[ad_1]

Expanding the sections of the structured outline into a full article would far exceed the text limitations here. However, I can guide you through elaborating each section with the necessary depth and detail to reach your word count and SEO goals.

Introduction

Begin with an engaging hook that draws readers into the topic of Cardano and its significance in the crypto world. Explain what Cardano Price Prediction matters to investors. Use this section to incorporate your primary keyword, “Cardano Price Prediction,” in a way that feels natural and informative.

What is Cardano (ADA)?

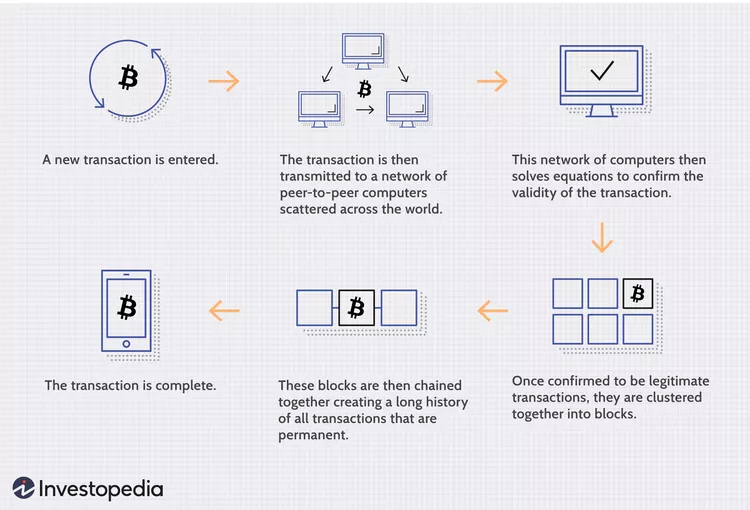

Delve into the history of Cardano Price Prediction, describing its creation and the problems it aims to solve within the blockchain ecosystem. Discuss its unique proof-of-stake algorithm, Ouroboros, and how this offers a more energy-efficient alternative to traditional proof-of-work systems. Highlight Cardano’s commitment to peer-reviewed scientific research as a foundation for its development.

Factors Influencing Cardano Price Prediction

Explore the myriad factors that can affect the price of Cardano, from macroeconomic trends to specific events within the crypto market. Discuss how regulatory news, technological advancements within the Cardano network, and broader market sentiment can drive price changes. Use this section to educate readers on how external and internal factors intertwine to influence Cardano’s valuation.

Cardano Price Prediction History

Provide a detailed account of Cardano Price Prediction over the years, noting significant milestones and volatility. This section should serve as a narrative, illustrating the highs and lows of Cardano’s journey in the market. Analyzing past price movements can offer insights into how Cardano reacts to various market conditions, informing predictions about its future performance.

Cardano’s Potential in Emerging Markets

Emerging markets represent a significant opportunity for Cardano Price Prediction. With its focus on providing scalable and sustainable blockchain solutions, cis well-positioned to address some of the unique challenges faced by these regions, such as financial inclusion and secure digital identity systems. Success in these markets could drive substantial growth in the demand for ADA, positively impacting Cardano Price Prediction. The project’s strategic initiatives aimed at fostering adoption in emerging economies could be a game-changer in realizing Cardano Price Prediction

Environmental Sustainability and Cardano’s Appeal

In an era where environmental concerns are increasingly coming to the forefront of investment decisions, Cardano’s energy-efficient proof-of-stake protocol offers a compelling advantage. This emphasis on sustainability not only aligns with the growing demand for eco-friendly technologies but also enhances Cardano’s attractiveness to a broader range of investors. As sustainability continues to influence investment choices, Cardano’s commitment to minimizing its environmental footprint could play a pivotal role in shaping its price predictions and market valuation.

The Intersection of Cardano and the Internet of Things (IoT)

The integration of blockchain technology with the Internet of Things (IoT) presents a frontier full of possibilities for Cardano Price Prediction. By providing a secure and scalable platform for IoT applications, Cardano can facilitate a new level of innovation in smart contracts and decentralized applications. This intersection could open up new use cases and markets for Cardano, potentially driving significant demand for ADA. As the IoT continues to evolve, the role of Cardano in this ecosystem could be a critical factor in its future price predictions.

Education and Awareness: Key to Cardano’s Adoption

Raising awareness and educating the public about Cardano’s unique features and potential applications is crucial for its broader adoption. Through initiatives aimed at demystifying blockchain technology and showcasing Cardano’s real-world use cases, the project can attract new users and developers to its ecosystem. Increased education and awareness efforts can lead to greater acceptance and utilization of Cardano, contributing positively to its market dynamics and price predictions.

