[ad_1]

Binance lost 18% of its spot trading market share to Asian exchanges by May 6 after lifting zero fee trading in March.

Analytics firm Kaiko estimates that Binance’s share of spot trading declined from 73% to 51% after it rescinded its zero-fee trading policy.

Asian Exchanges Absorb Volume as Traders Appear to De-Risk

Accordingly, rival exchanges saw an uptick, with Huobi gaining 8% of the volume and OKX 4%. South Korean exchanges saw their share increase from below 8% to roughly 14%.

Early signs pointed to the South Korean exchange Upbit as the beneficiary of Binance’s loss of market share. By the end of April, its market share has risen almost 2% in 2023.

Despite the falloff, Binance’s overall market dominance is relatively secure, with Coinbase and Upbit only accounting for about 10% of global trading volumes.

However, investors may have been spooked by the recent lawsuit by the U.S. Commodity Futures Trading Commission (CTFC) against Binance.

Cici Lo, founder of blockchain advisory firm Venn Link Partners, argued that investors concerned about the safety of funds on Binance migrated to other platforms to de-risk.

The CFTC has accused Binance, its former CEO Samuel Lim and CEO Changpeng Zhao of coaching U.S. market makers to bypass legal restrictions to trade derivatives on Binance.

Exchanges Diversify Revenue Streams Amid Lower Fee Revenue

Sentiments toward crypto soured around the collapses of several crypto firms last year.

The bear market saw trading volumes rapidly decline, with Coinbase recording a $402 billion annual decrease in Q1.

Exchanges turned to alternate revenue streams to remain well-capitalized, including Ethereum staking and subscription services, and in the case of Binance, zero trading fees for most spot pairs.

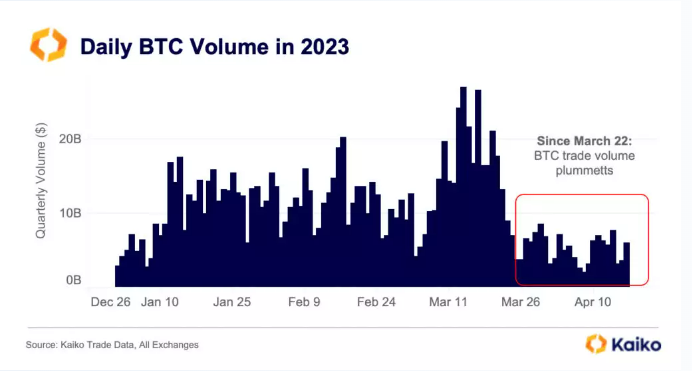

Binance’s promotion lasted roughly seven months, contributing to impressive Bitcoin (BTC) volumes for a bear market.

The dropoff may now paint a more realistic picture of where consumers are. Binance’s retraction saw market-wide BTC trading volumes plummet to levels accurately representing a bear market.

Its market share has now fallen to its lowest level since October 2022.

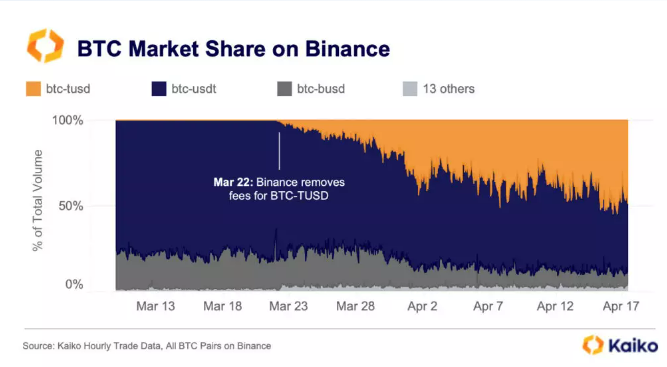

However, the exchange’s volume was boosted by zero-fee trading on the BTC/TUSD pair making up 50% of Binance’s trading volume. Trading volume for BTC/TUSD pair surpassed all other stablecoin pairs in April.

The U.S. banking crisis caused investors to favor stablecoins over USD for spot trading.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link