[ad_1]

Introduction

In the ever-evolving financial landscape, the advent of cryptocurency has ushered in a revolutionary era of digital assets, offering unprecedented opportunities for investors and traders alike. The quintessence of trading success in this digital age hinges upon the selection of the most optimal, or rather, the best market for crypto trading. This guide aims to illuminate the path for crypto enthusiasts, from novices embarking on their digital currency journey to seasoned investors seeking to optimize their trading strategies.

The Evolution of Crypto Markets

The genesis of cryptocurrency markets can be traced back to the inception of Bitcoin in 2009, an event that catalyzed the proliferation of digital currencies. Over the years, these markets have undergone significant transformations, propelled by technological advancements, increasing mainstream acceptance, and the advent of sophisticated trading platforms. These milestones have culminated in the creation of a diverse and dynamic ecosystem, ripe with opportunities for astute investors.

Identifying the Best Market for Crypto Trading

The designation of a market as “the best” is contingent upon a constellation of factors including, but not limited to, security protocols, liquidity, the intuitiveness of the user interface, and fee structures. A comparative analysis of top crypto markets reveals a spectrum of strengths and weaknesses, with each platform offering unique advantages to cater to the diverse needs of the crypto community.

Advanced Features of Top Crypto Markets

Premier crypto markets distinguish themselves through the integration of advanced trading features such as margin trading, futures contracts, and staking options. These functionalities not only enhance the trading experience but also offer avenues for traders to diversify their strategies, potentially leading to amplified returns on investment.

The Psychological Aspects of Crypto Trading

One often overlooked aspect of trading in the cryptocurrency markets is the psychological resilience required to navigate its volatile waves. Successful traders not only possess a profound understanding of market dynamics but also exhibit an exceptional level of emotional intelligence. They maintain composure amidst market turbulence, making decisions based on rational analysis rather than succumbing to the whims of fear or greed. Cultivating such a mindset is essential for anyone aspiring to thrive in the crypto trading arena.

Importance of Community and Networking

The crypto market is not just about transactions and trading algorithms; it’s also built on the foundation of community and networking. Engaging with other traders and participating in crypto forums can provide invaluable insights and tips that are not readily available through traditional market analysis. These communities serve as a nexus for sharing strategies, discussing upcoming ICOs, and receiving support during the inevitable ups and downs of market volatility.

