[ad_1]

Citigroup is reportedly assessing its relationship with Metaco amid banks’ growing need for safe asset custody as tokenization gains popularity.

According to sources familiar with the matter, Citi is informally reviewing its one-year relationship with the custodian Ripple recently bought for $250 million.

Citi chose Metaco’s Harmonize platform to explore the tokenization of traditional assets in June last year.

Tokenization refers to the digitizing of tangible or intangible real-world assets for fast transfers over blockchains. While not a tokenization project per se, JPMorgan’s JPM Coin allows corporate customers to exchange value over a private blockchain outside of regular business hours.

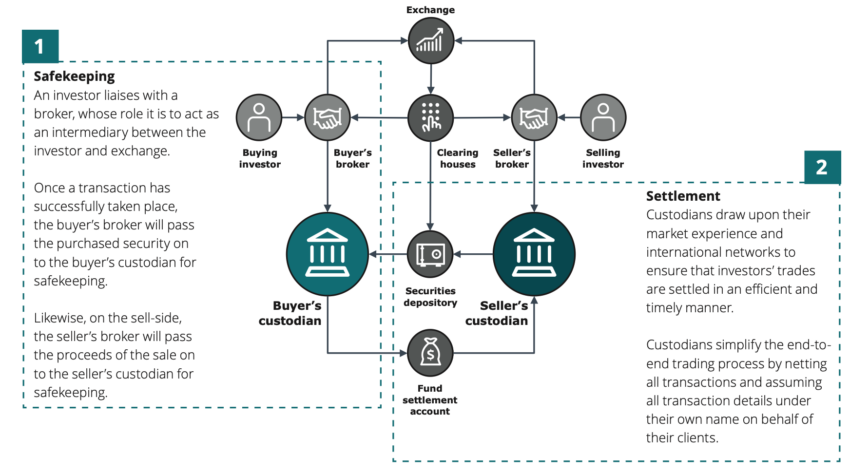

Custodians like Metaco keep safe private keys clients like Citigroup use to access digital assets including crypto. They increase security by storing assets in so-called”multi-sig wallets accessed only through multiple keys. They also offer to hold keys for these wallets offline.

Citigroup’s talks with Metaco come after the bank abandoned plans for its own Citicoin in 2019. Its partnership with the Swiss firm last year signaled its intention to make significant inroads into the tokenization space. Metaco owner Ripple Labs predicts the tokenization market could reach $10 trillion by 2030.

The San-Francisco-based company said its acquisition would preserve Metaco’s independence.

Last week, crypto firm EDX Markets, backed by Citadel Securities, Fidelity Digital Assets, and Charles Schwab Corp, canned plans to use custodian Paxos. Instead, the firm has favored Anchorage Digital and is reportedly in the final stages of negotiations.

Sygnum Bank’s new Singapore digital asset business joined Citigroup as a Metaco client earlier this week.

Investment firm BlackRock, Fidelity Investments, and Wisdom Tree all filed applications with the US Securities and Exchange Commission (SEC) to launch spot Bitcoin ETFs in recent weeks. BlackRock listed Coinbase as custodian in its application, even as the latter fights SEC charges it ran an unregistered brokerage.

Custodians Compelled to Segregate Funds After FTX

Citigroup’s talks with Metaco come as countries tighten custody requirements after FTX allegedly mixed customer and company funds. Crypto exchange Binance later attracted scorn for mixing some customers’ crypto deposit collateral in wallets holding company funds.

Read here about how to keep crypto safe without a custodian.

As a result, some countries’ laws now mandate a clear separation of wallet keys holding customer crypto and keys controlling corporate holdings.

For example, recent laws passed in Hong Kong require crypto exchanges to custody assets at a separate subsidiary, while Europe’s Markets in Crypto-Assets bill compels custodians to segregate customer assets clearly by storing them at different locations to the custodians’ own crypto.

European operators must also protect clients’ ownership rights in the event of bankruptcy and operationally separate client holdings from the company estate. They must also keep records of customer transactions.

Got something to say about Citigroup’s talks with Metaco or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link