[ad_1]

Crypto news: We bring you a round-up of what went down in crypto this week. Wrapped Bitcoin rises to $70,000 on Richard Heart’s Ethereum fork, PulseChain, as Bitcoin becomes a viable 401(k) alternative.

Across the Pacific, Hong Kong police explore the metaverse’s potential in fighting crypto crime, and Asia-based Hotbit exchange receives 500 billion Shiba Inu (SHIB) despite its imminent shutdown.

On Thursday, Binance rounded off the week by announcing the delisting of a perpetual futures contract tied to Korean-born LUNC.

Amid a complex U.S. economic landscape burdened with this week’s unlimited debt ceiling announcement and persistent inflation, slow investment growth has prompted 401(k) advisers to consider Bitcoin.

As Hong Kong launches its new crypto regulations, police join the party to enforce anti-money laundering (AML) compliance using the metaverse.

International exchanges like Binance also weigh the feasibility of operating in a bear market under burdensome regulations.

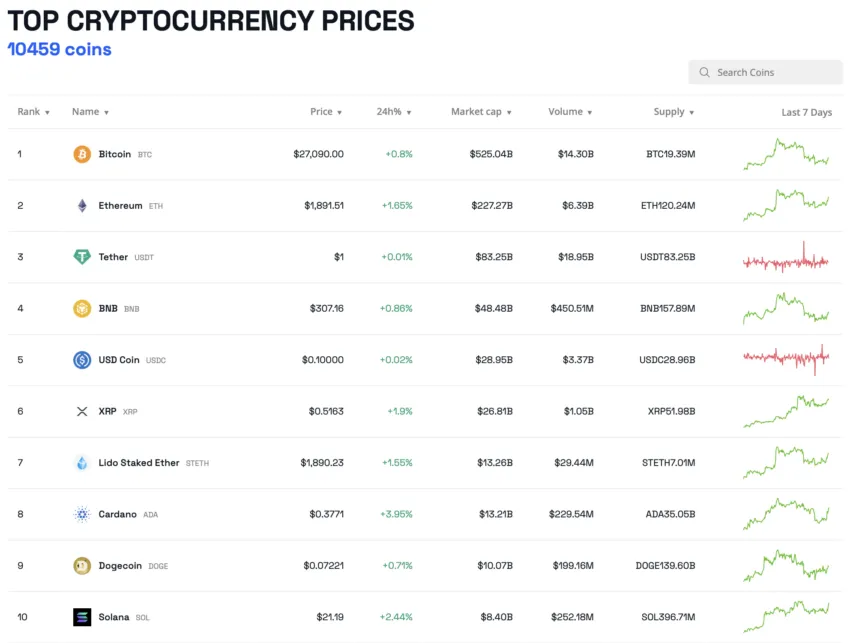

Bitcoin (BTC) Touches Bull Market Highs on Ethereum Fork

On Monday, news surfaced of a recent Bitcoin (BTC) price spike on PulseChain, an Ethereum fork founded by Richard Heart.

The price of wrapped Bitcoin rose to $70,000 in 20 minutes, accompanied by an unusual increase in trading volume on a chain normally bereft of liquidity.

The price fell back to below $27,000 after 10 minutes. One commentator pointed out that it took a mere $40,000 injection to spike the wrapped BTC price.

The price of Bitcoin rose on the same day to over $28,250 but ended May as its worst month since November 2022.

Investment Advisers Start Favoring Bitcoin

Despite having a rough May, Bitcoin may get a boost from new institutional interest, BeInCrypto reported on Sunday.

Scams, economic threats, and poor investment growth have seen 401(k) advisers start to recommend Bitcoin as their crypto choice to clients for their pensions. Advisers say Bitcoin is a viable asset while cautioning against impulsive investing based on social media advice.

Investor Kevin O’Leary argued earlier this year that greater institutional inflows could propel Bitcoin’s growth beyond $35,000.