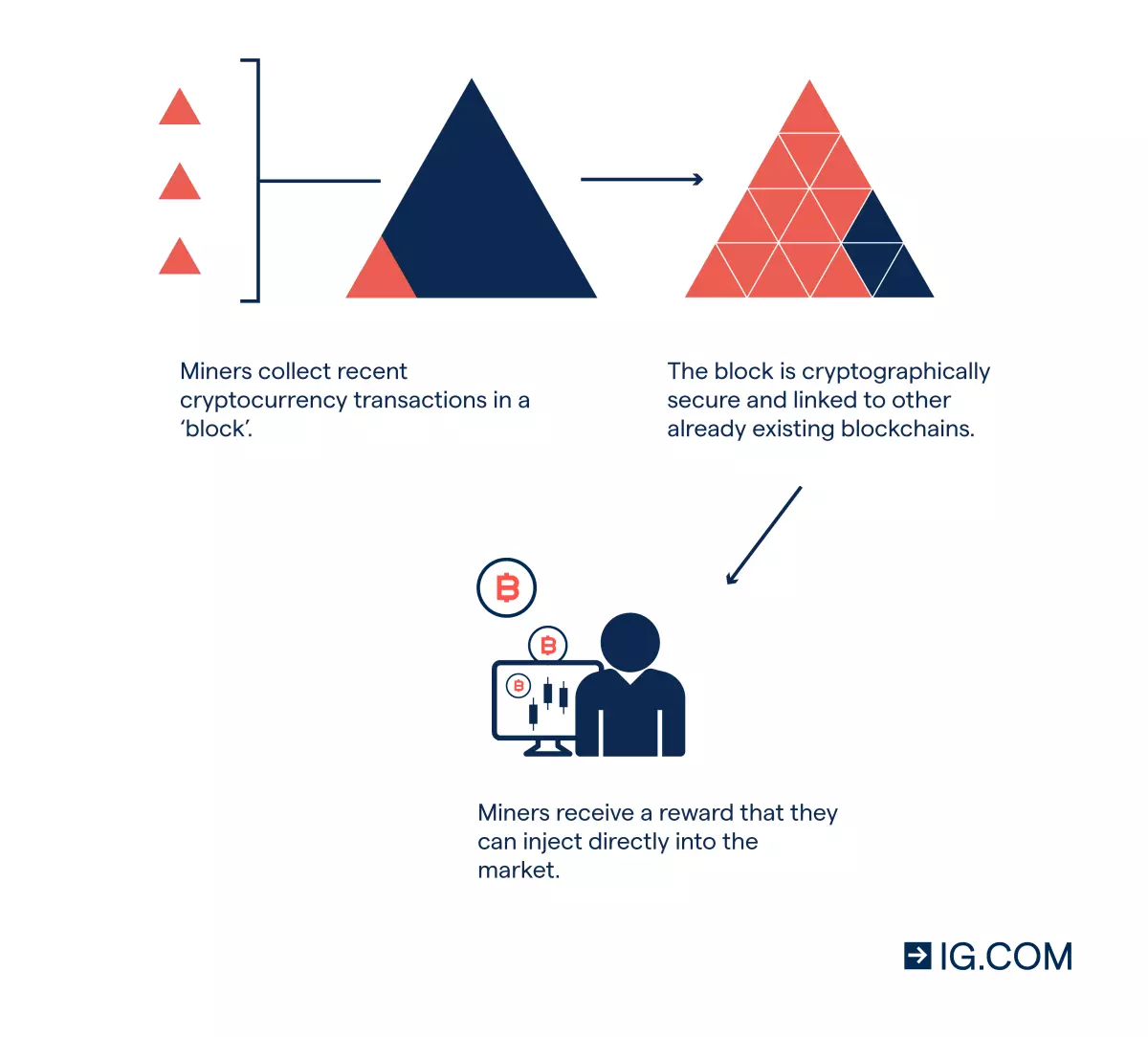

Decentralized Finance (DeFi) and Its Impact

Decentralized Finance (DeFi) has emerged as a groundbreaking development within the best markets for crypto trading. By leveraging blockchain technology, DeFi platforms offer a plethora of financial services, including lending, borrowing, and yield farming, without the need for traditional financial intermediaries. This democratization of finance not only expands the utility of crypto markets but also introduces new avenues for earning potential within the ecosystem.

The Influence of Quantum Computing on Cryptography

Quantum computing presents a futuristic challenge to the cryptographic foundations of the cryptocurrency market. As these powerful computers become more feasible, they could potentially crack the cryptographic codes that secure digital currencies, necessitating the development of quantum-resistant blockchain technologies. Understanding the intersection of quantum computing and cryptography is crucial for traders and investors looking to future-proof their assets in the best markets.

The Significance of Cross-Chain Technology

Cross-chain technology aims to enhance interoperability between different blockchains, allowing for seamless transactions and interactions across diverse cryptocurrency ecosystems. This technological advancement could significantly expand trading strategies and opportunities, making it a vital area of knowledge for participants in the best markets. It represents a leap towards a more interconnected and efficient crypto space.

Privacy Coins and Their Place in the Market

Privacy coins offer enhanced anonymity and security features, distinguishing them from other cryptocurrencies. As regulatory scrutiny increases, the role and acceptance of privacy coins in the best markets are subjects of debate. Traders interested in privacy coins must navigate the balance between privacy, regulatory compliance, and market accessibility, making informed decisions based on current trends and future projections.

The Growing Role of Cryptocurrency in Emerging Economies

In emerging economies, cryptocurrency is increasingly viewed as a tool for financial inclusion and economic empowerment, bypassing traditional banking barriers. The adoption rates in these regions can influence market trends and demand for certain cryptocurrencies. For traders in the best markets, understanding the dynamics of cryptocurrency adoption in different global contexts can uncover unique investment opportunities and contribute to a more diversified trading approach.

The Evolution of Tokenization

Tokenization, the process of converting real-world assets into digital tokens on the blockchain, is set to revolutionize ownership and investment strategies. From real estate to artwork, tokenization enables fractional ownership and increases liquidity, opening up new asset classes to crypto investors. Grasping the potential and challenges of tokenization is essential for navigating the future landscape of the best markets.

The Impact of 5G Technology on Crypto Trading

The rollout of 5G technology promises to significantly enhance the speed and efficiency of mobile internet, which could have profound implications for mobile crypto trading. Faster and more reliable connections will enable traders to execute trades more quickly and stay connected to the markets more consistently, potentially leading to greater market responsiveness and volatility. Keeping abreast of technological advancements like 5G is important for traders aiming to maintain a competitive edge.

