[ad_1]

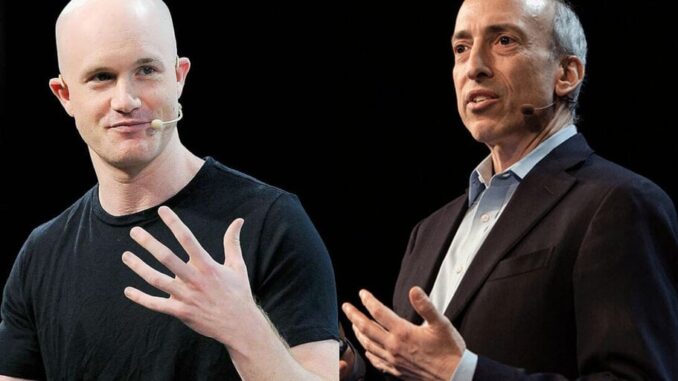

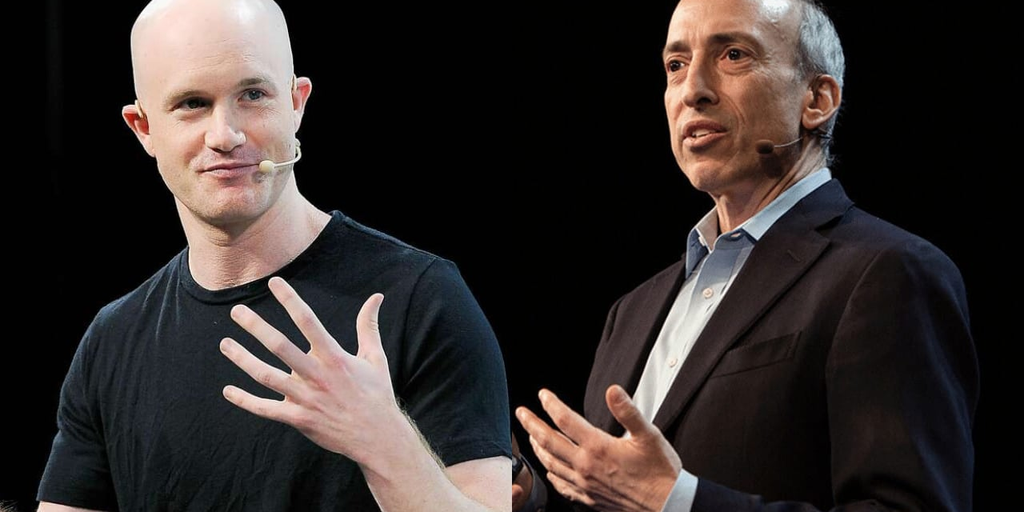

Cryptocurrency exchange Coinbase offered a judge its final take on Tuesday as to why a lawsuit from the Securities and Exchange Commission (SEC) should be put to rest, arguing tokens are not securities and that the SEC has overstepped its regulatory bounds.

The company outlined its stance in a legal brief for Southern District of New York Judge Katherine Polk Failla, as it pushed back against assertions made by the regulator in a 40-page rebuttal earlier this month, according to a court filing.

The regulator sued Coinbase in June, alleging the firm failed to register as an exchange, clearing house, and broker despite offering the services to customers. The SEC also said the exchange’s staking products are problematic. Coinbase moved to have the lawsuit tossed out later that month.

Coinbase’s argument is primarily two-fold: Tokens traded on the exchange aren’t securities under criteria for so-called “investment contracts,” and the SEC is violating the Major Questions Doctrine that establishes limits on the regulators’ authority.

While a decision could come as soon as tomorrow, a person familiar with the matter told Decrypt that Coinbase’s motion “is a taller hill to climb” than the company may like, and motions for judgment on the pleadings are “normally not easy.”

The filing effectively asks Judge Failla to throw out the SEC’s case before it has really begun. A motion for judgment on the pleadings asks the court to assess whether a ruling could be reached as a matter of law, operating under the assumption that all facts included in the SEC’s complaint are true.

If Failla isn’t convinced, the exchange would “like to get to trial as quickly as possible,” the person familiar with the matter said. They added a discovery phase could take up to a year and push a potential trial date out “until at least the first quarter of 2025.”

At this point, Judge Failla is no stranger to crypto. This year alone, she’s issued rulings in favor of DeFi giant Uniswap and Ripple. In September she analyzed how DeFi exchanges that use liquidity pools work and separately found that Ripple (XRP) “is not necessarily a security on its face” in July.

Whether or not tokens traded on Coinbase constitute securities is a critical component of the SEC’s claims. In order to convince a court that Coinbase failed to register with the regulator, the SEC has to establish certain cryptocurrencies are indeed securities.

Under the Howey Test, the SEC believes that some tokens are securities because “there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

The agency’s approach stems from a 1946 Supreme Court case. However, the SEC mischaracterizes decades of precedent in its lawsuit, the person familiar with the matter said, pointing to a lack of a contractual commitment between token sellers and buyers.

The Supreme Court has made clear that a contractual commitment on the part of the seller—that gives a buyer some legal claim—is a critical component of an investment contract, which the SEC doesn’t identify, the person familiar with the matter said.

The exchange’s brief also invokes the Major Questions Doctrine, a theory referenced by the Supreme Court this year when it struck down President Joe Biden’s plans for student loan forgiveness and said it was unconstitutional.

Under the theory, courts should presume that Congress does not delegate major questions of economic and political significance to executive agencies, such as the SEC. In terms of crypto, Coinbase argues that crypto is a major question.

Edited by Ryan Ozawa.

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link