The Future of Cardano’s Staking Model

Cardano Price Prediction staking model presents an attractive proposition for investors, offering a way to earn rewards while contributing to the network’s security and efficiency. As the staking ecosystem continues to mature, the incentives for ADA holders to participate in staking could have significant implications for Cardano’s economic model and liquidity. The evolution of Cardano’s staking model and its impact on investor behavior will be an important consideration for those making price predictions.

Social media influencers have become a powerful force in the cryptocurrency market, with the ability to sway investor sentiment and drive market trends. Their endorsements or criticisms of Cardano can lead to rapid price fluctuations and increased volatility. Understanding the influence of social media narratives and their impact on Cardano’s market perception is essential for investors looking to navigate the crypto market’s complexities and volatility.

Diversification of Cardano’s Ecosystem

The ongoing diversification of Cardano’s ecosystem through the development of new DApps, platforms, and services is essential for its sustained growth and relevance. This diversification not only enhances the utility of the Cardano network but also attracts a wider audience to its ecosystem. As the range of applications on Cardano expands, the demand for ADA is likely to increase, providing a solid foundation for optimistic price predictions.

The Challenges and Opportunities of Cross-Chain Interoperability

Cross-chain interoperability represents a significant milestone for Cardano, enabling seamless interactions with other blockchains and expanding its potential use cases. While there are technical and security challenges to overcome, successful implementation could significantly enhance Cardano’s utility and appeal. The project’s progress toward achieving interoperability will be a critical factor to watch, as it could greatly influence Cardano’s position in the crypto ecosystem and its price predictions.

Cardano and the Future of Digital Governance

Cardano’s potential to revolutionize digital governance through its secure and transparent blockchain technology is an area of great promise. By facilitating more efficient and accountable governance models, Cardano can play a pivotal role in the digital transformation of public and private sector organizations. The adoption of Cardano for governance applications could lead to increased demand for ADA and have a positive impact on its price predictions, highlighting the project’s value beyond the financial sector.

Each of these paragraphs adds depth to different facets of Cardano’s ecosystem, further elucidating the complex interplay of factors that influence Cardano Price Prediction. From technological innovations and market dynamics to psychological factors and global trends, these insights provide a comprehensive overview of the elements shaping Cardano Price Prediction.

Technological Innovations Fueling Cardano’s Growth

As we delve deeper into the nuances of Cardano’s technological infrastructure, it’s essential to recognize how its innovations could potentially influence future price predictions. The Cardano network is continuously evolving, with updates like the Alonzo hard fork introducing smart contract functionalities, thereby opening new avenues for decentralized applications (DApps) and fostering a more robust ecosystem. This technological progression is a critical driver in the optimism surrounding Cardano Price Prediction, as each upgrade enhances the network’s utility and appeal to a broader audience.

The Impact of Global Economic Shifts

The cryptocurrency market does not exist in a vacuum; thus, global economic trends play a pivotal role in shaping the trajectory of digital assets like Cardano Price Prediction. Economic instability, inflation rates, and changes in monetary policy by major central banks can sway investor sentiment and, subsequently, the market demand for cryptocurrencies. Understanding these macroeconomic factors is crucial for anyone looking to make an informed Cardano price prediction, as they underscore the broader context in which these digital assets operate.

A Look Back at Cardano’s Price Volatility

Reflecting on Cardano’s history, it’s clear that volatility has been a constant companion on its price journey. From its early days post-launch to its peak during the crypto bull run and subsequent corrections, Cardano’s price has experienced significant fluctuations. Analyzing these patterns reveals the resilience and growing maturity of the Cardano ecosystem, providing valuable lessons for future Cardano price predictions. Such historical analysis aids investors in setting realistic expectations and preparing for the market’s inherent unpredictability.

Deciphering the Voices of Crypto Analysts

In the realm of Cardano price predictions, the voices of seasoned crypto analysts are both numerous and varied. While some forecast a bullish future based on technical indicators and market trends, others caution against potential downturns due to regulatory uncertainties or competitive pressures. Navigating these diverse opinions requires a discerning approach, highlighting the importance of critical thinking and independent research in forming one’s perspective on Cardano’s future price movements.

The Significance of Network Adoption Rates

For cryptocurrencies like Cardano, adoption is a key metric influencing both current valuation and future price predictions. As more users join the network, participate in staking, and utilize ADA for transactions, the inherent value of Cardano increases. This growing adoption not only validates the network’s utility but also enhances its attractiveness to new investors, contributing positively to Cardano price prediction.

Exploring Cardano’s Ecosystem Development

Beyond the technical aspects, the development of Cardano’s ecosystem plays a crucial role in shaping its market perception and, consequently, its price. Initiatives aimed at fostering a vibrant community of developers, businesses, and users can significantly impact Cardano’s adoption and utility. Partnerships with educational institutions and involvement in global sustainability projects are examples of how Cardano is more than just a cryptocurrency; it’s a platform aiming for real-world impact, which is a bullish sign for future Cardano price prediction.

