambiguity Makes Businesses Feasible

While industry participants have often criticized the SEC’s regulation by enforcement approach, instead calling for clear rules, the practical realities of other regimes suggest crypto regulation delays could be a blessing in disguise.

Tighter regulations often mean virtual assets platforms often have to re-engineer infrastructure to comply, a task whose cost can outweigh its benefits.

A case in point is the new virtual asset platform regulations in Hong Kong.

Given the region’s stringent custody, capital, custody, and other requirements, venture capitalist Adam Cochran recently commented that he would rather set up an exchange in the US.

“Maybe it gets reeled in a bit, but remarkably restrictive and burdensome currently.”

The recently-gazetted regulations also do not allow virtual asset platforms to list stablecoins. The Hong Kong Securities and Futures Commission recently said it would cover fiat-pegged cryptocurrencies in later legislation.

Exchanges could also require re-engineering to comply with the European Union’s recently-passed Markets-in-Crypto-Assets bill.

Among other things, businesses must identify both ends of crypto transactions irrespective of the amount exchanged.

On the legislative side, MiCA has been criticized for omitting rules that could prevent crypto collapses like FTX.

It also does not cover decentralized finance and non-fungible tokens.

The UK’s Financial Conduct Authority rejected more than 85% of crypto applicants in the UK in January for what it deemed were insufficient risk policies and controls.

The agency was later criticized for pushing firms away from the region.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link