[ad_1]

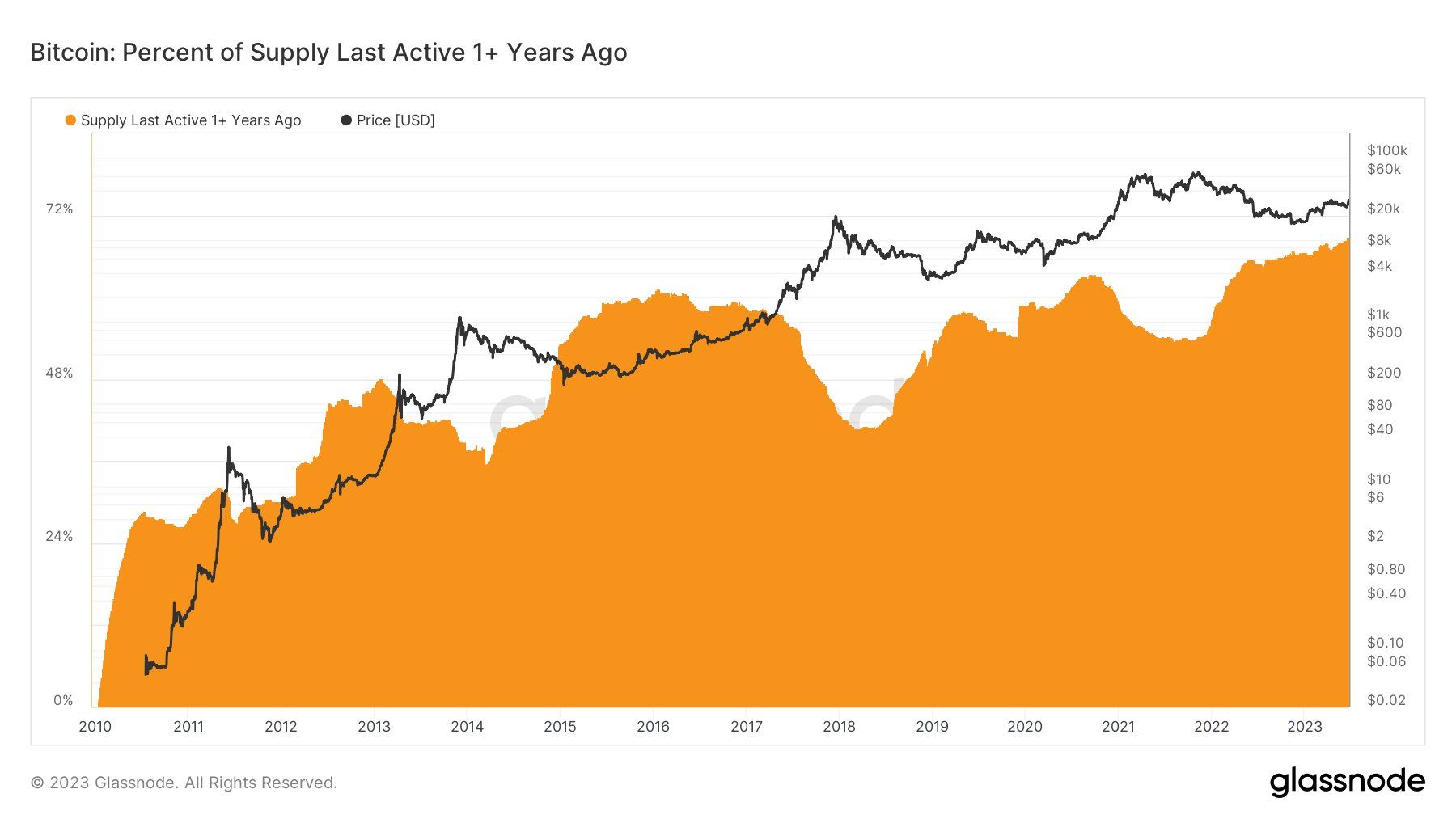

The amount of Bitcoin supply that remains dormant is increasing as investors remain reluctant to sell. This comes despite BTC prices tapping a new 2023 high over the weekend.

