[ad_1]

Rising inflation and 10 consecutive interest rate hikes have led to American losing confidence in the economy. But is Bitcoin (BTC) helping?

The Consumer Price Index (CPI) for all items has come down to 5%. But the daily necessities like food, electricity, and transportation services are still expensive. Uncontrollable inflation is leading American citizens to question their leaders.

Investors Lose Hope for an Economic Recovery

According to a Gallup survey, CNN Business reported that just 35% of respondents believe President Joe Biden can help the American economy to recover. The ratings for Biden are similar to George Bush’s ratings of 34% during the financial crisis of 2008.

48% of respondents have no confidence that Biden would pave the way out of the economic downturn. At the same time, 28% of Americans don’t have confidence in the Federal Reserve (Fed) chairman, Jeremy Powell’s leadership.

This is because the Fed has hiked the interest rate for the 10th consecutive time, causing a cash crunch in the economy. Some believe that Fed’s aggressive rate hikes have created the banking crisis in the U.S.

Skyrocketing Inflation

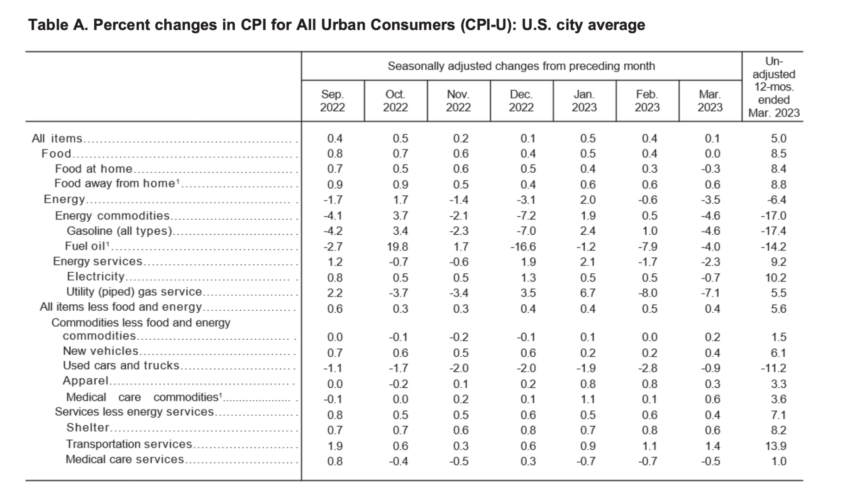

Despite rising interest rates, the Fed has barely been able to control inflation. The inflation for all items is slowly cooling down, as March’s figure indicates 5% year-on-year (YoY) growth and 0.1% month-on-month (MoM). But that itself is not the full story.

The screenshot below shows that YoY inflation growth in necessities like food is still at 8.5%, while shelter is at 8.2%. Similarly, for electricity, the YoY inflation growth is at 10.2%, and transportation services are getting expensive at a whopping rate of 13.9%

Can Bitcoin Help American Investors?

Investors rushed to safe havens such as Bitcoin and gold due to the banking crisis. While gold is trading near its all-time high, Bitcoin (BTC) has been in a range for around two months.

Despite a 70% surge this year, BTC is down by around 12% from its local top of $31,000. On top of that, it is forming a Head and Shoulders pattern on a daily time frame. It is a reversal pattern that indicates the end of an uptrend.

A daily close below the neckline at around $27,200 may indicate a reversal in trend. Then, Bitcoin might test its next support at around $25,200

Furthermore, there is a regulatory crackdown on crypto in the U.S. Due to the crackdown, Charles Storry, the head of growth at crypto index provider Phuture, believes that new money might not enter the market. He told the FT:

Sentiment hasn’t changed, and regulatory scrutiny is sidelining a lot of new money that might otherwise enter the space.

Price movements don’t mean much if the industry isn’t making meaningful progress to regain trust and attract new investors,

Got something to say about Bitcoin, the American economy, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link