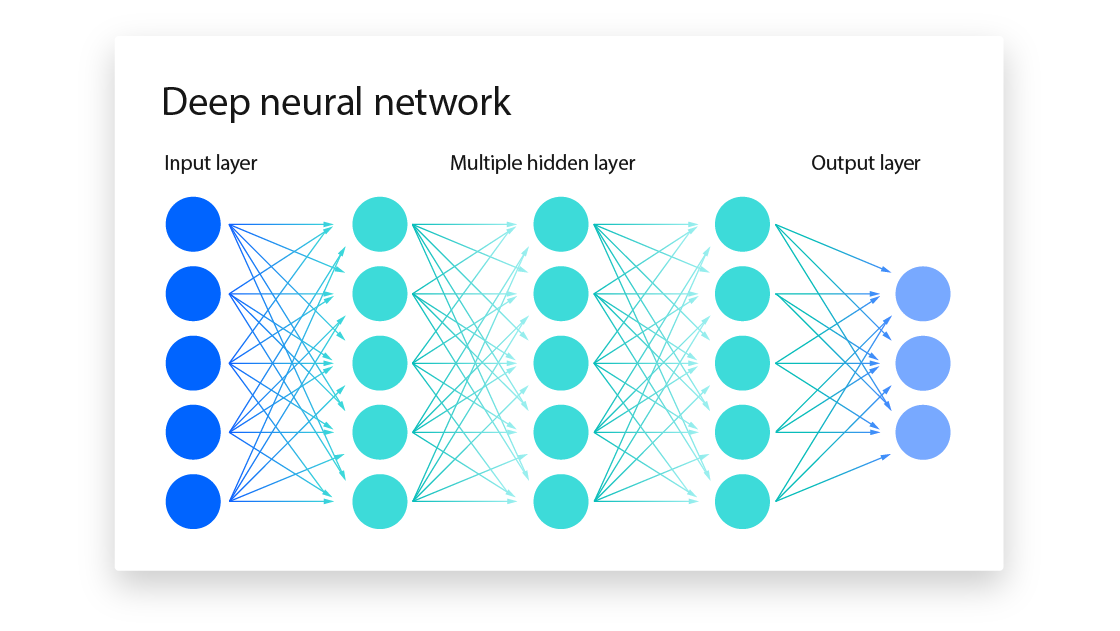

The Intersection of AI and Blockchain

The convergence of AI and blockchain technology has the potential to create more intelligent and efficient crypto markets. AI algorithms can optimize blockchain operations, enhance security measures, and provide deeper insights into market trends, while blockchain can offer a transparent and secure framework for AI operations. Exploring the synergies between these technologies can provide traders with innovative tools and strategies for success in the best markets.

Regulatory Evolution and Its Market Impact

Regulatory frameworks for cryptocurrency are evolving at a varied pace across different jurisdictions, impacting market accessibility and investor confidence. Staying informed about regulatory changes and understanding their implications is critical for traders navigating the global landscape of the best markets. Proactive engagement with regulatory trends can also help traders anticipate market shifts and adjust their strategies accordingly.

The Challenge of Scalability in Blockchain Technology

Scalability remains a significant challenge for many blockchain networks, affecting transaction speeds and costs. Innovations like layer-two solutions and sharding are being developed to address these issues, promising to enhance the efficiency and capacity of blockchain networks. Traders and investors in the best markets must monitor these technological advancements, as they have the potential to dramatically influence market dynamics and investment opportunities.

The Future of Work with Blockchain and Cryptocurrency

Blockchain and cryptocurrency are not only transforming financial markets but also reshaping the future of work. From facilitating seamless cross-border payments for freelancers to enabling new forms of decentralized autonomous organizations (DAOs), these technologies are creating new economic opportunities and models of collaboration. For forward-thinking traders, understanding the broader implications of blockchain and cryptocurrency can reveal investment opportunities in emerging sectors and companies leading this transformation.

These additional insights aim to provide a more rounded perspective on the multitude of factors influencing the best markets for crypto trading. The complexity of the crypto market demands a broad and deep understanding, not only of financial and technological aspects but also of the socio-economic and regulatory environments. As the crypto landscape continues to evolve, so too must the strategies and knowledge of those who wish to navigate it successfully.

Understanding Market Liquidity

Market liquidity is a critical factor that influences the ease with which assets can be bought or sold at stable prices. In the context of cryptocurrency trading, high liquidity levels facilitate smoother transactions and less price volatility, making it a key consideration when identifying the best market. Platforms with higher liquidity typically attract more traders, which in turn perpetuates the liquidity cycle, creating a more favorable trading environment.