Every day, new record highs are being set in the amount of Bitcoin supply that has not moved in at least a year.

The metric was observed on June 26 by industry analyst Will Clemente citing a Glassnode chart.

Bigger Bitcoin Supply Being ‘Hodled’

“This is even more impressive considering a year ago was when BTC initially dropped down to $20K following the Luna collapse,” he added.

There are also more than 1 million “wholecoiner” addresses holding more than 1 BTC, he noted.

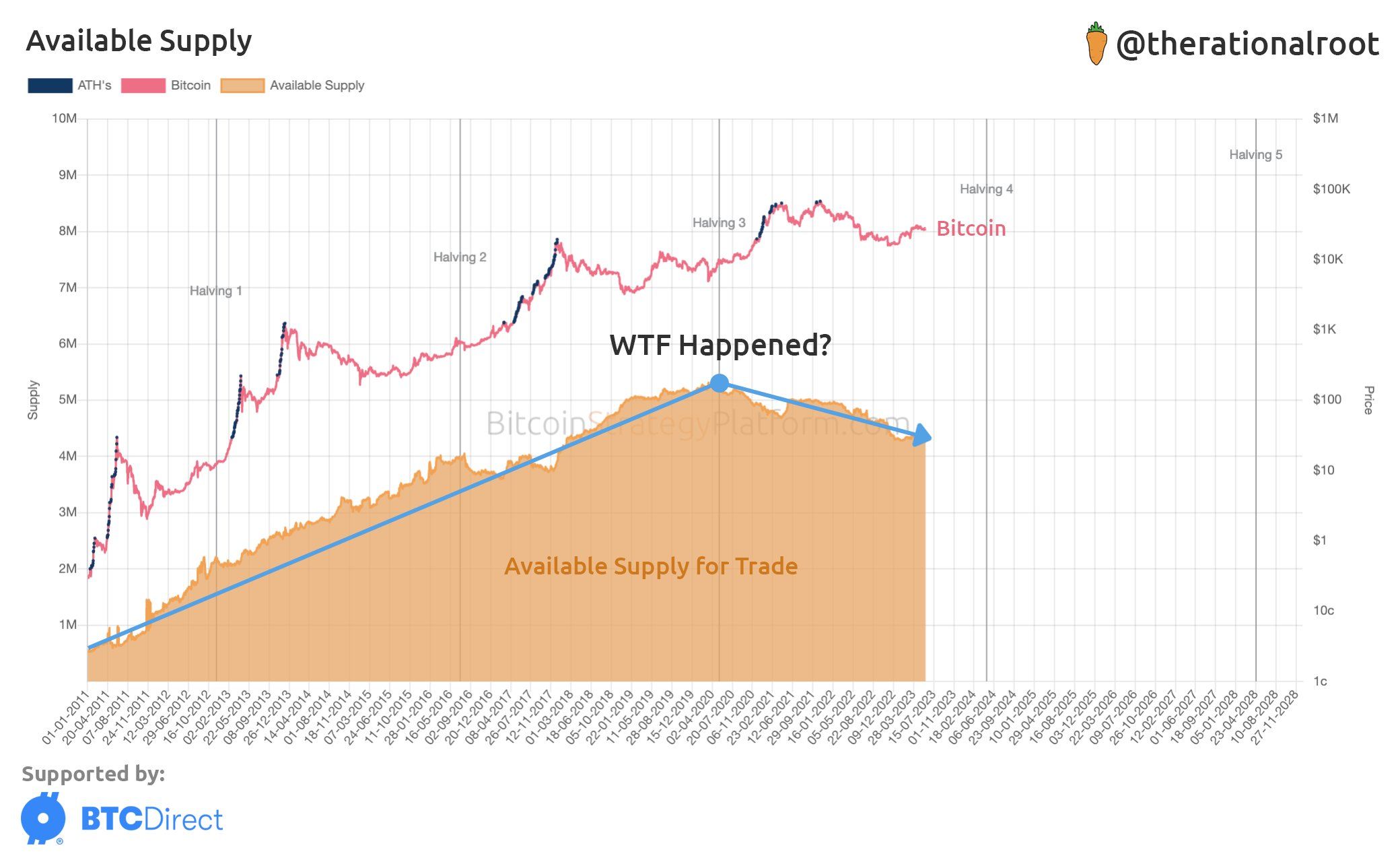

On June 25, on-chain analyst “@therationalroot” reported that the supply available to trade has declined since the third halving in May 2020.