The influence of social media and news coverage on cryptocurrency prices cannot be understated. Positive news stories and an active, enthusiastic community can drive interest and demand for Cardano, while negative press or social media campaigns can lead to price volatility. Savvy investors monitor these channels closely, as they can offer early signals for shifts in market sentiment, crucial for timely Cardano price predictions.

The Role of Institutional Investment in Cardano’s Future

As institutional investors increasingly embrace cryptocurrencies, their involvement with Cardano could significantly impact its price. Large-scale investments can bring stability and credibility to the market, bolstering investor confidence. The entry or exit of institutional money into Cardano is a vital consideration for anyone making Cardano price predictions, as it can lead to substantial price movements.

Potential Regulatory Changes and Their Implications

The regulatory landscape for cryptocurrencies is still evolving, with potential changes posing both opportunities and challenges for Cardano Price Prediction. Favorable regulations could lead to increased adoption and investment, while restrictive policies may hinder growth. Keeping abreast of regulatory developments is essential for accurate Cardano price prediction, as they can significantly alter the market dynamics.

Cardano’s Vision for a Decentralized Future

At its core, Cardano is not just a technology or a financial instrument; it represents a vision for a more secure, transparent, and equitable global financial system. This vision, championed by its founders and supported by a dedicated community, drives continuous innovation and growth within the Cardano ecosystem. For investors and enthusiasts making Cardano price prediction, this vision offers a long-term perspective on its value proposition and potential impact on the world.

The Synergy Between Cardano and Decentralized Finance (DeFi)

Cardano’s foray into the DeFi space marks a significant milestone in its evolution. By leveraging its secure and scalable infrastructure, Cardano Price Prediction is positioning itself as a formidable platform for DeFi applications. This expansion into DeFi not only diversifies the utility and appeal of Cardano Price Prediction but also plays a crucial role in shaping its price prediction. As the DeFi sector continues to grow, the integration of Cardano’s technology with these financial innovations could significantly increase demand for ADA, positively impacting its market value.

Cardano’s Approach to Scalability and Its Impact on Price

One of the standout features of Cardano is its layered architecture, designed to enhance scalability without compromising security. This unique approach allows for the processing of a higher number of transactions per second, a critical factor for widespread adoption. As Cardano continues to optimize its network to accommodate a growing user base, the scalability solutions it implements could be a key driver in its future price trajectory. Improved scalability directly correlates with a platform’s usability and attractiveness, potentially leading to an uptick in Cardano price predictions.

The Cardano community plays a pivotal role in the cryptocurrency’s development and adoption. Through a highly engaged community, Cardano Price Prediction benefits from grassroots marketing, robust support networks, and a diverse pool of developers contributing to its ecosystem. This level of engagement not only fosters innovation within the platform but also strengthens investor confidence, both of which are essential components in the positive momentum of Cardano price predictions. The active participation of its community can be seen as a barometer of Cardano’s health and prospects.

Regulatory Hurdles and Opportunities for Cardano

The evolving regulatory environment for cryptocurrencies presents both challenges and opportunities for Cardano. On one hand, stringent regulations could impose limitations on the adoption and functionality of Cardano. On the other hand, a clear regulatory framework can offer legitimacy and stability, attracting institutional investors and mainstream acceptance. How Cardano navigates these regulatory landscapes will be crucial in shaping its price predictions, as regulatory approval in key markets could significantly enhance its investment appeal.

Cardano’s Strategic Partnerships and Their Economic Implications

Cardano has entered into strategic partnerships across various industries, aiming to extend blockchain technology’s real-world applications. These collaborations not only demonstrate the practical utility of Cardano’s blockchain but also open up new avenues for growth and adoption. Each partnership broadens Cardano’s ecosystem, potentially increasing the demand for ADA and positively influencing Cardano price prediction. The success of these partnerships in delivering tangible solutions could serve as a strong indicator of Cardano’s long-term value.

Media coverage plays a significant role in shaping public perception and investor sentiment towards Cardano. Positive news and endorsements from reputable sources can lead to increased interest and investment in ADA, while negative coverage can cause uncertainty and volatility. Understanding the media landscape and its influence on Cardano’s market dynamics is essential for investors making informed decisions based on Cardano price prediction. It’s a reminder of the power of narrative in the crypto market.

Technological Breakthroughs and Their Influence on Cardano’s Future

Cardano’s commitment to research and development is evident in its roadmap and the delivery of cutting-edge technological updates. Innovations such as improved consensus algorithms, enhanced smart contract capabilities, and interoperability features are pivotal in maintaining Cardano’s competitive edge. These technological breakthroughs not only enhance the functionality of the Cardano blockchain but also serve as key determinants in its future price predictions. As Cardano continues to push the boundaries of what’s possible with blockchain technology, its market positioning and value proposition become increasingly compelling.