The Role of Cryptocurrency Exchanges

Cryptocurrency exchanges play a pivotal role in the ecosystem, acting as the gateway for both new entrants and experienced traders to buy, sell, and trade digital currencies. The best markets are often those that offer a broad spectrum of cryptocurrencies, including both established coins and promising altcoins, thereby providing traders with a wealth of options to diversify their portfolios.

The Emergence of Crypto ETFs and Index Funds

The introduction of cryptocurrency ETFs (Exchange-Traded Funds) and index funds marks a significant milestone in the maturation of the crypto market. These financial instruments allow investors to gain exposure to a diversified portfolio of digital assets without the need to manage individual investments. This development not only simplifies the investment process but also attracts a new segment of institutional investors to the best markets for crypto trading.

Navigating Taxes in Crypto Trading

The tax implications of cryptocurrency trading can be complex and vary significantly by jurisdiction. Understanding the tax regulations that apply to crypto transactions is crucial for traders aiming to optimize their returns. In the best markets, platforms often provide tools and resources to help traders track their transactions and generate reports that can be used for tax filing, thereby simplifying the compliance process.

The Integration of Artificial Intelligence in Crypto Trading

The advent of artificial intelligence (AI) and machine learning technologies has begun to reshape the landscape of the best markets for crypto trading. Sophisticated algorithms are now capable of analyzing vast datasets to identify trends, predict market movements, and execute trades at an unprecedented speed and efficiency. For traders, understanding and leveraging these technologies can provide a significant edge in optimizing trading strategies and enhancing portfolio performance.

The Environmental Impact of Cryptocurrency Mining

As the popularity of cryptocurrency continues to grow, so too does the scrutiny over the environmental impact of mining activities, particularly with proof-of-work (PoW) cryptocurrencies like Bitcoin. The best markets are those that are beginning to incorporate environmental, social, and governance (ESG) criteria into their operations and offerings, providing traders with options to invest in more sustainable crypto assets, such as those leveraging proof-of-stake (PoS) mechanisms.

The Emergence of Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) have taken the world by storm, creating new opportunities and markets for digital art, collectibles, and more. While not a traditional market for crypto trading, the NFT space offers a unique blend of art, technology, and finance, attracting a new wave of investors to the crypto ecosystem. Understanding the nuances of NFTs and their market dynamics is becoming increasingly important for those looking to diversify into this burgeoning sector.

The Psychology of FOMO in Trading

Fear of missing out (FOMO) is a powerful emotion in the world of crypto trading, often driving irrational investment decisions and market speculation. The best traders are those who recognize and mitigate the influence of FOMO, adhering to disciplined investment strategies and avoiding the pitfalls of market hype and speculation. Cultivating a mindset that prioritizes long-term goals over short-term gains is essential in navigating the volatile waters of the crypto market.

The Impact of Social Media on Crypto Markets

Social media platforms have become influential drivers of sentiment and trends in the cryptocurrency market. High-profile endorsements or criticisms can lead to rapid, significant market movements. Savvy traders monitor social media channels and influencers to gauge market sentiment, but always cross-reference this information with thorough research to make informed decisions. The best markets provide tools and analytics to track social media trends and their potential impact on trading activities.

Security Best Practices for Crypto Investors

The decentralized nature of cryptocurrency offers many benefits, but it also comes with increased responsibility for security. Best practices include using hardware wallets for significant holdings, enabling two-factor authentication, and regularly updating security protocols. Educated investors in the best markets understand the importance of these practices in protecting their digital assets from theft and hacking attempts.

The Role of Stablecoins in Crypto Trading

Stablecoins play a critical role in the cryptocurrency market by providing a bridge between the volatile crypto space and the stability of traditional fiat currencies. They enable traders to quickly move funds within the market without converting back to fiat, reducing transaction costs and time. Understanding the mechanisms and trustworthiness of various stablecoins is essential for effective trading in the best markets.

