[ad_1]

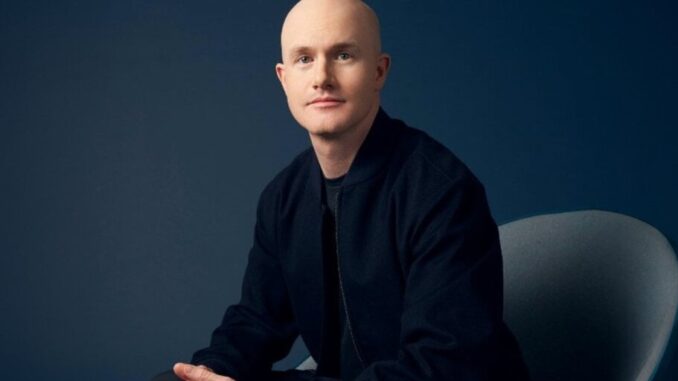

Coinbase Chief Legal Officer Paul Grewal today said the cryptocurrency exchange plans to take the SEC to court once again—this time to challenge the Commission’s denial of the company’s rulemaking petition.

The U.S. Securities and Exchange Commission today denied a petition by Coinbase to clarify new crypto rules for the digital assets industry. America’s biggest cryptocurrency exchange last year filed a petition asking the SEC to propose and adopt new rules on how best to regulate digitally native securities.

The SEC dragged its heels in giving an answer, leading Coinbase in April to ask a court to push the top regulator in giving an answer.

But the SEC today finally did so: a denial. “The existing securities regime appropriately governs crypto asset securities,” SEC chair Gary Gensler said in a Friday statement.

Grewal then responded in a post on X (formerly known as Twitter), explaining that the company plans to challenge the denial. “After 18 months of silence, we went to court to get the response the law requires. With appreciation for the Third Circuit, later today we’ll again seek its help by challenging the SEC’s abdication of its duty,” he tweeted.

Today the SEC denied Coinbase’s petition for rules for crypto. After 18 months of silence, we went to court to get the response the law requires. With appreciation for the Third Circuit, later today we’ll again seek its help by challenging the SEC’s abdication of its duty. 🧵⬇️ pic.twitter.com/tFjiW53eF7

— paulgrewal.eth (@iampaulgrewal) December 15, 2023

“No one looking fairly at our industry thinks the law is clear or that there isn’t more work to do,” Grewal added.

The SEC and Coinbase have clashed continuously over crypto regulation in the world’s biggest economy.

San Francisco-based Coinbase, which allows people to buy and sell Bitcoin, Ethereum, and many other digital coins and tokens, says the SEC is not clear enough with its rules; the SEC has alleged that the crypto platform has sold unregistered securities and in June hit the company with a massive lawsuit.

The quarrels focus mainly on one hot topic: whether certain cryptocurrencies are securities or not. The SEC’s lawsuit against Coinbase names several top coins as unregistered securities, including Cardano, Polygon, and Solana.

Gensler has repeatedly said that most digital coins and tokens—except for Bitcoin—likely fall into the category of unregistered securities, which means that the exchanges that allow for their trading could face legal action from the regulator. Just last month, the SEC hit another San Francisco-based crypto exchange, Kraken, with a lawsuit that essentially mirrors the complaint against Coinbase.

Not all members of the SEC are happy with today’s decision, though. Commissioners Hester Peirce and Mark T. Uyeda said in a statement that they were “disappointed that the Commission is not hosting these important conversations” surrounding what constitutes securities.

Commissioner Peirce has previously criticized the SEC for being “ambiguous” and “uninterested in facilitating innovation and competition in the financial markets.”

“We’re grateful that two Commissioners disagreed with the denial and called for real dialogue,” Grewal said on Twitter. “We should be working together to create laws and rules that will benefit consumers and US innovation, not defending lawsuits based on legal positions that change month after month.”

Edited by Guillermo Jimenez

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link