[ad_1]

In a remarkable reversal, Bitcoin broke free from its historical September slumber, marking its first positive performance for the month since 2016. This achievement occurred in the face of substantial resistance from the U.S. Securities and Exchange Commission (SEC) regarding Bitcoin spot exchange-traded fund (ETF) applications.

Starting the month at approximately $25,800, Bitcoin surged by almost 4%, reaching nearly $27,000 at the time of writing.

Bitcoin’s Rally Despite SEC Scrutiny

Despite the SEC’s repeated postponement of multiple BTC spot ETF applications, the flagship cryptocurrency ascended.

In the past month, the regulatory body delayed decisions on over seven applications, even in light of recent efforts to expedite the approval process.

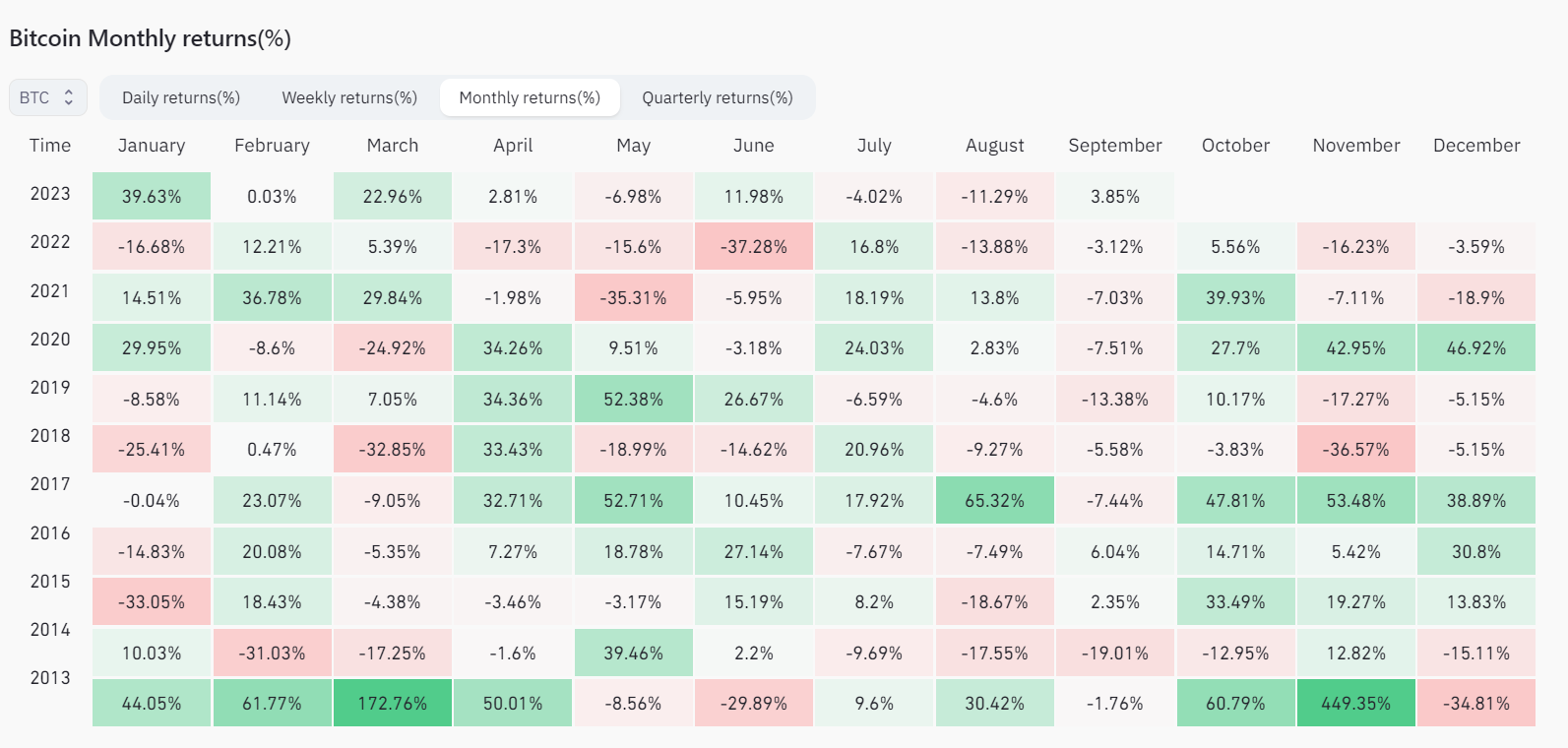

As per Coinglass data, this price surge marks Bitcoin’s fourth positive September since 2013 and its first since 2016. Interestingly, BeInCrypto reported on two crypto analysts who had failed to predict its price movement correctly.

Nevertheless, it’s crucial to note that despite this strong September, Bitcoin suffered its first quarterly loss of the year, shedding approximately 12% of its value over the past three months.

Anticipating an “Uptomber”

Looking ahead, investors are cautiously optimistic about a bullish October for Bitcoin. Historically, the cryptocurrency has performed well during this month.

