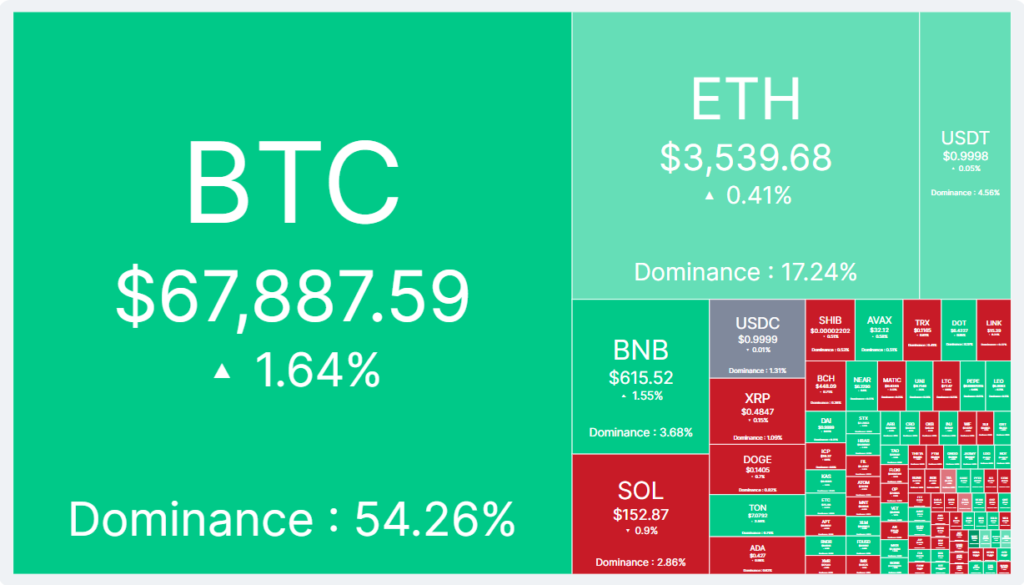

Market Overview

June 11th saw a significant decrease in cryptocurrency prices, especially Bitcoin and Ether. From $69,547 to $66,018, Bitcoin dropped by 2.5% throughout the day. Ether’s decline was higher at 2.58% to $3,500. It led to a loss of about $200 million due to leveraged trades.

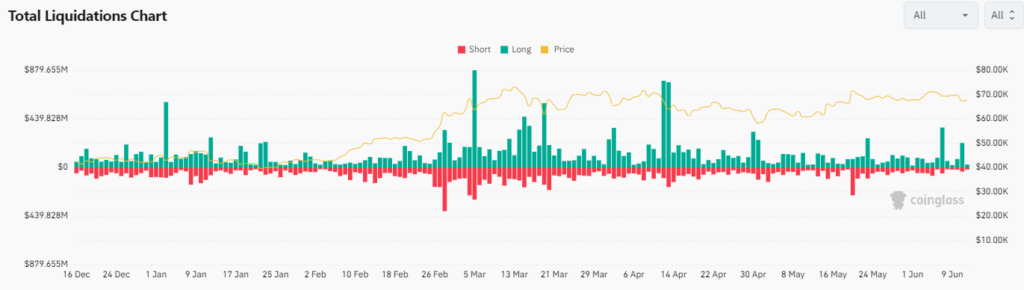

Leveraged Positions Wiped Off

According to data provided by CoinMarketCap, a crypto analytics company, within the last 24 hours, 83,912 traders got liquidated which amounted to $190.97 million worth of liquidations. OKX had the biggest single liquidation order where they swapped ETH/USDT valued at $5.21 million.

When a trader fails to satisfy margin calls or runs out of funds for upholding opened positions, their leveraged trade position is usually closed down by exchanges in what is known as “liquidation”. This means that part or whole initial margin amount is lost by the trader as it has happened to thousands during this latest downfall.

Hard Hit For Bitcoin & Ether Leveraged Traders

Over the last day $46.9 million liquidations hit BTC traders the most which had longs taking $36.8 million while shorts took $14.07 million. ETH followed suit with $41.0million being wiped off from their market through long liquidations amounting to $31.3m and short ones totaling at 9.68m

These liquidations are occurring within days after having seen a $400 million liquidation event on Friday 7th June in what seems like very volatile times for traders.

Traders Eagerly Anticipate FOMC Meeting and CPI Release

In recent weeks, there has been a sharp decline in leveraged markets liquidations and an overall market correction, which are closely related to the upcoming Consumer Price Index (CPI) for May and the Federal Open Market Committee (FOMC) meeting that is scheduled to take place on June 12. Cryptocurrency investors have always been quick to decouple risk during historical occasions when the aforementioned events occur.

The 30-day correlation between digital currencies and US stocks is at its highest level since last year. Whenever CPI goes up, Bitcoin value tends to drop. The same applies to the entire digital asset class because people have less money to invest when prices of necessities increase; thus leaving them with reduced disposable income.

Expectation and Sentiment in the Market

According to reports, it is predicted that FOMC will leave rates unchanged at 5.25% – 5.50% while CPI data should range between 0.1% – 0.3%. Traders will be closely monitoring these developments so as to determine where the market is headed next.

Given that macro-economic indicators have a significant impact on crypto markets, we are now at a critical juncture where we need to establish if this downturn is likely to continue over the coming days or if there may be signs of recovery. Therefore traders are reminded that they should remain vigilant and handle their positions with care during this period of heightened volatility.