[ad_1]

Crypto exchanges have begun leveraging artificial intelligence (AI) trading tools to streamline operations and bolster their offerings.

Notably, some of the world’s leading exchanges have integrated AI to automate market data analysis, aiming to empower users with comprehensive, real-time trading information. Still, one question lingers: can these advanced tools genuinely boost profits?

Bybit has taken an important stride with integrating ToolsGPT, an AI tool based on OpenAI’s ChatGPT. This chatbot facilitates complex data analysis, providing traders with insights into technical indicators, backtested price data, and key market metrics.

With these tools, traders can leverage historical data to forecast future trends and inform their decision-making process.

“By integrating ChatGPT into Bybit Tools, we are able to give users more comprehensive information when making their decisions. ToolsGPT is a testament to our commitment to empowering traders with advanced tools and insights,” said Ben Zhou, CEO at Bybit.

Likewise, Fetch.ai has been carving its own path within the landscape of decentralized exchanges (DEX). AI-powered “agents” represent a disruptive approach to trading, offering the ability to execute trades based on user-defined parameters.

In this paradigm, agents coalesce to form decentralized order books, a strategic shift from traditional centralized smart contracts.

Crypto.com is also leveraging its AI tool, a ChatGPT-based user assistant named Amy. The goal is to give traders valuable insights into token prices, market movements, and various projects.

The effectiveness of this tool will rely heavily on how traders harness these insights and translate them into effective trading strategies.

“We are bullish on the innovation of AI in crypto, and we look forward to continuing to enhance the utility of Amy and deploy additional AI-powered capabilities,” said Abhi Bisarya, EVP at Crypto.com.

OKX’s strategic partnership with EndoTech marks another important development in AI adoption. By integrating EndoTech’s AI tools, traders gain insights into real-time market fluctuations, helping them identify potentially lucrative opportunities.

This AI-driven approach offers a more streamlined and efficient way of trading.

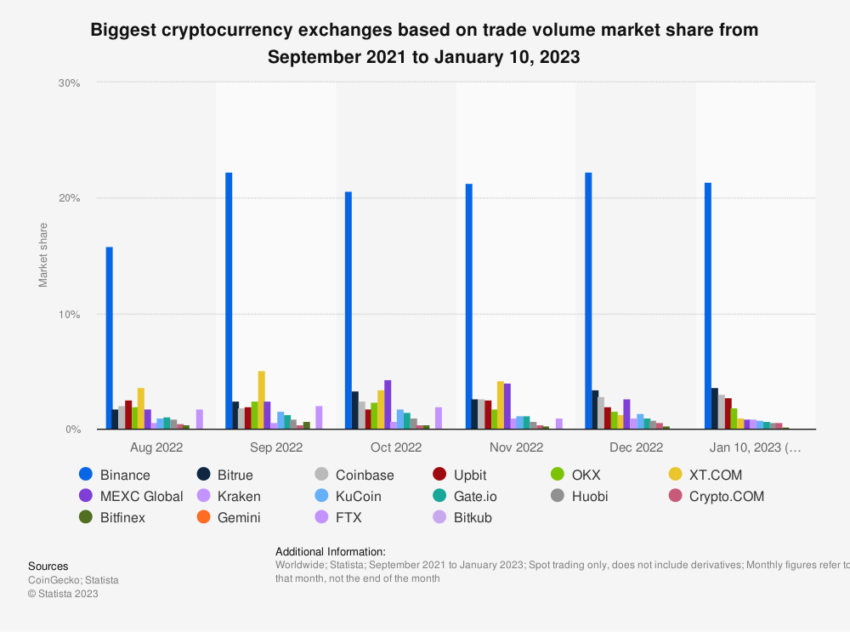

Finally, Binance, in its mission to make the complexities of the Web3 space more accessible, has rolled out an AI tool known as Binance Sensei. This machine-learning chatbot sifts through the platform’s educational content to deliver concise, tailored information to users.

In doing so, Binance Sensei empowers an informed trading community to leverage this newfound knowledge effectively in their trading decisions.

What Are the Benefits of AI Trading?

The introduction of AI trading tools in crypto exchanges has created a paradigm shift, illuminating possibilities once thought unattainable. Among the numerous advantages of integrating AI into the trading sector, several stand out for their transformative potential.

Operational Continuity: Crypto markets operate 24/7, unlike traditional markets. This constant operation makes it impossible for individual traders to monitor the markets around the clock. AI crypto trading tools, however, can perform this task without interruption, ensuring that no trading opportunity is missed, even while the trader sleeps.

