[ad_1]

In the crypto market, sudden price movements can send shockwaves. Recently, a Bitcoin flash rally on Bitfinex raised concerns over the risks associated with low liquidity on crypto exchanges.

It is crucial to understand the factors contributing to such events, the potential dangers for traders, and the measures that they can take to mitigate these risks.

Understanding Liquidity in Crypto Markets

Liquidity refers to the ease with which an asset can be bought or sold in a market without significantly affecting its price.

In crypto exchanges, high liquidity implies a large trading volume and a narrow spread between buy and sell orders, leading to price stability. On the other hand, low liquidity can result in significant price swings and increased vulnerability to market manipulation.

A key factor affecting liquidity in the crypto market is the number of market participants, including retail and institutional investors.

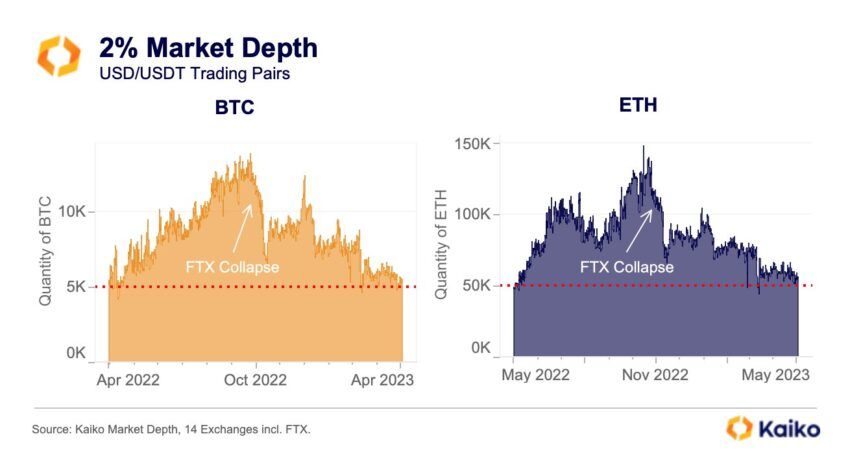

As the market grows and attracts more participants, liquidity typically increases, leading to more efficient price discovery and reduced price volatility. However, recent events have shown that even well-established cryptos like Bitcoin are not immune to the effects of low liquidity.

Bitcoin Flash Rally: A Case of Low Liquidity

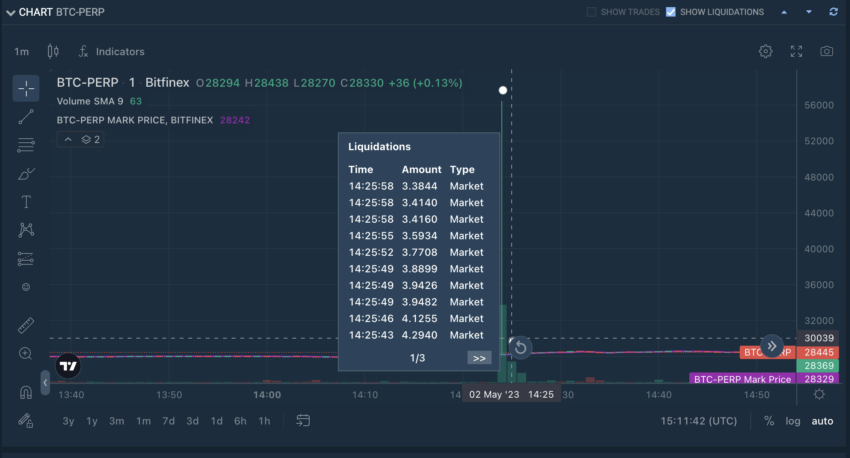

On May 2, Bitcoin experienced a flash rally on Bitfinex, a popular cryptocurrency exchange. Its price briefly surged above $56,000, representing a 100% increase.

The sudden spike in price was short-lived and followed by an equally rapid decline, leaving many traders perplexed.

