[ad_1]

Crypto fear and greed index has moved to the greed area ahead of the upcoming Bitcoin options expiry. Bitcoin price was trading at $30,392 on Wednesday, where it has been in the past few days. This price is a few points below the year-to-date high of $31,478. At its peak, the coin jumped by more than 104% from the lowest level in 2022.

Fear and greed index points to greed

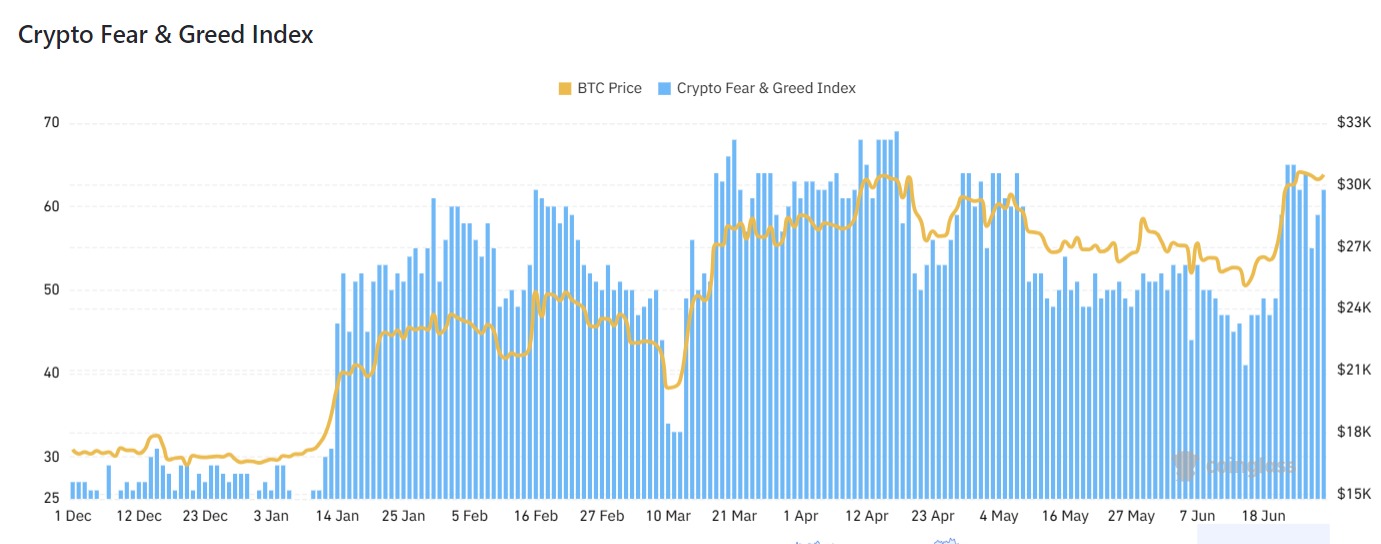

The crypto fear and greed index has made a strong recovery in the past few weeks. It has moved from the fear zone of 41 to the greed area of 62. This means that investors are getting modestly greedy helped by the recent ETF news. The most recent Bitcoin news came on Tuesday when Fidelity announced that it had filed its ETF proposal with the SEC.

Investors believe that a spot ETF will lead to more demand for Bitcoin from institutional investors. Still, this view should be taken with a grain of salt since ProShares Bitcoin Strategy ETF (BITO) has had modest growth in the past few years. It now has about $1 billion in assets. While BITO tracks Bitcoin futures, it has a close correlation with Bitcoin itself.

The fear and greed index points to more upside for Bitcoin since investors tend to buy it when there is greed in the market. Perhaps, these gains will happen ahead or after the upcoming Bitcoin options expiry scheduled for Friday this week.

Data shows that most of these options are calls with a strike price of about $30,000. This explains why Bitcoin has barely moved this week.

Bitcoin price prediction

A good technical analysis can help you predict the next price action of a cryptocurrency or other assets. Turning to the daily chart, we see that Bitcoin is oscillating at the 50% Fibonacci Retracement level. This is an important level that traders look at.

At the same time, this is an important price since it was the highest point on April 14th. Most importantly, the coin has formed what looks like a bullish pennant pattern. Therefore, there is a likelihood that the price will soon have a bullish breakout as buyers target the next key level at $35,000. This price is about 15% above the current level. A move above this level will see it jump to the next resistance point at $40,000.

[ad_2]

Source link