[ad_1]

A recent survey conducted by the CFA Institute shed light on whether central banks should introduce digital versions of fiat currencies. 42% believed that central banks should launch digital currencies (CBDCs), while 34% disagreed, and 24% expressed no preference.

The survey had over 4,000 participants and comes at a time when almost all major economies are considering a CBDC.

Key Findings Reveal Mixed Results

According to the survey, only 13% of participants said they had a thorough understanding of CBDCs.

Olivier Fines of the CFA Institute told Reuters that even among a sophisticated and financially literate group like their members, there is very little understanding of CBDCs. Additionally, Fines noted skepticism regarding the potential benefits of CBDCs, particularly in developed economies.

The survey found that 87% of respondents considered their understanding of CBDCs to be little or moderate.

Younger participants, especially those under age 30, were likelier to report a low level of understanding. 51% in the younger cohort compared to 39% among those over 55 years of age.

According to the report, younger respondents, individuals in the Asia-Pacific region, and participants from developing economies like China and India strongly supported CBDCs. Developing markets also highlighted the importance of CBDCs in improving financial inclusion.

Developing Markets Value CBDCs More

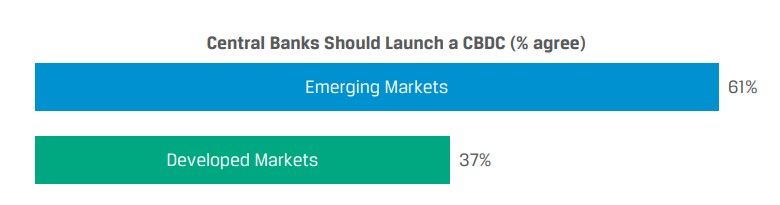

In developed markets, only 37% of respondents preferred a CBDC, whereas in emerging markets, 61% favored one. However, the survey showed variations in results across regions and age groups.

Specifically, support for a digital dollar was relatively low in the United States, with only 31% in favor. The possibility of introducing a digital dollar in the United States has triggered intense discussions on privacy and surveillance.

This month, the US Federal Reserve initiated its FedNow payments service, leading experts to speculate that it might pave the way for a future CBDC pilot launch. The US follows Canada with a 38% preference, 45% in the European Union, and 46% in the United Kingdom.

In Asia, the CBDC pilot in India achieved successful enrollment of thousands of customers and merchants. The e-rupee initiative explores the potential of a digital alternative to physical cash. Meanwhile, China has been making significant progress in the implementation of its e-CNY (digital yuan) rollout.

Check out our guide to India’s digital rupee here.

That said, the key drivers for CBDC remain accelerating payments and transfers. But, participants expressed concerns regarding cybersecurity and fraud, data privacy, and the lack of use cases for CBDCs.

Private Money Remains Secondary

The survey’s findings are intriguing, as most respondents believed that CBDCs and private cryptocurrencies could coexist. However, participants still viewed private money as inferior to government-issued currency despite this coexistence.

According to the CFA Institute, their survey results regarding developing markets align with surveys and studies conducted by the International Monetary Fund (IMF) and the Bank for International Settlements. In these emerging markets, two key motivations for exploring CBDCs are to offer a cash-like payment method and to enhance financial inclusion.

This convergence of findings emphasizes the significance of CBDCs in addressing the specific needs and opportunities in developing economies. This could provide crucial information to policymakers and other stakeholders in understanding the perceptions surrounding CBDCs.

Notably, the Atlantic Council highlights that 19 G20 countries are currently in the advanced stage of CBDC development, while 11 countries globally have already fully launched their digital currencies. Additionally, a remarkable 130 countries, accounting for 98 percent of global GDP, are actively exploring the implementation of CBDCs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link