This may be due to accumulation, long-term holding, or institutions buying and locking away the asset. Either way, it should positively affect price action since there are fewer Bitcoins to buy and sell.

However, some could argue that holding BTC means not using it, which negates its properties as decentralized money.

The counter-argument is that BTC is being used as a store of value in times of high inflation and diminishing fiat values.

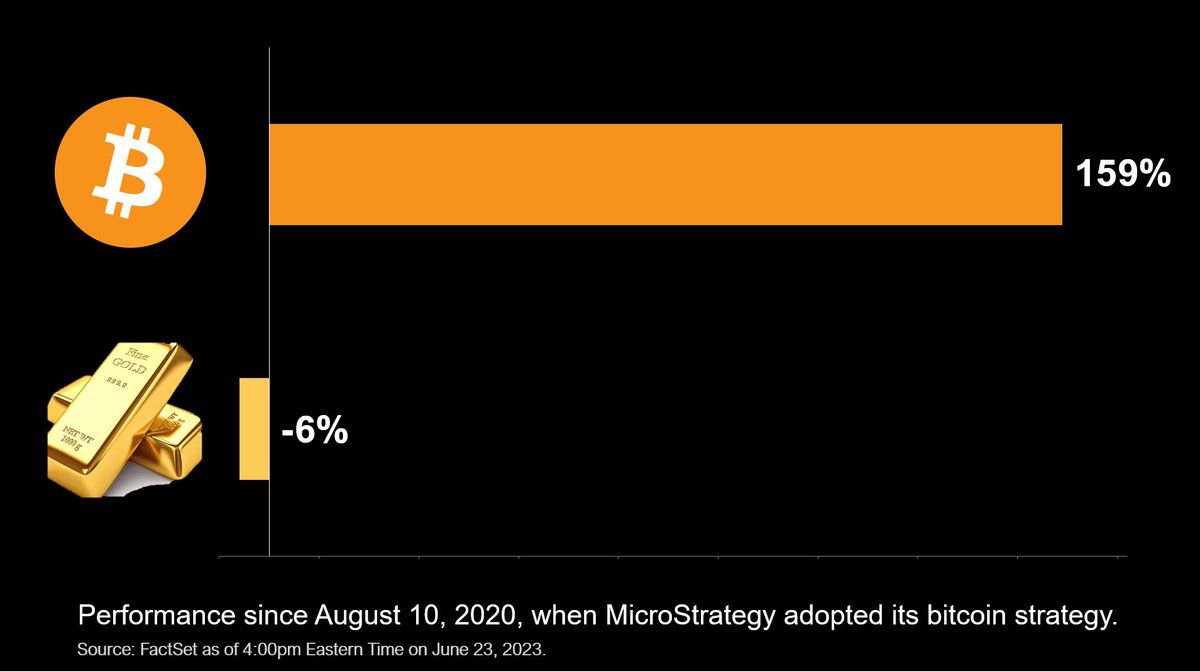

Furthermore, this was alluded to by MicroStrategy CEO Michael Saylor, who compared Bitcoin to gold since the firm adopted its strategy.

Glassnode also reported that the recent BTC move from $25,000 to above the $30,000 level has sent an additional 1.8 million short-term holder coins into profit. Additionally, this places the percentage of short-term holder supply in profit at 97% or around 2.6 million BTC.

“With respect to historical precedence, previous periods of unilateral STH profitability has marked extreme elation in price action.”

BTC Price Outlook

Bitcoin prices hit a new 2023 high of $31,185 on June 24. However, resistance remains heavy at this level.

The asset retreated 1.7% on the day to trade at $30,224 during the Monday morning Asian trading session.

BTC is still up 14% since the same time last week, buoyed by BlackRock’s ETF application and renewed institutional interest.

If resistance cannot be breached, a double-top pattern may form. This may lead to another retreat to support at lower levels and more consolidation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link