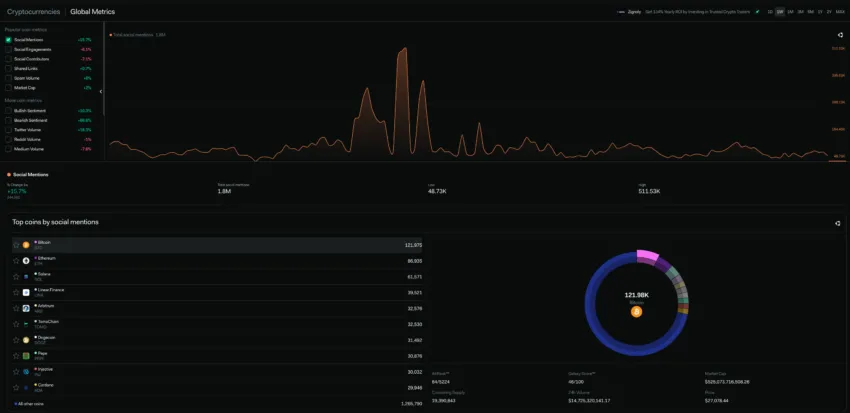

Crypto News – Socially Speaking

Mysterious Whale Cuts Shiba Inu (SHIB) Losses

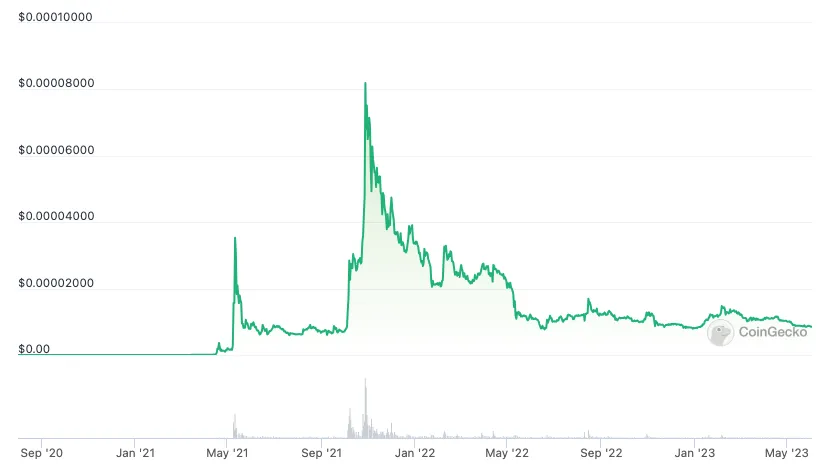

On Saturday, a whale curiously transferred 500 billion SHIB to an exchange on the brink of shutdown. The whale, which earned $70 million from SHIB in October 2021, appeared to be cutting their losses by moving assets from cold storage to a crypto exchange.

SHIB holdings have lost 90% of their value since the 2021 high.

Hotbit previously advised customers to withdraw funds by June 21 amid cash flow and operating difficulties.

Binance Waited One Year to Delist LUNC

With Do Kwon finally in jail, Binance announced yesterday it would delist a LUNC derivative on June 8.

On Thursday, the exchange adjusted margin tiers for leveraged LUNC perpetual positions amid mounting problems for Kwon. The LUNC creator is currently languishing in a Montenegrin jail awaiting trial for passport fraud as US and Korean prosecutors prepare extradition arguments.

Binance did not provide a reason for the delisting.

The exchange will automatically close and settle all positions on the contract come June 8.

Hong Kong Police Beef up Compliance

With the first round of crypto regulations effectively in place, Hong Kong police announced the new CyberDefender metaverse project to tackle Web3 crime this week.

Cybersecurity chief Ip Cheuk-yu said advanced criminals cost the public $570 million through digital asset crimes in Q1 at the initiative’s launch.

On the same day, the Hong Kong Securities Regulatory Commission launched revised money laundering rules to combat illicit crypto fund flows. Institutions must collect sender and recipient information for digital asset transactions of RMB8,000 or over.

Crypto Coin News

Optimism (OP) led this week’s bearish charge, plummeting 13.6% to move below a $1.85 horizontal resistance area to $1.34 on Wednesday. Flagging meme coin PEPE bounced off a parallel descending channel’s support level on May 31, having fallen 12.96% since May 13.

Flare (FLR) has traced a descending resistance line and is at risk of breaking below $0.024, BeInCrypto’s Valdrin Tahiri noted. The token fell 9.6% this week.

Toncoin (TON) fell by 6.1% to trade around the $1.80 horizontal support, while Conflux (CFX) has declined 6.04% to around $0.28.

On the upside, Injective (INJ) rose 27.88% to reach $8.04 at press time. Quant (QNT) has risen roughly 21% in the past week to $117.60, while XDC Network (XDC) is up 17.13%.

Aptos (APT) gained 13.82% to reach $9.00, while The Graph (GRT) rounds off the top five, rising over 13.5% to $0.13.

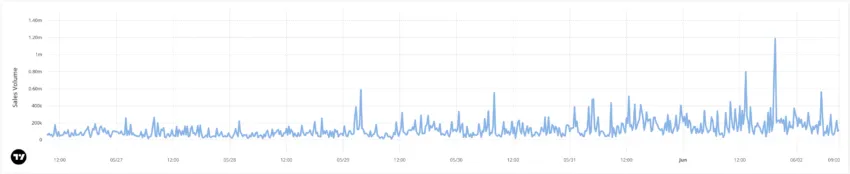

This Week in NFT Sales

OXBT tokens, following an experimental Bitcoin token standard BRC-20, topped this week’s sales with $9.8 million. Twitter users paid homage to the new token standard with orange profile pictures.

Ethereum’s Bored Ape Yacht Club, Azuki, and Mutant Ape collections recorded $9.7 million, 9.1 million, and $7.4 million in weekly sales.

Accordingly, Ethereum accounted for $105 million of the top 5 blockchains’ $165 million in weekly non-fungible token (NFT) volumes.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link