[ad_1]

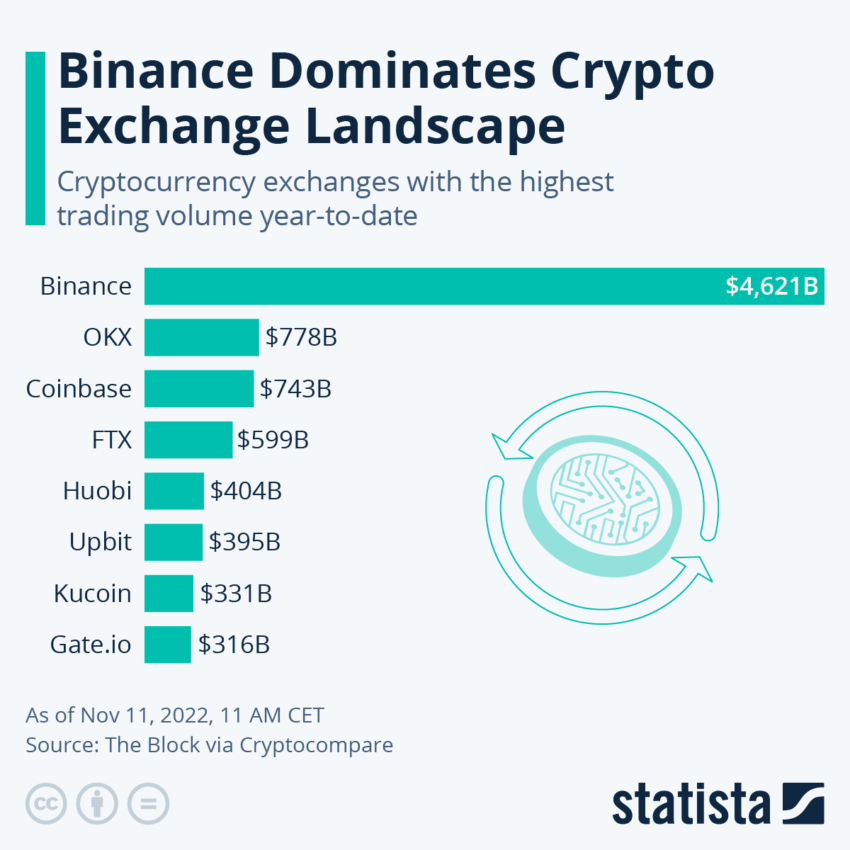

According to insiders, Germany’s financial watchdog, BaFin, has allegedly urged Binance to retract its license application.

The Wall Street Journal disclosed on July 28 that BaFin has expressed reservations about Binance’s intricate corporate structure and the firm’s founder, Changpeng Zhao, often referred to as “CZ.”

Binance Reevaluates European Expansion

Earlier this week, Binance revealed its decision to withdraw its German license application. Despite plans to reapply in the future, this move marks a significant obstacle in Binance’s European growth strategy.

Adding to its challenges in Germany, Binance has confronted regulatory setbacks in Belgium, the Netherlands, and the United Kingdom. The company also faces scrutiny over potential lapses in its Know Your Customer (KYC) protocols in France.

Read more: 7 Best Binance Alternatives in 2023

Belgium’s authorities, citing anti-money laundering regulations, instructed Binance to halt its operations in the country recently. In the Netherlands, Binance had to cease operations due to licensing issues.

Meanwhile, following the Financial Conduct Authority’s (FCA) withdrawal of key permissions in the UK, Binance had to transition to a crypto-only exchange, eliminating fiat transactions.

Complex Structure Under the Microscope

The WSJ’s report suggests that BaFin’s primary concern is Binance’s multifaceted company structure, believing it might complicate regulatory oversight.

However, a spokesperson from the company disputed the report’s accuracy. He stated that the withdrawal focused on acquiring a new European Union crypto license.

Read more: 13 Best No KYC Crypto Exchanges in 2023

Binance’s operational model is somewhat unique. While it operates offices worldwide, the firm claims it does not have a global headquarters and promotes a remote work environment.

As a privately-owned entity, Binance is not obliged to disclose its detailed financials, leading some critics to question the transparency of its accounting practices. A Reuters investigation last December even labeled the company’s financials as a “black box,” highlighting the opacity in its financial and operational dealings.

BaFin’s Concerns Extend to the Leadership

Furthermore, BaFin’s apprehensions are not limited to Binance’s corporate structure. The watchdog has reportedly expressed doubts about founder Changpeng Zhao’s suitability to operate or own a business in Germany.

Read more: 9 Best Crypto Futures Trading Platforms in 2023

Since founding Binance in 2017, CZ’s leadership role has increasingly come under the lens. In the United States, he is currently embroiled in a legal dispute with the Securities and Exchange Commission (SEC).

It alleges Zhao of creating “an intricate web of deception” and has subsequently served him with a court summons in its case against Binance US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link