For context, despite a significant market downturn last October that led to the collapse of several crypto-related firms, including FTX and Celsius, Bitcoin still managed to record a 5.56% gain.

Crypto analyst Tedtalksmacro explained this strong October performance as “a period of positive seasonality.” He stated, “On average over the past three years, October has been Bitcoin’s best-performing month, and this positive seasonality typically extends into Q1 of the following year.”

However, the analyst warned that:

“Prior to 2022, BTC had never existed in a world with rates much higher than 2%… whereas now in late-2023, the Federal Funds rate is above 5% and will likely remain there for much longer while central banks of the world try to keep the lid on inflation.”

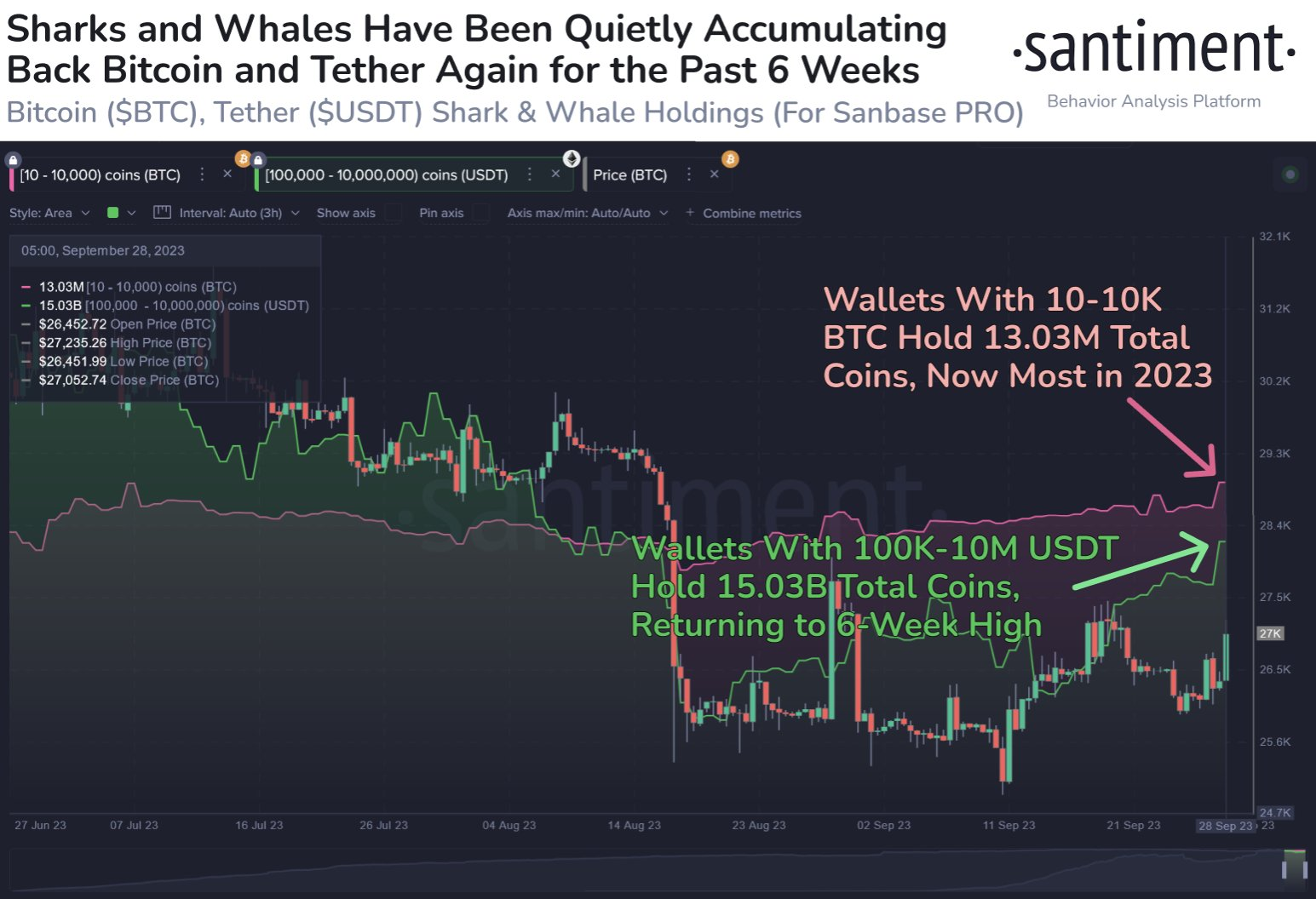

Meanwhile, prominent blockchain analytics firm Santiment pointed out that Bitcoin’s long-term prospects look promising. This is supported by the fact that whales have been accumulating Bitcoin alongside Tether’s USDT for the past six weeks.

According to the firm, this accumulation signifies buying power and suggests the rally could persist into October.

While expectations for October are high, it’s important to remember that the SEC’s decision regarding any of the spot-ETF applications could potentially impact Bitcoin’s price behavior.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link