[ad_1]

Huobi customers pulled $64 million in Tether (USDT) from the platform this weekend amid rumors of insolvency that could benefit Binance’s new stablecoin push.

Customers withdrew funds after rumors surfaced that Chinese authorities were questioning employees of Huobi because of possible insolvency at the exchange.

Cochran Suggests Inconsistent Data Validates Huobi Insolvency Fears

In response, citing on-chain data and public reports, Cochran argued the exchange is “deeply insolvent.”

Huobi’s July proof-of-reserves report claimed the exchange held $630 million in USDT and USD Coin (USDC) to meet customer demands. However, on-chain data revealed that deposits of USDT go to addresses linked with Justin Sun and Huobi instead of being invested in government bonds.

Interested in earning interest on your stablecoins? Click here.

Moreover, according to Cochran, these funds only account for about half of Huobi’s liquidity requirements. As a result, the exchange only holds $90 million to satisfy withdrawal requests and could fall short if customers withdraw in bulk.

Additional network data on DefiLlama suggests the exchange has $72 million USDT liquidity.

Cochran added:

“Just like he did with Poloniex, Sun has been using Huobi as a personal piggy bank to earn from user deposits – and he can’t honor the balances there on ETH or USDT if users try and withdraw or sell in bulk.”

Huobi has denied the rumors and maintains business is healthy and operational.

Binance Smells Blood Amid New Stablecoin Push

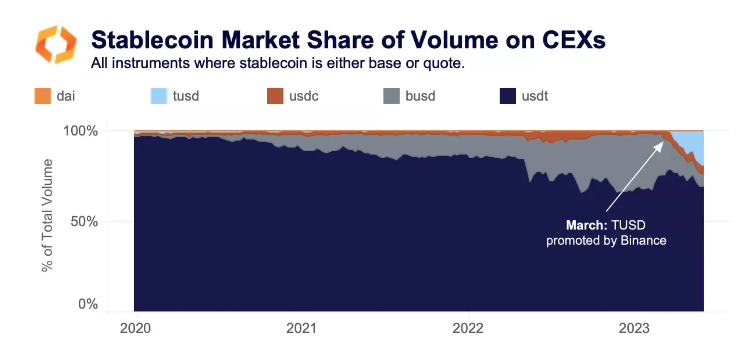

Cochran argues that Binance could want to see Tether fail through Huobi’s demise to push its own stablecoins. In February, the New York finance regulator ordered the issuers of Binance-branded stablecoin BUSD to stop minting the coin.

A few months later, Binance started offering free trading for all trading pairs of TrueUSD, a new stablecoin, with a market cap of $2.9 billion.

Additionally, Binance CEO Changpeng Zhao indicated the exchange would start offering customers smaller, algorithmic fiat-pegged cryptos. He opined in a recent Twitter Space,

“We should just work with as many stablecoins as possible. We shouldn’t have a single bet.”

Moreover, he added he hadn’t seen audit reports from USDT issuer Tether, making the asset somewhat of a “black box.” Tether’s quarterly attestation reports have been criticized for not being audited according to standard accounting practices.

Earlier this year, Tether’s CTO Paolo Ardoino took aim at new stablecoins when Binance launched the new dollar-pegged stablecoin FDUSD in Hong Kong on July 26.

Got something to say about the rumored Huobi insolvency, the stablecoin push at Binance, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link