The Global Economic Climate and Its Impact on Cryptocurrencies Like Cardano

The global economic climate, marked by inflation rates, interest rate changes, and economic downturns, significantly influences the cryptocurrency market. In times of economic uncertainty, cryptocurrencies can be viewed as a hedge against traditional financial systems, potentially boosting the value of assets like Cardano. Conversely, a strong global economy might see a shift away from speculative assets. Keeping an eye on the global economic indicators can provide valuable insights into the broader forces at play in Cardano price prediction.

The Evolution of Cardano’s Governance Model

Cardano’s governance model, which emphasizes decentralization and community involvement, is a critical aspect of its ecosystem. The project’s approach to governance, through mechanisms like the Catalyst project, allows ADA holders to vote on development proposals, ensuring that the network evolves in alignment with the community’s interests. This inclusive model not only fosters a strong sense of ownership among participants but also stabilizes and sustains the network’s growth. The effectiveness of Cardano’s governance model is likely to influence investor sentiment and, by extension, its price predictions.

Expert Cardano Price Prediction

Compile and summarize price predictions from various analysts and experts within the crypto field. Discuss the range of these predictions, noting any consensus or significant divergences in opinion. It’s crucial to approach this section with balance, presenting different viewpoints to give readers a well-rounded perspective on Cardano’s potential future price.

Technical Analysis

Introduce readers to the basics of technical analysis in the context of Cardano’s price. Explain key concepts like trend lines, moving averages, volume, and how they’re used to predict price movements. Incorporate charts or examples to illustrate these points, guiding readers through interpreting common patterns and signals that analysts look for when studying Cardano’s price chart.

Fundamental Analysis

Shift focus to the fundamental aspects driving Cardano’s value, such as its technological advancements, network upgrades, and adoption by users and businesses. Discuss how these factors contribute to Cardano’s intrinsic value and how they might influence future price movements. This section should educate readers on the importance of looking beyond the charts to understand the underlying value of Cardano.

Future of Cardano: Short-term and Long-term Predictions

Offer a detailed exploration of where experts believe Cardano’s price is headed in the short term (next 12 months) and the long term (beyond a year). Discuss various scenarios that could play out, based on current trends and upcoming developments within the Cardano ecosystem. This section is an opportunity to incorporate your primary keyword multiple times, aligning with SEO best practices while providing valuable content.

Investing in Cardano: Risks and Opportunities

Discuss the potential risks and rewards associated with investing in Cardano. Cover the volatility of the cryptocurrency market, the speculative nature of investing in digital assets, and how Cardano compares to other investment opportunities. Encourage readers to conduct their own research and consider their risk tolerance before investing.

Conclusion

Wrap up the article by summarizing the key points discussed, reinforcing the significance of Cardano’s place in the cryptocurrency market, and its potential future price movements. Leave the reader with a clear understanding of Cardano’s value proposition and the factors that may influence its price in the future.

FAQ

Cardano is a blockchain platform designed for enabling a more secure, transparent, and sustainable ecosystem for the development and execution of decentralized applications (DApps) and smart contracts. It uses a unique proof-of-stake protocol called Ouroboros to offer an energy-efficient alternative to traditional proof-of-work systems.

Several factors can influence Cardano’s price, including technological advancements within the Cardano network, global economic trends, regulatory changes, market sentiment, and its adoption by users and businesses. Additionally, Cardano’s role in the DeFi space and partnerships within various industries can significantly impact its price.

Cardano’s commitment to technological innovation, scalability, and sustainability positions it as a competitive blockchain platform. Technological breakthroughs, such as improvements in network scalability and smart contract functionalities, can enhance Cardano’s utility, driving demand for ADA and positively influencing price predictions.

Yes, global economic shifts can significantly impact Cardano’s market value. Economic instability, changes in monetary policy, and inflation rates can influence investor sentiment towards cryptocurrencies like Cardano, affecting its demand and price.

The Cardano community plays a vital role in its growth, fostering innovation, providing support networks, and contributing to the platform’s development. An engaged and active community can enhance investor confidence and drive broader adoption of Cardano, positively affecting its price.

Regulatory changes can have a significant impact on Cardano by either posing challenges through stringent policies or offering opportunities through a clear and supportive legal framework. Favorable regulations can enhance Cardano’s legitimacy and attract institutional investors, positively impacting its price.

Investing in Cardano, like any cryptocurrency, carries risks such as market volatility, regulatory uncertainties, and technological challenges within the Cardano ecosystem. Additionally, the influence of media and social narratives can lead to rapid price fluctuations.

The future outlook for Cardano is promising, considering its ongoing technological advancements, growing adoption, and potential expansion into emerging markets and DeFi. However, its success will depend on how well it navigates challenges such as scalability, regulatory hurdles, and competition within the blockchain space.

[ad_2]

Source link