[ad_1]

Almost one billion dollars worth of Bitcoin options are set to expire today, but will they put further pressure on BTC prices? Furthermore, exchange-traded fund (ETF) trading demand has ticked up in the wake of several high-profile ETP filings.

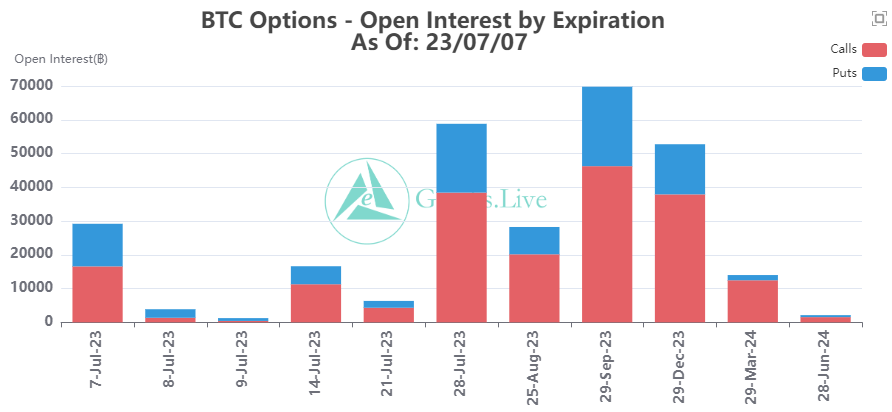

Around $880 million in notional value Bitcoin options contracts will expire on July 7. Although this isn’t a large volume compared to previous contract expiries, crypto markets are already in retreat.

Bitcoin Options Expiring

Around 29,000 Bitcoin options contracts are set to expire today, according to Greeks Live. Their max pain point is $30,000, which is close to where BTC is currently trading.

Max pain refers to the level with the most open contracts at which the most losses will be made upon contract expiry.

The put/call ratio for today’s expiring contracts is 0.76 which is slightly bullish but leaning towards neutral.

This metric divides the number of short seller contacts but the number of long seller contracts. Ratios below one mean that there are more call (long) contracts, suggesting bullish sentiment for the underlying asset.

Derivatives trading feed Greeks Live said that the crypto rally was not sustainable:

“Volatility continued to rise this week and despite several positive stimuli, such as Hong Kong’s stable coin plans, the rally was clearly not sustainable.”

“Short-term buying on BTC and ETH are relatively cheap,” it said before adding, “while in the longer term, a decline in volatility now seems an inevitable trend.”

Additionally, around 220,000 Ethereum options contracts are also set to expire today. They have a notional value of $410 million and a max pain point of $1,875.

The put/call ratio for ETH options is 0.48, meaning there are almost twice as many call contracts as puts.

On July 5, the on-chain analytics platform Glassnode observed increased open interest (OI) for Bitcoin options. OI refers to the total number of outstanding derivative contracts that have not been settled.

“This suggests market investors are increasing their exposure to risk-defined derivative instruments.”

Crypto Market Outlook

Crypto markets are in retreat for the fourth day in a row, dropping a further 1.5% on the day to $1.21 trillion.

Moreover, BTC fell below $30,000 for the first time this month. This occurred during the morning hours of July 7, when BTC dropped to $29,904.

Ethereum is in a lot more pain at the moment following a 3% slide to $1,854 at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link