[ad_1]

Bitcoin whales and sharks accumulated 71,000 BTC over the past three weeks when the asset’s value has remained largely “boring.” US entities have increased their exposure to the flagship asset during this period.

The high accumulation rate by these top holders suggests a high conviction fueled by traditional institutional firms’ flurry of Spot ETF applications.

BTC Whales Add $2.15 Billion in 3 Weeks

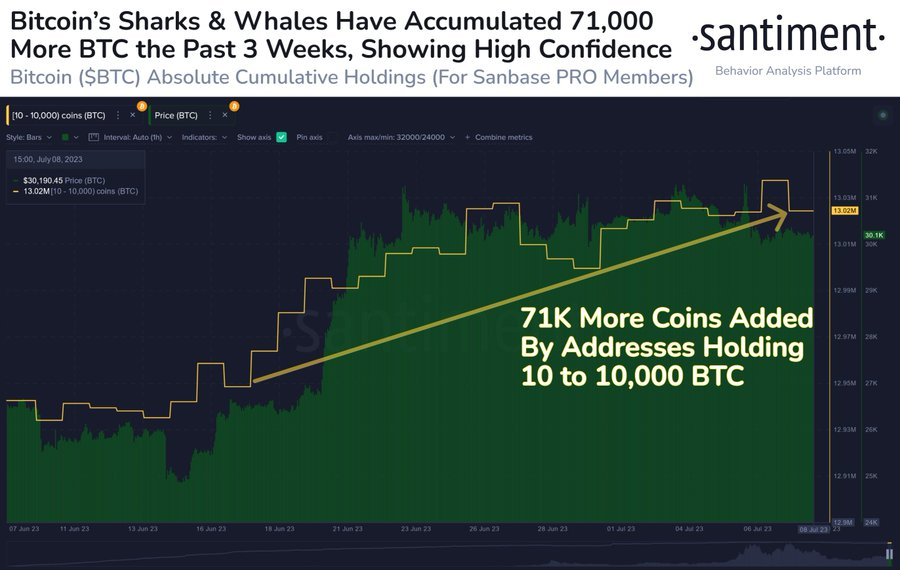

Data from blockchain analytical firm Santiment showed that addresses holding between 10 and 10,000 BTC have been very busy in the past few weeks. Since June 17, these addresses accumulated over 71,000 BTC worth $2.15 billion.

According to the market intelligence platform, it did not add wallets holding more than 10,000 BTC because such addresses usually belong to exchanges.

This accumulation rate is a sign of high confidence in the flagship asset. But it is even more surprising considering BTC’s price has mostly traded around the $30,000 and $31,000 range.

US Entities Driving BTC Accumulation

Traditional financial institutions’ recent interest in offering Spot Bitcoin exchange-traded funds (ETF) has primarily driven the current bullish sentiment around BTC. BlackRock’s June 15 application triggered an avalanche of similar applications by other financial institutions like Fidelity and others.

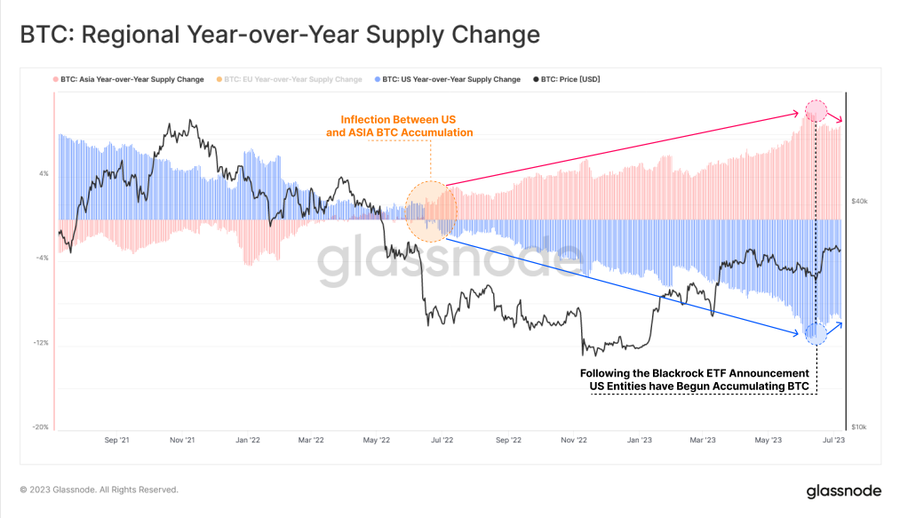

Glassnode, a data aggregator, further observed that U.S. entities have seen a significant increase in their share of Bitcoin supply. The firm added that this could indicate a potential shift in supply dominance if the trend continues.

BeInCrypto previously reported that institutional investors have steadily increased their accumulation of Bitcoin since BlackRock filed an application for a spot BTC ETF. Several market observers note the significant BTC accumulation and share this sentiment.

Crypto analyst Miles Deutscher suggested that the industry was witnessing the “beginning of widespread institutional BTC accumulation.” Gemini co-founder Cameron Winklevoss said:

“The Great Accumulation of bitcoin has begun. Anyone watching the flurry of ETF filings understands the window to purchase pre-IPO bitcoin before ETFs go live and open the floodgates is closing fast.”

BlackRock CEO Larry Fink has also changed his stance on BTC and now lauds the asset as an “international asset.” Fink believes it could be an alternative to other assets based on countries’ fiat currencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link