[ad_1]

Binance lost access to Australian dollar transfers via its PayID payment portal as banks narrowed payment options.

A spokesperson said Australians could not transfer fiat to Binance or withdraw funds to their bank account using PayID.

Binance Australian Business Under Increasing Pressure

Customers can still buy and sell crypto with credit and debit cards and withdraw Australian dollars in the near term. Binance Australia said it was “working hard” to find another payment provider. It reassured customers their funds are safe.

Crypto traders on Binance face difficult decisions amid tightening global scrutiny on crypto businesses.

The Australian Securities and Investments Commission (ASIC) recently canceled Binance Australia’s derivatives license. The license allowed the exchange to offer derivatives and foreign exchange products to wholesale traders.

The watchdog had previously scrutinized how Binance identifies between retail and wholesale customers.

In the U.S., the Commodity Futures Trading Commission (CFTC) accused Binance of helping its U.S. customers illegally access its derivatives trading desk.

The CFTC requires any derivatives exchange to register according to the Commodity Exchange Act. The agency regulates Bitcoin and Ethereum futures contracts in the U.S.

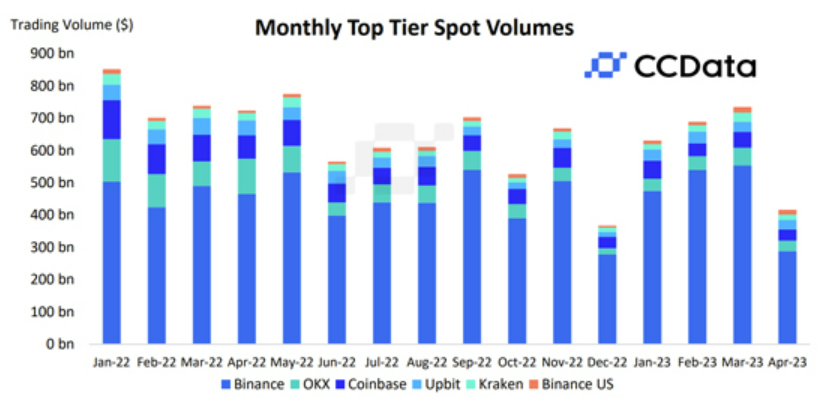

Binance lost 18% of its global market share to Asian exchanges since dropping its zero-fee spot trading promotion in March. Its global share of spot trading volume dropped to 46.3% in April, according to CCData.

Scams Prompt Tighter Aussie Rules as Revolut Jumps on Bandwagon

Crypto firms face headwinds from global regulators trying to curb money laundering.

Australia’s Westpac Banking Corp. started testing new customer protections for cryptocurrency payments. The bank sees a future for crypto exchanges in the financial industry but cautions that criminals are increasingly scamming people through overseas exchanges.

The bank added that by the time customers realize they have been scammed, their money has crossed the border, making it difficult to recover.

Westpac did not say whether it banned Binance, though other firms have retained banking access.

London’s Revolut has launched new payments-focused accounts for Australian business clients. It also allows Australian customers to buy and sell crypto and seeks a banking license to promote brand confidence.

The permit requires, among other things, a risk management system for local and international transactions. This license could lend credence to the crypto services Revolut offers by reducing counterparty risk.

Crypto firms in Europe must soon comply with the Transfer of Funds Rule in Europe’s new Markets-in-Crypto Assets regulation. The law compels platforms to report parties on both ends of a transaction. Exchanges have at least 18 months to comply with the new standard.

Metropolitan Bank in the U.S. exited the crypto industry amid U.S. regulatory risk and the asset class’s value proposition to its business.

Exchanges face increasing uncertainty if the U.S. Securities Exchange Commission refuses to change its regulation-by-enforcement approach, leaving companies uncertain whether they will be the next domino to fall.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link