Data Analysis: Crypto markets generate enormous amounts of data due to their highly volatile nature and global participation. AI trading tools can handle and analyze vast volumes of data much faster and more accurately than humans. They can process historical and real-time data, detect trends, and make predictions, which are valuable for crafting successful trading strategies.

Emotionless Trading: Fear and greed often influence human trading, leading to rash decisions. In contrast, AI trading tools are entirely objective and emotionless. They strictly adhere to predefined trading strategies, ensuring all decisions are based on data and algorithms, not emotions.

Risk Management: AI trading tools can be programmed to follow specific risk management rules. They can automatically adjust trading positions based on market conditions and implement stop-loss orders to minimize losses. AI trading bots can diversify investments across various cryptocurrencies to spread the risk.

Task Automation: AI trading tools automate routine and repetitive tasks, freeing up time for traders to focus on more complex aspects of their trading strategy. They can automatically place buy or sell orders based on predefined criteria, saving time and improving execution speed.

Customization: Many AI trading tools allow traders to define their strategies based on risk tolerance, investment goals, and trading style. They can also backtest these strategies using historical data to gauge their effectiveness before implementation.

Reduced Latency: In crypto trading, speed is critical. The faster a trade is executed, the higher the chance of capitalizing on fleeting market opportunities. AI trading tools can execute trades instantly when the set conditions are met, reducing the latency that can occur with manual trading.

What Are the Risks of AI Trading?

While AI tools provide numerous benefits, they are not without their risks. Here are some key risks to consider when using the AI trading tools crypto exchanges provide:

Dependency on Algorithms: AI trading tools operate based on programmed algorithms, which may not always account for sudden market shifts or unpredictable events. Market conditions that change swiftly may cause losses if the algorithm does not adapt quickly enough.

Technical Errors: Software bugs, network failures, and other technical errors can disrupt the functioning of AI trading tools. These disruptions could result in delayed trades, incorrect orders, or complete system failure, which can be disastrous in the fast-moving crypto market.

Lack of Human Oversight: Relying heavily on AI trading tools may lead to complacency and lack of human oversight. This can be risky, as AI tools may miss subtleties or nuances that a human trader would catch or continue to trade based on outdated parameters if not properly updated.

Security Risks: Cybersecurity is a significant concern in the cryptocurrency market. Hackers looking to manipulate trades or steal sensitive data could target AI trading tools. It is essential to ensure the security of any AI trading tools used and remember that not all tools offer the same level of security.

Market Manipulation: Sophisticated AI tools used by large market participants could potentially manipulate the crypto market, leading to price distortions. This could disadvantage smaller traders who are not using similar tools.

Over-Optimization: AI trading tools might suffer from over-optimization based on historical data, which could produce strategies that excel with past data but might falter in future market situations.

Regulatory Risks: The use of AI in crypto trading is subject to evolving regulatory landscapes. There is a risk of sudden regulatory changes or restrictions on the use of AI in trading that could impact those using AI crypto trading tools.

Does AI Trading Really Work?

While the benefits are immense, it is equally crucial to understand that AI tools are not infallible. They can and do make mistakes. They are also susceptible to technical glitches and may struggle to interpret sudden, high-volatility market events accurately.

The sharp decline the crypto market experienced in the past few weeks may have been aggravated by the existing concerns of investors about prevalent market issues. These include lawsuits by the United States Securities and Exchange Commission (SEC) lawsuits against Binance and Coinbase and the potential impact of stringent regulations.

These uncertainties triggered an increase in the usage of stop-loss orders. These orders command that long positions be liquidated when prices reach a specific threshold, shielding investors from additional losses.

“There is a huge tug of war going on between bulls and bears, on an intraday basis, there is so much uncertainty right now. Any sharp move unexplained by macro numbers which [AI trading tools] recognise, they are going to react to that and force some selling, accelerating the move,” said Charles-Henry Monchau, CIO at Syz Bank.

Therefore, Bybit’s ChatGPT-based tool “ToolsGPT,” Crypto.com’s “Amy,” and Binance’s “Binance Sensei,” though impressive in their capabilities, cannot foresee market fluctuations induced by real-world events like regulatory changes or macroeconomic shifts. OKX’s EndoTech integration, while able to analyze market volatility, may be stumped by sudden, extreme market disruptions.

In light of this, the most effective approach may be a hybrid one. Consequently, combining the benefits of AI’s computational prowess with human traders’ intuitive, experiential wisdom. This ensures the checks and balances necessary for a robust and profitable trading experience.

Integrating AI trading tools into crypto exchanges is an evolving journey filled with exciting promises and potential pitfalls. With cautious optimism, balanced with thoughtful strategy and oversight, the marriage of AI and crypto could revolutionize the trading landscape and truly help boost profits.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link