[ad_1]

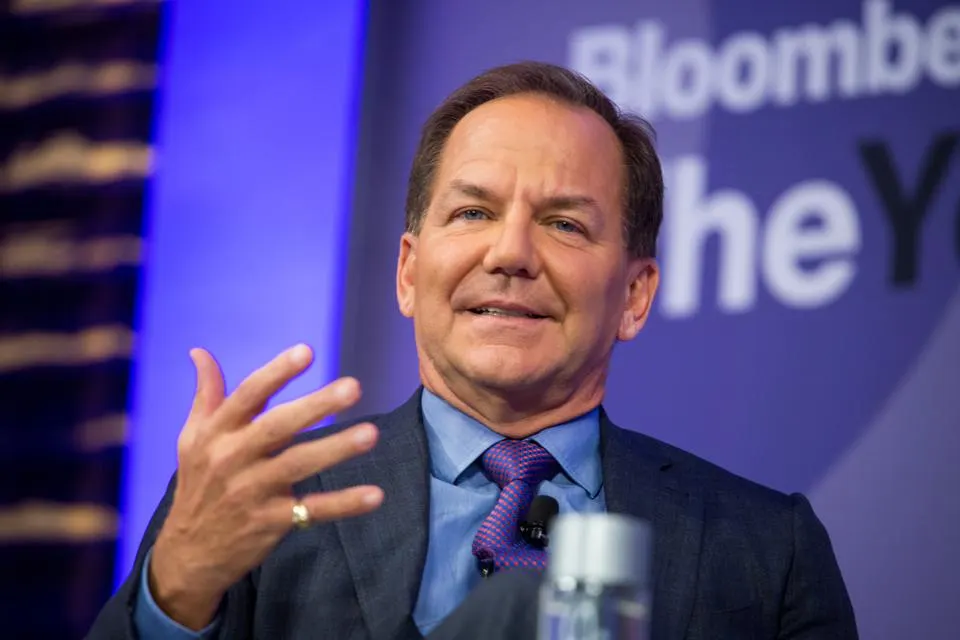

The legendary hedge fund manager – Paul Tudor Jones III – said he will always keep a “small” exposure to bitcoin since it is “the only thing that humans can’t adjust the supply in.”

The American billionaire also suggested that the US Federal Reserve will cease its aggressive interest rate hike policy. Many experts previously opined that such a move could benefit the entire cryptocurrency industry and positively affect BTC’s price.

BTC Investor for Life

Prominent legacy investor Paul Tudor Jones, who entered bitcoin’s ecosystem in 2017, seems to remain tied to the primary cryptocurrency for the rest of his life. In a recent interview for CNBC, he vowed to always have exposure, praising its fixed supply of 21 million coins ever to exist:

“From the beginning, I’ve always said I want to have a small allocation to it because it’s a great tail event. It’s the only thing that humans can’t adjust the supply in. So I’m sticking with it; I’m going to always stick with it. It’s just a small diversification in my portfolio.”

For some HODLers who have been present long enough in the space to witness BTC trading at nearly $70,000, the current valuation could seem like a good buying opportunity. Such is the case with Jones, who said he “would probably” purchase more of it.

In addition, the billionaire touched upon the inflationary environment in the USA and the Fed’s efforts to solve the issue. According to him, the central bank’s interest rate hikes at the beginning of May (bringing the benchmark to 5%-5.25%) were the last one.

Higher rates result in higher borrowing costs which logically lowers consumer spending and makes risky investments (such as dealing with crypto) less appealing. Numerous experts have argued that the opposite scenario could trigger a bull run for digital assets.

One example is Anthony Scaramucci – the Founder of SkyBridge Capital and former White House official – who said:

“I do believe that the Fed declares victory at 4% to 5% inflation. If I’m right, there will be a resurgence in the market. There’ll be a lot of short covering in crypto, and there’ll be a rebirth of risk assets.”

Paul Tudor Jones’ Crypto Journey

The 68-year-old billionaire initially bought Bitcoin in 2017 at around $10,000 and later doubled his money by selling at $20K.

His more notable interaction with the asset began in the spring of 2020 (shortly after the COVID-19 pandemic hit the financial world) when he purchased BTC as a hedge against inflation. Back then, the American forecasted that inflation would surge in a short period of time, prompted by the mass printing of fiat currency by central banks.

“The best profit-maximizing strategy is to own the faster horse. If I am forced to forecast, my bet is it will be Bitcoin,” he stated.

His prediction came true, with inflation hitting record levels in many parts of the globe. On the other hand, BTC skyrocketed to almost $70K at the end of 2021 before diving in 2022. Still, the asset started the ongoing year on the right foot, reclaiming some of its lost ground.

Paul Tudor Jones’ support towards BTC has risen so much in the following years that at one point, he deemed it superior to gold as a hedge against inflation:

“I do think we’re moving into an increasingly digitized world. Clearly, there’s a place for crypto, and clearly, it’s winning the race against gold at the moment, right?”

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

[ad_2]

Source link