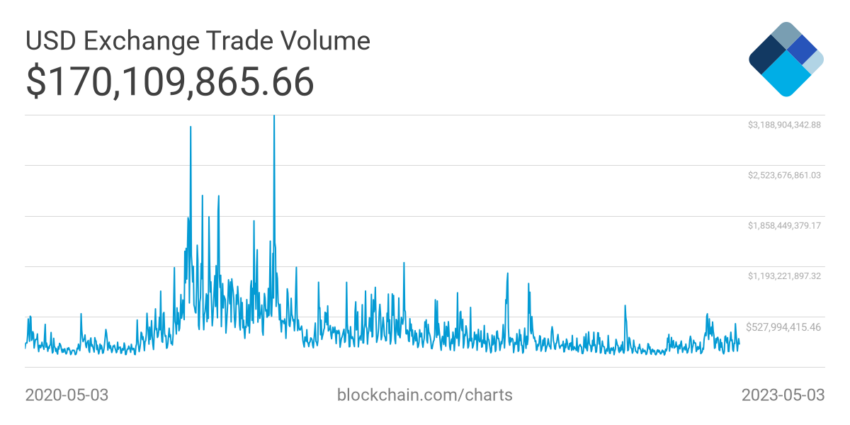

The phenomenon can be attributed to low liquidity on the platform, which bred an environment ripe for price manipulation and exacerbated the impact of large orders on the market. A combination of factors contributed to the low liquidity at the time, including increased regulatory scrutiny and a general decline in trading volume.

The flash rally on Bitfinex is a cautionary tale, highlighting the risks associated with trading on low-liquidity exchanges.

The Dangers of Trading on Low-Liquidity Exchanges

Price Manipulation

Low liquidity allows market manipulators to influence asset prices in their favor. A single large transaction can cause significant price fluctuations without sufficient buy and sell orders.

This allows bad actors to engage in practices like “pump and dump” schemes, artificially inflating an asset’s price and then selling their holdings at a profit, leaving unsuspecting traders with significant losses.

Slippage

When trading on low-liquidity exchanges, the difference between the price at which a trader intends to buy or sell an asset and the actual execution price can be significant.

This phenomenon, known as slippage, can lead to unexpected losses for traders and is particularly problematic during periods of high market volatility.

Difficulty in Exiting Positions

Traders who hold large positions in illiquid assets may face challenges when attempting to sell their holdings.

The lack of counterparties on low-liquidity exchanges can result in extended waiting times for trade execution. This can force traders to either accept unfavorable prices or remain locked into their positions.

The Impact of Regulation on Crypto Exchange Liquidity

Regulatory actions can significantly impact liquidity on cryptocurrency exchanges.

In recent years, regulatory authorities like the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) have tightened oversight of the crypto industry. Consequently, leading to increased scrutiny and enforcement actions against exchanges.

These regulatory developments have chilled the crypto market. Some institutional investors are pulling back from the sector due to concerns about compliance and potential penalties.

This has, in turn, contributed to declining liquidity on some exchanges, as evidenced by the Bitcoin flash rally on Bitfinex.

How to Mitigate the Risks of Low Liquidity

Traders can take several precautions to reduce their exposure to the risks associated with low liquidity on crypto exchanges:

Trade on reputable exchanges with high trading volumes and narrow spreads.

Monitor market depth and order books to gauge liquidity levels before placing orders.

Use limit orders instead of market orders to minimize slippage.

Diversify trading activities across multiple exchanges to avoid overexposure to a single platform.

The Future of Liquidity in the Crypto Market

As the crypto market matures, exchanges must prioritize high liquidity to ensure a fair and efficient trading environment. Technological advances, such as decentralized exchanges and liquidity aggregation solutions, will play a crucial role in addressing liquidity challenges in the crypto market.

Furthermore, regulatory clarity and a more welcoming approach from authorities can help to boost institutional adoption of cryptocurrencies, leading to increased liquidity on exchanges.

While the risks associated with low liquidity cannot be entirely eliminated, a combination of market maturity, technological innovation, and regulatory support can contribute to a more stable and robust crypto market.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link