[ad_1]

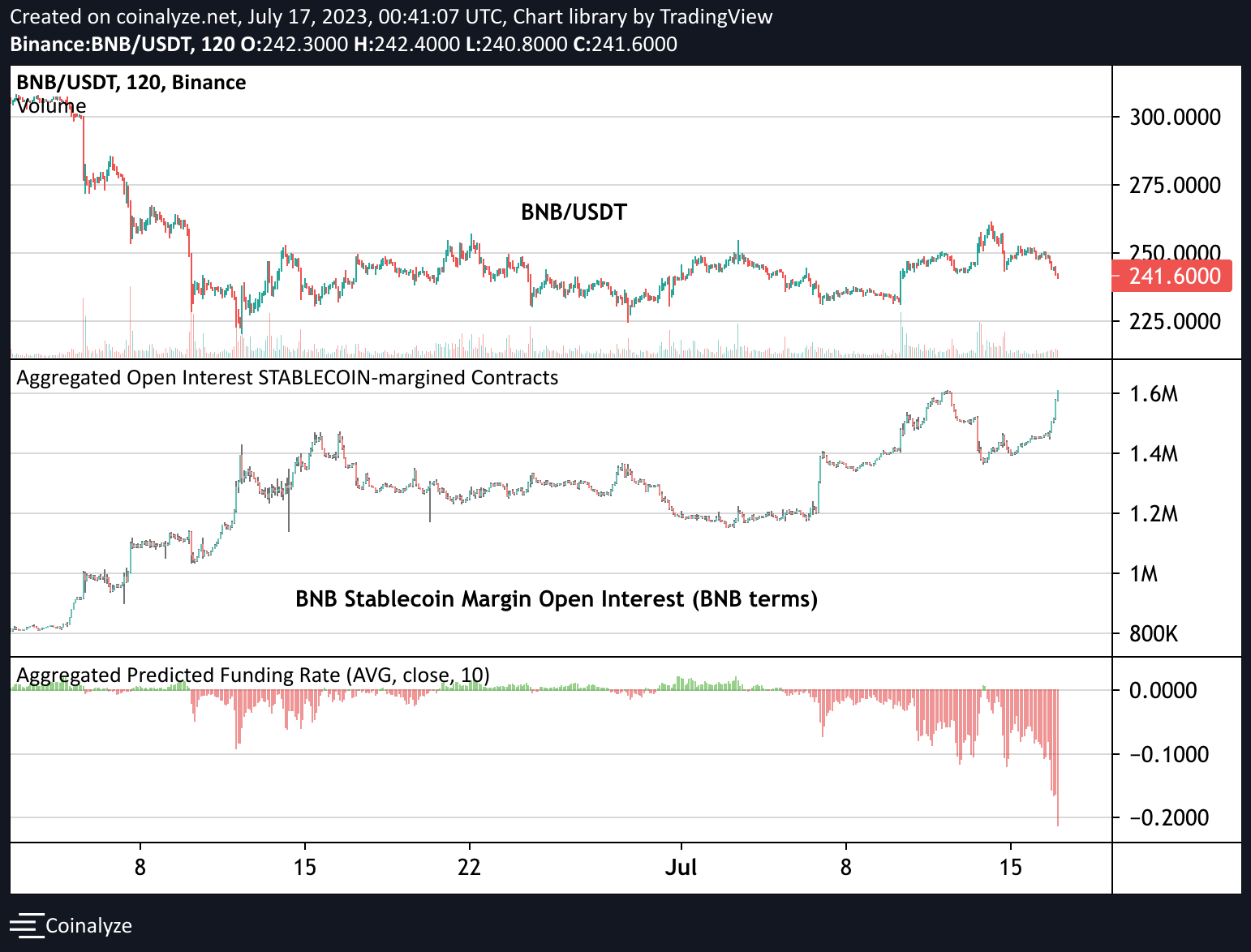

Open interest (OI) for perpetual futures contracts on Binance Coin (BNB) has surged to new highs. The move could be driven by speculators anticipating bad news and a rocky road ahead for the world’s largest crypto exchange.

Open interest in stablecoin margined futures contracts for BNB has skyrocketed. Additionally, funding rates have fallen deep into negative territory for derivatives for the exchange token,

BNB Futures Fund Rate Sinks

Speculators are loading up on BNB derivatives as the number of outstanding contracts yet to be settled has surged.

On July 17, market analyst Dylan LeClair posted a roundup of the situation with BNB perpetual futures. He commented on the negative funding rates stating it “looks as if someone is getting ahead of some bad news flow.”

The last time BNB-denominated open interest was this high was in December 2020, when the price was $30, and funding was extremely positive, he said.

He also observed that OI on other platforms aside from Binance was also the highest it has been. “It’s a market that’s no longer completely driven on Binance – very notable in my opinion,” he added.

Perpetual futures contracts are agreements to non-optionally buy or sell an asset at an unspecified point in the future.

Since perpetual futures contracts never settle, exchanges use Funding Rates to ensure that futures prices and index prices converge on a regular basis.

Binance describes them as “periodic payments made to or by traders who are long or short based on the difference between perpetual contract markets and spot prices.” Moreover, a negative Funding Rate means that short positions pay for longs and is considered bearish.

“Traders are getting short BNB and don’t seem to care about the high cost of funding to do so,” LeClair said before concluding:

“Personal hunch is that DoJ charges arrive shortly and people in the know are positioning accordingly, let’s see.”

Furthermore, Binance’s woes continue as it has just announced a major staff layoff axing around a thousand positions.

BNB Price Outlook

BNB prices are falling back again, with a 2.1% loss on the day to trade at $243 at the time of writing.

However, the exchange token has made 4% over the past week, with the Ripple-induced rally helping all altcoins out.

BNB has lost 20% since the SEC sued Binance in June. Nevertheless, the coin is 64.5% down from its all-time high, which is much better than most altcoins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link