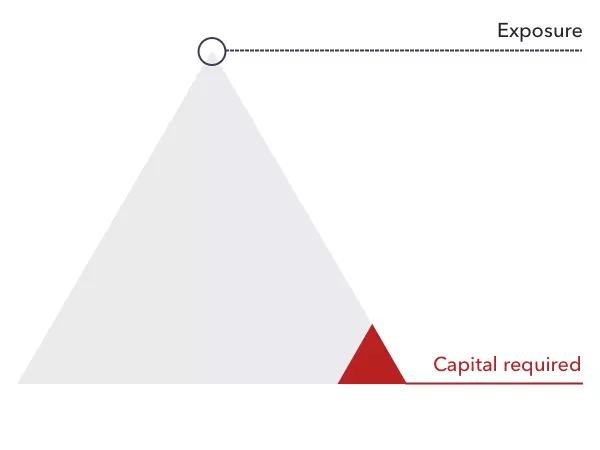

Exploring the World of Crypto Derivatives

Crypto derivatives, such as futures, options, and swaps, offer traders advanced tools for hedging, speculating, and leveraging their positions. These financial instruments can amplify gains but also increase risks. The best markets for crypto derivatives provide a robust regulatory framework, transparent pricing, and comprehensive educational resources to help traders navigate these complex products.

The Importance of Continuous Learning

The crypto market is characterized by rapid change and innovation. Staying informed through continuous learning is vital for success. The best investors dedicate time to reading, attending webinars, and engaging with communities to keep up with the latest trends, technologies, and regulatory developments. Lifelong learning is a hallmark of success in the dynamic world of cryptocurrency trading.

Looking Ahead: The Adoption of Central Bank Digital Currencies (CBDCs)

The potential introduction of Central Bank Digital Currencies (CBDCs) represents a significant evolution in the financial landscape, with implications for the crypto market. These digital currencies, backed by central banks, could offer a new level of stability and trustworthiness in digital transactions. As the world moves closer to the adoption of CBDCs, understanding their impact on traditional and crypto markets alike will be crucial for forward-thinking traders and investors.

By diving deeper into these aspects of the crypto market, our guide seeks to equip readers with a comprehensive understanding and nuanced insights into the opportunities and challenges presented by this ever-evolving landscape. Whether you are just beginning your journey or looking to refine your strategies, the key to success lies in informed decision-making, continuous learning, and a disciplined approach to navigating the complexities of the crypto world.

The Significance of Technical Analysis

Technical analysis is a cornerstone of trading strategy in the cryptocurrency market. By analyzing historical price data and market trends, traders can make informed predictions about future price movements. The best markets provide advanced charting tools and analytical features that enable traders to conduct thorough technical analysis, enhancing their decision-making process.

The Influence of Global Events on Crypto Markets

Cryptocurrency markets, like traditional financial markets, are not immune to the impact of global events such as economic policies, regulatory changes, and geopolitical tensions. The best markets are those that offer real-time news feeds and analysis, helping traders stay informed and adapt their strategies to the ever-changing global landscape.

The Future of Cryptocurrency Markets

As we look to the future, it’s evident that the cryptocurrency markets are poised for further innovation and growth. The continuous emergence of new technologies, combined with increasing adoption and regulatory clarity, will likely lead to the expansion of trading opportunities and the introduction of new digital assets. For traders and investors, staying informed and adaptable will be key to navigating the future landscape of the best markets for crypto trading.

By expanding on these topics, the article can provide a comprehensive and detailed exploration of the crypto trading market, catering to both novice and experienced traders seeking to optimize their strategies in the quest for success in the dynamic world of cryptocurrency.

Security Measures in Crypto Markets

In the digital realm where security breaches can have catastrophic implications, the paramount importance of robust security measures cannot be overstated. Leading crypto markets deploy an arsenal of security protocols, including two-factor authentication, cold storage solutions, and advanced encryption technologies, to safeguard users’ assets against malevolent actors.

The Role of Regulation in Crypto Trading

The landscape of crypto trading is inextricably intertwined with the fabric of global regulatory frameworks. The best markets proactively navigate these regulatory challenges, ensuring compliance while fostering a secure and transparent trading environment for their users.

Tips for Successful Trading in the Best Market

Success in the volatile world of crypto trading is predicated on a foundation of sound strategies and informed decision-making. Key recommendations include the adoption of risk management practices, the diversification of investment portfolios, and a commitment to staying abreast of market trends and technological advancements.

The Future of Crypto Markets

As we gaze into the horizon, the future of crypto markets is poised for continued evolution, shaped by ongoing innovations and regulatory developments. These changes promise to further refine the criteria defining the best markets, offering exciting prospects for the global crypto community.

Conclusion

This guide has traversed the multifaceted landscape of crypto trading, shedding light on the critical aspects that define the best market for digital currency enthusiasts. As the crypto ecosystem continues to mature, investors are encouraged to conduct diligent research and choose a trading platform that aligns with their objectives, thereby unlocking the full potential of their crypto trading endeavors.

[ad_2]

Source link