[ad_1]

Last year, reforms in Brazil made cryptocurrencies legal as a payment option, but the crypto community still hopes for further changes. The country ranks 7th globally in crypto adoption, yet its leading politicians often have little to say about the technology. An executive of crypto asset manager Hashdex spoke exclusively with BeInCrypto and shared his thoughts on Brazil’s legal frameworks and what we can expect in the future.

When it comes to crypto, Brazil has a mixed record. In December, then-President Jair Bolsonaro legalized and regulated Bitcoin and other cryptocurrencies as a payment option. The president signed a far-reaching bill into law after Congress gave its approval. The law sets out a comprehensive framework for the trading and use of virtual currencies in Brazil. However, progress is often stop-and-start.

Does Brazil Deserve to Rank in the Top 10 for Crypto Adoption?

The Brazilian crypto community hopes that this reform will be the first of many favoring wider use of digital assets. How hopeful should people be?

President Lula da Silva, who took office on January 1 this year, has been less clear than his predecessor about his stance on crypto and blockchain. He has said very little about the technology on the campaign trail or in office. In fact, an EXAME survey revealed that none of the 11 candidates for president in 2022 included crypto assets or cryptocurrencies in their plans.

Compare that state of affairs to the nascent presidential election in the United States. Several front-runners have already declared a stance.

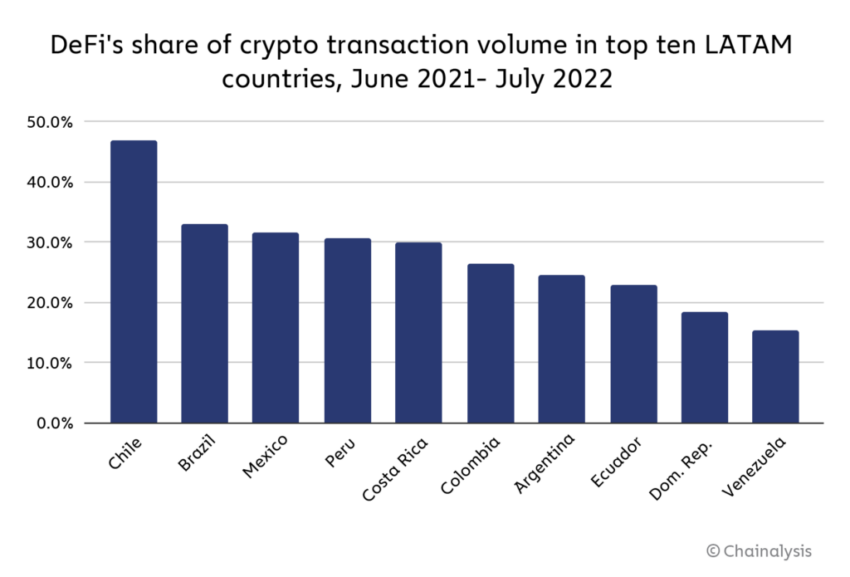

Even so, Brazilians are among the top cryptocurrency users globally, according to Chainalysis. The country sits at 7th in the league table, beating out all of its neighboring states in South and Central America. Only the United States beats Brazil in the Western Hemisphere.

According to Bruno Ramos de Sousa, Head for US and Europe at Hashdex, the country’s officials are beginning to get their heads around the technology. Hashdex is a Brazilian crypto asset management firm that offers a variety of regulated investment products for institutional and individual investors seeking exposure to cryptocurrencies.

“Brazilian regulators are making progress in developing their understanding and regulation about crypto and the associated technology,” Sousa told BeInCrypto.

“Authorities such as the Central Bank and the Securities Commission (CVM) have been actively involved in studying the crypto sector.”

Institutional Adoption on the Rise

It’s clear that industry players are moving fast. In February, the oldest bank in Brazil partnered with Bitfy to enable residents to pay taxes using digital assets. Last October, the Brazilian Tax Authority recorded over 12,000 companies in the country declaring ownership of cryptocurrency on their balance sheets. Surpassing the previous count of 11,360 companies in July. So clearly, progress is underway.

Has Hashdex experienced any cultural differences when operating in Brazil compared to other countries? Sousa says the answer is yes. It is reasonable to expect cultural differences when operating in any market, he said. But local regulators have taken proactive steps, and the results are evident.

“Brazilian regulators have already approved regulated products with exposure to crypto. [And this] helps initial conversations with service providers such as administrators, accountants, banks, market makers, authorized participants, distributors, etc.,” said Sousa.

The level of institutional adoption also helps, he explained. “Since in Brazil most of the more prominent financial institutions are already in the crypto space, it is usually easier to develop relationships and create innovative and efficient products that can be offered to the general public.”

Sousa compared this state of affairs to other jurisdictions which have imposed heavier burdens on businesses. Such burdens affect everything from “simple tasks such as opening a bank account to actually talking to investors and raising capital,” he said.

One jurisdiction which has famously become more hostile to crypto is the United States. This week, the Securities and Exchange Commission (SEC) sued the two largest cryptocurrency exchanges on the planet, Coinbase and Binance.

The industry is currently battling the SEC over whether most crypto assets are securities. A designation that is highly contentious across the sector. Exchanges are looking abroad for greener pastures. For some countries, including Brazil, crypto’s US troubles may be their gain.

A Complex Tax Regime

Any assessment of crypto’s prospects in Brazil must take the tax code into account. Taxation in Brazil is renowned for its complexity. So much so that some businesses want to stay out. To what extent is this a burden on the digital assets industry?

“The tax system in Brazil is indeed complex,” said Sousa. “But rules applicable to financial instruments are somewhat straightforward. Income taxation is much less complex than consumption taxation in Brazil.”

Sousa pointed to the example of crypto ETFs and mutual funds, which authorities tax just like regular equity products. He acknowledged that crypto transactions may be subject to capital gain taxes. But officials have made concessions.

“The Brazilian IRS has created a special section in the income tax reporting form for natural and legal persons to declare their crypto holdings,” Sousa said.

Sousa’s take on the regulatory approach to crypto in Brazil is generally positive. But he sees room for further progress.

“The regulators’ stance in Brazil helped and still helps [to foster] crypto adoption and acceptance in Brazil. Industry players can help foster it even more by offering competitive and safe products and services, adhering to high compliance standards even when they are not obliged to, being transparent, and doing a good job overall,” he said.

However, Sousa agrees with many that the industry needs to fill vast knowledge gaps about what it does.

“Education is key,” he said. “Industry players should invest more time and resources in educating the public. From hedge fund managers to your usual retail investor.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link