[ad_1]

Cryptocurrency exchange failures and high-profile lawsuits in the United States have given the industry a lot to think about. In an interview with BeInCrypto, Gracy Chen, Managing Director of crypto derivatives exchange Bitget, shared her thoughts about exchange’s flight from the US market, its possible return, Gary Gensler’s obsessions, and much more.

Chen joined Bitget in April 2022 and now serves as its managing director. She described the exchange’s current alienation from the US market as something of a lovers’ quarrel. An arrangement that might change if the climate gets better. But, despite Ripple’s partial victory last week, that’s still a very big “if.”

Bitget May Return to the US

The exchange operates in almost every country on the planet, with the notable exception of the United States. (Only Syria, Iran, Russia, Uzbekistan, and North Korea sit alongside America on the proscribed list.) Why would a crypto exchange remove itself from the most lucrative crypto market on the planet?

Despite wanting to be at the heart of crypto innovation, Chen emphasized the importance of staying on the right side of compliance in a fast-moving industry. What goes unsaid in Chen’s answer is that Bitget—like many other industry players—considers the American market a little too fast-moving. At least from a certain standpoint.

“To align with regulations in the United States, we ceased business in that market and currently do not target US users. Still, we continue to keep an eye on the US crypto market,” said Chen.

Bitget may reenter the United States sometime in the near future, she told BeInCrypto.

The SEC Comes for Exchanges

Just last week, Ripple won a partial victory against the agency, refuting the SEC’s assertion that XRP—Ripple’s token—was a security. A judge ruled that when it was sold to the public on an exchange, it wasn’t.

This interview took place before the Ripple decision. It was, again, a partial victory, and Ripple still faces legal trouble for its sale of XRP to sophisticated investors. Besides the Coinbase litigation and all the other actions that still make life tough for exchanges.

So, one could forgive Bitget for holding off. Only weeks before the interview took place, the US Securities and Exchange Commission (SEC) sued Coinbase and Binance for violating securities laws.

In the case of Binance, the world’s largest cryptocurrency exchange, the SEC also targeted its ubiquitous founder and CEO, Chaopeng Zhao (or “CZ”). Zhao faces charges of hiding his secret control of Binance.US from regulators (Binance.US is a separate entity for compliance reasons), manipulating trading volumes, and making illegal trading exceptions for high-value investors.

Running a crypto exchange these days comes with profound risks and consequences. And the regulatory war on crypto does not make life easier for anyone.

For its part, the SEC has been widely accused of a lack of clarity around digital assets and bringing cases based on novel legal theories.

Chen is understandably wary about the near future and the possibility of regulatory enforcement getting even harsher. Although, she emphasized the need for a dialogue involving the industry’s key players.

“While it’s clear that all regulators have good intentions when offering initiatives to protect customers, since crypto is very new, it’s challenging to find the best way to regulate it,” she remarked.

Crypto Expected Another Silicon Valley

Chen is open and honest about the sky-high expectations the industry had for the United States. For decades, the country has been the tech capital of the world, and its largest market.

The stars seemed aligned for America to own the crypto revolution, too.

“There were expectations of another Silicon Valley emerging for the blockchain industry,” said Chen. She continued:

“In 2022, the United States was seen as an attractive jurisdiction where many companies, including blockchain startups, aimed to establish themselves. However, today’s landscape is evolving rapidly.”

On Thursday, Bitget announced it was expanding into the Middle East, specifically Bahrain and the UAE. Included in the announcement are plans to set up a regional headquarters and add staff.

When asked about jurisdictions with promise for crypto, Chen brings up Hong Kong. In contrast to mainland China, the city has been on a charm offensive towards the industry.

Chen and her Bitget colleagues have taken note. “We are looking with interest at Hong Kong,” she said. “We are actively engaging in negotiations with authorities and banks, although I prefer not to make any bold statements at this point.”

The Rise of AI

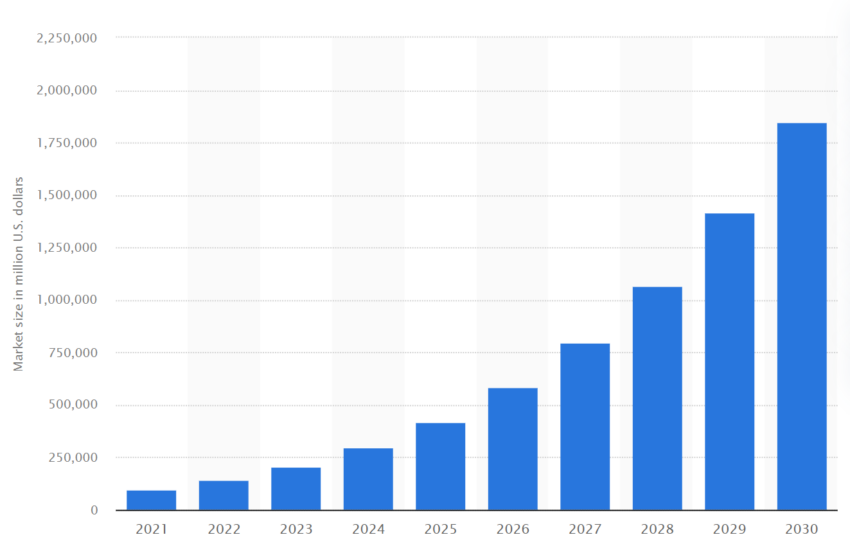

Perhaps even more than regulation, artificial intelligence casts a shadow over the crypto industry. Last year’s crypto collapse coincided almost perfectly with the sudden rise in the visibility of generative AI.

And as crypto’s star has fallen, AI has risen to replace it.

On that front, Bitget is watching with interest. Although, Chen is keen to critique the rise in investors using tools like ChatGPT for trading advice.

“Today, ChatGPT and other similar products are essentially in open alpha testing. Many users believe that these tools act as oracles that can predict the future. But in reality, they can make mistakes and provide unprofitable deals,” she said.

Recently, Chen confirmed in a separate interview (with Cointelegraph) that Bitget is working on its own “customizable, crypto version of ChatGPT.”

In our interview, Chen made a slightly different admission. She said Bitget is developing “AI-driven solutions to enhance the user experience.” However, it is being patient as to what it will launch, so as to avoid offering users a “raw product.”

To do so would be “unfair and could undermine consumer confidence,” Chen said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link