[ad_1]

Binance in trouble again after a Reuters article, citing insider sources, claims that it co-mingled customers’ funds.

The centralized exchanges are constantly under the community’s and journalists’ watchful eyes, particularly after the collapse of FTX. But is this recent allegation Fear, Uncertainty, and Doubt (FUD)?

Binance Co-Mingled Billions of Dollars?

According to Reuters, Binance co-mingled customers’ funds and the company’s revenue in 2020 and 2021. The article claims that the exchange used to co-mingle billions almost daily.

Citing bank records, Reuters claimed that on Feb. 10, 2021, Binance intertwined $20 million from its balance sheet with $15 million of users’ funds.

Binance’s Communications Vice President, Brad Jaffe, clarified that:

“These accounts were not used to accept user deposits; they were used to facilitate user purchases. There was no commingling at any time because these are 100% corporate funds.

When users sent money to the account, they were not depositing funds but buying the exchange’s bespoke dollar-linked crypto-token, BUSD. This process was exactly the same thing as buying a product from Amazon.”

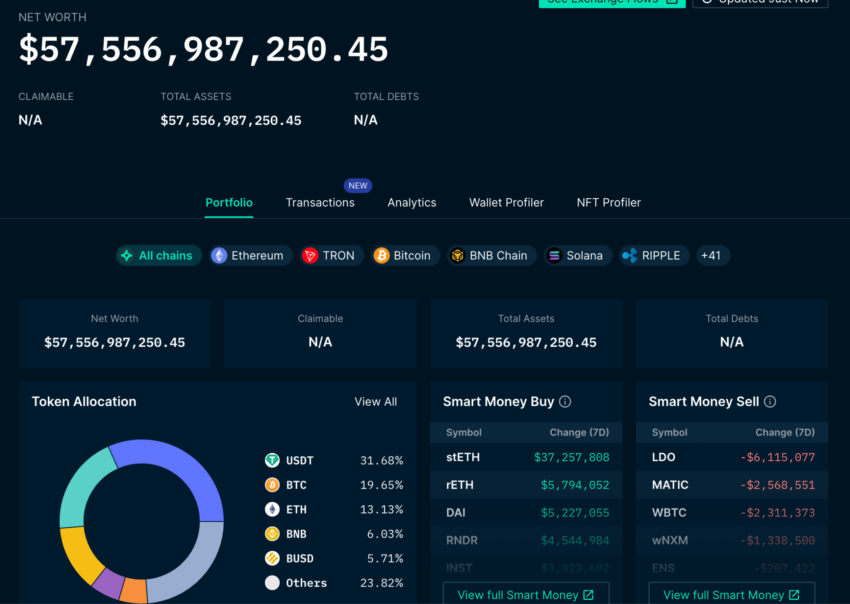

Nansen shows that Binance holds over $57.5 billion in customers’ funds.

Former SEC Official Hits Again

Binance’s website showed the word “deposit” when users tried to purchase BUSD. John Reed Stark, the former Securities and Exchange Commission (SEC) official, says:

These representations created the expectation that clients’ funds would be safeguarded in the same way as traditional cash deposits

BeInCrypto reported earlier this month about Stark warning users that the future of Changpeng Zhao’s business is in jeopardy.

A Conspiracy Theory?

The Reuters article accuses Zhao of co-mingling funds to avoid paying taxes, citing former employees. Furthermore, the article mentions that Zhao feared banks freezing Binance’s account.

Hence, he had to convert the business’s funds into crypto and co-mingle it with users’ crypto.

Patrick Hillmann, the Chief Strategy Officer at Binance, criticized the Reuters article and called it a conspiracy theory. He tweeted:

This story is so weak that they had to put up front, “Reuters found no evidence that Binance client monies were lost or taken” in a transparent attempt to protect themselves from a libel suit.

Underneath that, they then pinned 1000 words of conspiracy theories (which we explained were false) with zero evidence other than a “former insider.”

In February, Forbes alleged that Binance was engaging in malpractices similar to FTX, and co-mingling users’ funds.

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link