[ad_1]

Bitcoin, the world’s leading cryptocurrency, has recently completed a significant milestone in its price movement as it successfully reached the 61.8% Fibonacci retracement level.

This retracement pattern, based on the mathematical ratios derived from the Fibonacci sequence, is often used by traders and analysts to identify potential support and resistance levels in the market.

The completion of the 61.8% retracement suggests a crucial turning point for Bitcoin’s price trajectory.

In this Bitcoin price prediction, we will delve into the implications of this retracement level and explore the possible scenarios for Bitcoin’s future movement.

Bitcoin Price

As of today, Bitcoin is being traded at a price of $26,742, accompanied by a trading volume of $11.9 billion within the past 24 hours.

The cryptocurrency has witnessed a gain of approximately 1.30% during this period. In terms of market capitalization, Bitcoin retains its top position with a live market cap of $518 billion.

The circulating supply of Bitcoin stands at 19,384,918 BTC coins, while the maximum supply is capped at 21,000,000 BTC coins.

Bitcoin Price Prediction

On Saturday, Bitcoin exhibited a narrow trading range with the upper boundary around the 26,875 level and the lower boundary near the 26,675 level.

A closer look at the four-hour timeframe reveals that Bitcoin has already completed a 61.8% Fibonacci retracement at the 26,875 level.

The recent candlestick closures below this level have raised concerns about continuing the upward trend.

Therefore, if Bitcoin fails to surpass the 26,875 level, there is a potential for a decline toward the next support level at 26,500, which is also reinforced by the 50-day exponential moving average.

Further down, if Bitcoin breaks below the 26,500 level, the next support can be expected around 26,250. Moreover, if this level holds, Bitcoin may decline further towards 25,900.

On the other hand, if Bitcoin successfully breaches the 26,875 level, it has the potential to target the resistance level at 27,011, followed by a possible breakthrough towards 27,200, which could expose Bitcoin to levels around 28,000.

The current technical indicators, such as the RSI, MACD, and the 50-day exponential moving average, all favor a buying trend.

Therefore, it is advisable to wait for the violation of the 26,800 level before confirming the upward momentum.

Keeping a close watch on this particular level is recommended to assess the continuation of the trend.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Cryptonews Industry Talk brings forth a captivating selection of cryptocurrencies expected to flourish in 2023.

These virtual assets have been meticulously chosen based on their optimistic prospects, signaling substantial growth potential in both the immediate and distant future.

Equipped with distinctive attributes and pioneering technologies, these cryptocurrencies are well-positioned to thrive and achieve remarkable progress in the years that lie ahead.

Prepare to embark on an exploration of the thrilling opportunities awaiting these digital currencies.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

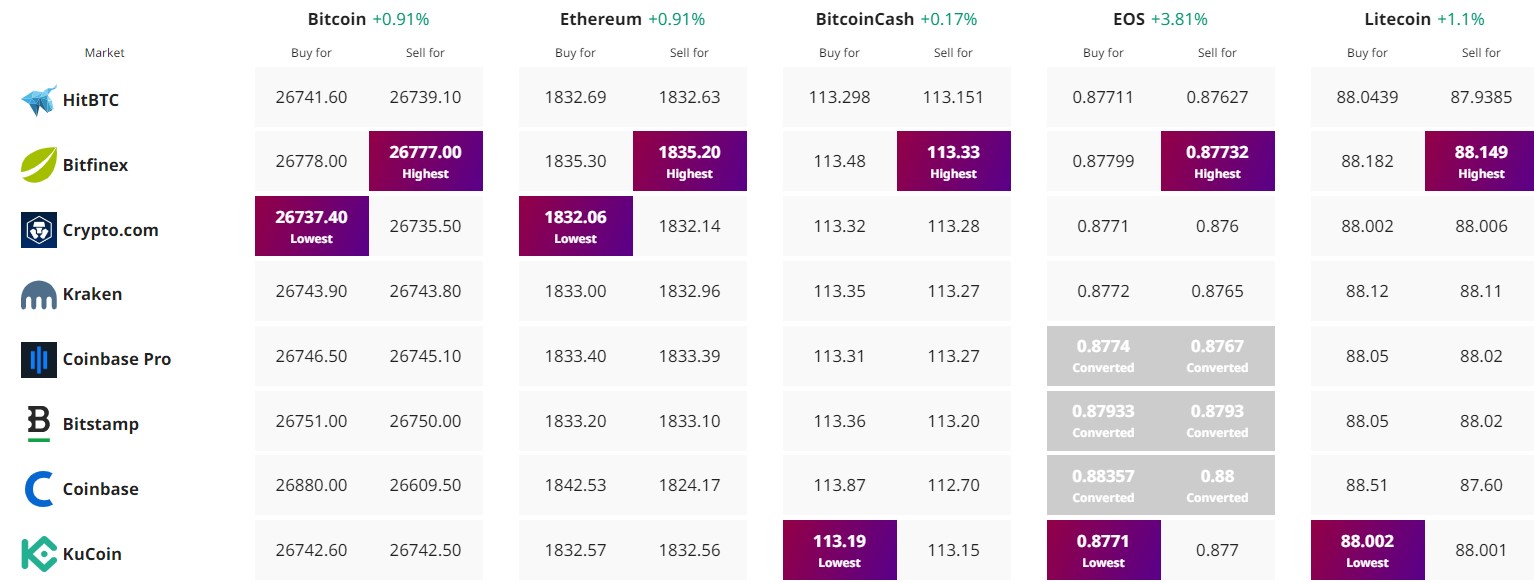

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

Source link