[ad_1]

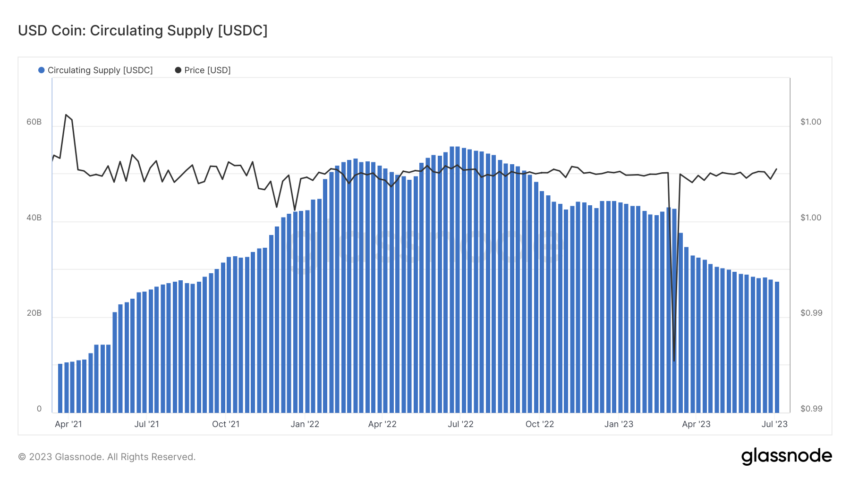

In the past week, Circle’s USDC stablecoin has decreased its circulating supply by approximately $100 million. According to Circle, over seven days ending last Sunday, USDC redemptions amounted to $1.4 billion, outpacing the $1.3 billion issued in new coins.

Questions arise as to whether the world’s second-largest stablecoin can uphold its position in light of such declines.

USDC Supply Dwindles as Redemption Surpasses Issuance

Though stark, the past week’s USDC circulation reduction is not a unique occurrence. Over the previous month, $4.6 billion was redeemed, and a lower amount of $3.6 billion in new stablecoins was issued.

This downward trend, spanning a year, has caused roughly $28 billion to be erased from USDC’s market capitalization.

USDC’s supply witnessed a contraction of $10 billion in March alone. At that time, investor concerns over Circle’s exposure to a Silicon Valley bank triggered a temporary disruption in the stablecoin’s dollar peg.

Read more: What is a Stablecoin and How do They Work?

Even though the disruption was short-lived, as USDC fell to a value of $0.97, the ensuing loss of market share has persisted.

Circle’s Loss is a Gain for Stablecoin Giant Tether

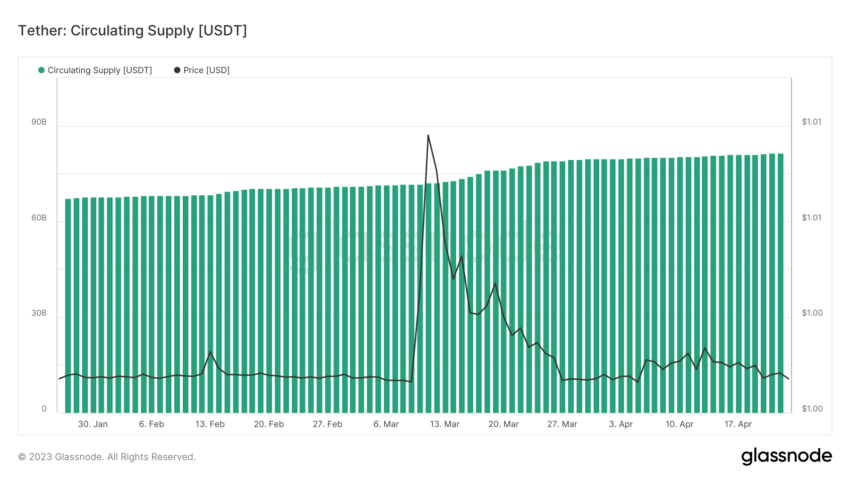

While the supply of USDC has dwindled, Tether, Circle’s main competitor, has made considerable strides over the past year, solidifying its leading position. On-chain data reveals a surge of approximately $17.8 billion in USDT circulation over the past year, with most of this growth occurring in 2023.

Furthermore, the same week that USDC supply dropped by $100 million, the total amount of USDT in circulation expanded by $22 million.

Read more: 10 Platforms That Provide the Best Interest Rate on Stablecoins

USDT dominance has experienced significant growth in recent months, currently standing at over 7%. Throughout the last year, Tether’s supply as a percentage of the total market cap has repeatedly exceeded 8%.

Conversely, USDC’s market dominance slipped below 5% in January and has not recovered since, currently hovering around 2.3%.

Rising Competition from Smaller Stablecoins Rivals

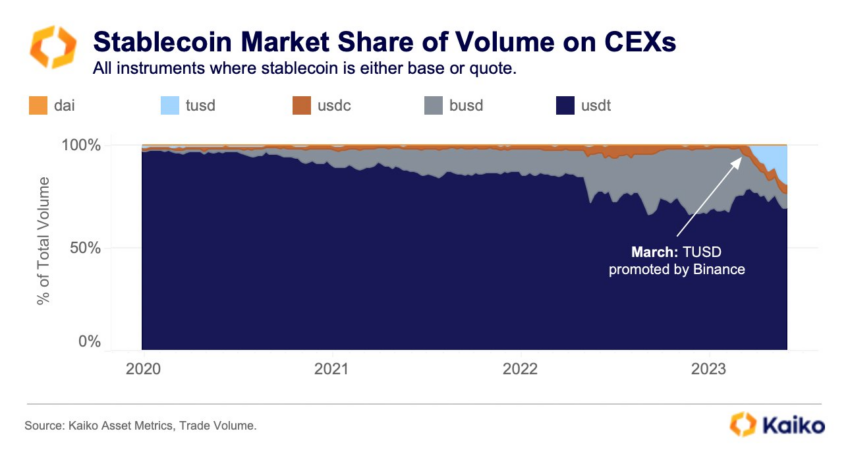

Despite USDC’s dwindling circulation, the near-duopoly of Circle and Tether in the market remains unchallenged, constituting over 83% of all dollar-pegged stablecoins.

However, smaller competitors have not been deterred from playing for market share, and the stablecoin issuance landscape continues to evolve. Last month, Dai surpassed BUSD to become the third-largest stablecoin, while TrueUSD (TUSD) supply exceeded $3 billion.

Tether and Circle’s uninterrupted dominance across all blockchains is not guaranteed. For instance, following the launch of USDD stablecoin last year, TRON DAO prioritized supporting this decentralized stablecoin as part of its strategic vision for the network.

Read more: Stablecoin Regulations Around the World

TRON’s success could be critical as the blockchain is faster and cheaper to transact with than Ethereum. The TRX network hosts more USDT than any other chain, with over $44 billion USDT as TRC20 tokens.

As recently as March, the total value of all stablecoins on TRON surpassed $40 billion for the first time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link