[ad_1]

Binance Delisting Announcement

Binance delisting XMR and MULTI, one of the world’s largest cryptocurrency exchanges, has announced the delisting of four tokens from its platform, sending shockwaves across the market.

Tokens Facing Delisting

The tokens slated for delisting on Feb. 20 include Aragon (ANT), Multichain (MULTI), Vai (VAI), and Monero (XMR). Binance cites the need to uphold standards and adapt to industry changes as reasons behind the decision.

Market Reaction

Following the announcement, Monero (XMR) and Multichain (MULTI) experienced substantial declines in value, signaling a swift reaction from traders. While VAI and ANT initially showed minimal reaction, the impact on MULTI and XMR was profound.

Multichain (MULTI) Collapse

MULTI saw a significant drop in value, losing over 27% in the past 24 hours, with its market capitalization also plummeting by the same percentage. Despite this, trading volumes surged, suggesting active movement or liquidation of positions by traders.

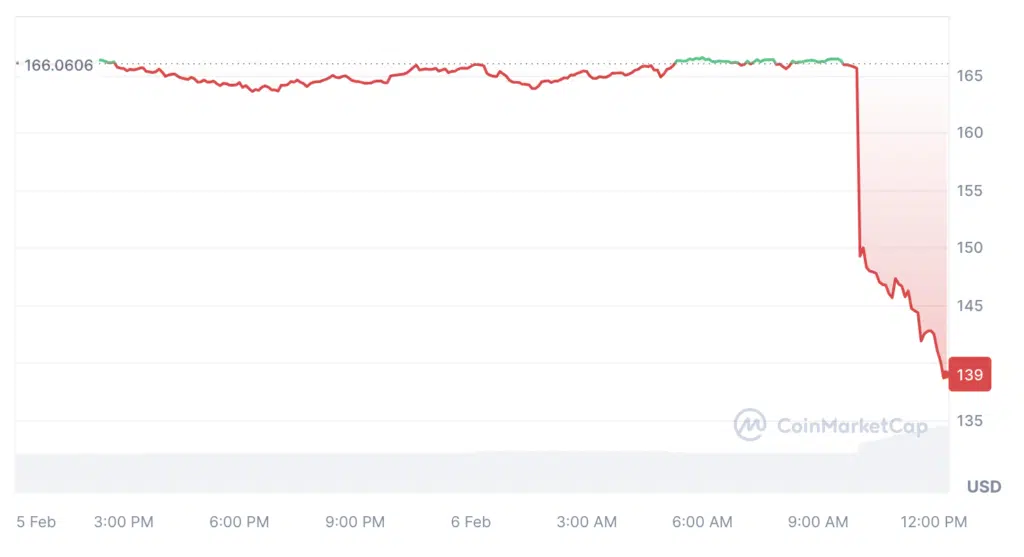

Monero (XMR) Downturn

Monero (XMR) witnessed a notable decline of 17%, with its trading price falling to $137.77. Trading volumes spiked by nearly 77%, indicating heightened activity surrounding the token following the delisting announcement.

Previous Delistings and Market Trends

Binance delisting decision to delist Monero follows a similar move by OKX, which announced the removal of Monero and ZCash trading pairs due to not meeting strict criteria. Such actions highlight the exchange’s commitment to maintaining standards within the industry.

Conclusion

The delisting of tokens by major cryptocurrency exchanges like Binance and OKX underscores the importance of regulatory compliance and adherence to industry standards. As the market continues to evolve, traders and investors must remain vigilant to navigate these changes effectively.

[ad_2]

Source link