[ad_1]

BlockFi’s Unsecured Creditors’ Committee (UCC) has initiated court proceedings accusing BlockFi CEO Zac Prince for defrauding customers and engaging in excess while delaying a way forward.

The UCC filed papers with the US New Jersey District Court today accusing Prince and BlockFi of undue excess through their debtors’ exclusivity motion.

CEO Zac Prince and Colleagues Accused of Self-Enrichment

The exclusivity motion granted BlockFi management permission to lead internal bankruptcy management because of their knowledge of the company.

The committee argues that BlockFi’s Motion will not lead to a “principled or swift conclusion.” Instead, it appears to enrich BlockFi insiders at the expense of creditors while the company is not earning revenue.

“It is time for the Debtors’ unsecured creditors to finally come to know what BlockFi truly was, who Zac Prince truly is, how much he personally profited from the company, and what he and certain of his colleagues were doing (in juxtaposition to what they promised customers) when no one was watching.”

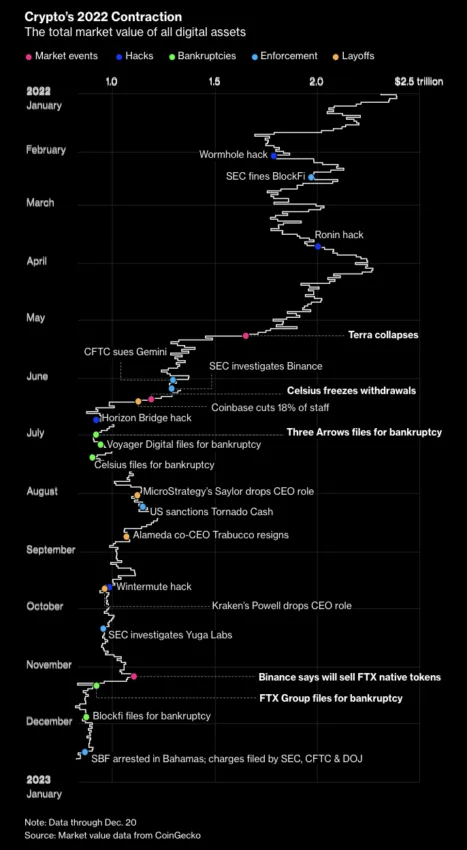

BlockFi filed for bankruptcy on Nov. 28, 2022, citing exposure to FTX.

It lent crypto deposits to, among other companies, lender Celsius Holdings.

UCC’s New Plan to Minimize Waste

Unless the court takes action, Prince and BlockFi will deplete funds owed to creditors, the UCC said.

Read here about the spectacular collapse of FTX and its effects on the entire crypto industry.

Accordingly, they have asked the court to appoint a Chapter 11 trustee because Prince allegedly violated his fiduciary duty by allowing $900 million in fraudulent transfers. Additionally, BlockFi liquidated customer holdings against previous promises, exposing them to undue tax risk.

The company also tied up the case and broke federal law by soliciting a restructuring plan too early. It also lied about its actions, and the existence of a Creditor Committee Plan.

Instead of a Chapter 11 plan, creditors propose the court can reduce the exclusivity period of BlockFi’s motion because the company has not moved forward in coming up with a meaningful plan.

A third alternative would see the judge convert BlockFi’s bankruptcy to Chapter 7. While under Chapter 7 proceedings, the company must prove that its current efforts will not erode distributions it owes parties.

Zac Prince has yet to comment on the allegations.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link